September 7th – Market Wrap

/166 Comments/in Premium /by Alex - Chart FreakOn this Thursday of trading, let's review what the markets are doing so far, and we'll have just a couple more interesting trade set ups.

NASDAQ - The NASDAQ put in a low that was a buy on August 21, and that has not been violated. It almost made new all time highs on Monday. It is still early enough in the daily cycle to break the highs and Tuesday & Wednesday looked like a back-test of the recent break out from the downtrend line. I would raise my stop to that point.

SPX - That sharp drop on Tuesday also looks to have back tested a break out. Day 11 and this can break to new all time highs too. Recently, breaking to new all time highs has not turned into a strong rally higher, the markets just keep rolling over into the next dcl, but it is slowly putting in higher lows and higher highs, and that is a trend higher. A bit of a rough ride for the BUY & HOLD investor.

TQQQ - So here is the TQQQ that many here trade. Tuesday, Wednesday, or even today you could add to your current position, with a stop below the 50sma. If you bought in at the DCL, I would raise that stop now that we've had the first drop out of the way.

Read More

Read MoreWednesday September 6

/108 Comments/in Premium /by Alex - Chart FreakSo far, the trades that we have been really focusing on have been excellent. We'll do a quick review and then discuss those trades and set ups.

DJIA - Wow, that wasn't a very healthy looking drop on day 9, was it? The DOW landed right back on the 50sma, so at this point, support is support. If this were to roll over and continue down, that means that this could still drop into an ICL. ( I never did call an ICL, just a dcl, but we are overdue for one).

SPX - As a cautionary note going forward, I mentioned that we had a buyable DCL in place, but using this weekly long term chart, it's easy to see a rising wedge in SPX. It is important to look ahead when we take on a trdae. That is called being alert and prepared, not biased , rigid, and foolish.

That way if we do get a sudden drop, we aren't surprised or overly biased and married to positions.

Read MoreSEPTEMBER 3 – WEEKEND REPORT

/155 Comments/in Premium /by Alex - Chart FreakNOTE: GAS PRICES HAVE SKYROCKETED IN THE U.S. THIS WEEK. We'll keep that in mind as we discuss the Energy sector.

NASDAQ - We got the follow through to that daily cycle low that I was expecting, and now we also have a weekly swing low in place. Stay long and watch overhead resistance. I do see divergence, as shown on this chart.

Read More

Read MoreHey, Look! Surprises To The Upside!

/169 Comments/in Premium /by Alex - Chart FreakActually, we were expecting higher prices in many of the Market sectors yesterday, so this Green Board that I captured Thursday afternoon was a welcome sight. Let's discuss these GREEN market Sectors and some Stocks.

Read More

Read MoreThursday August 31

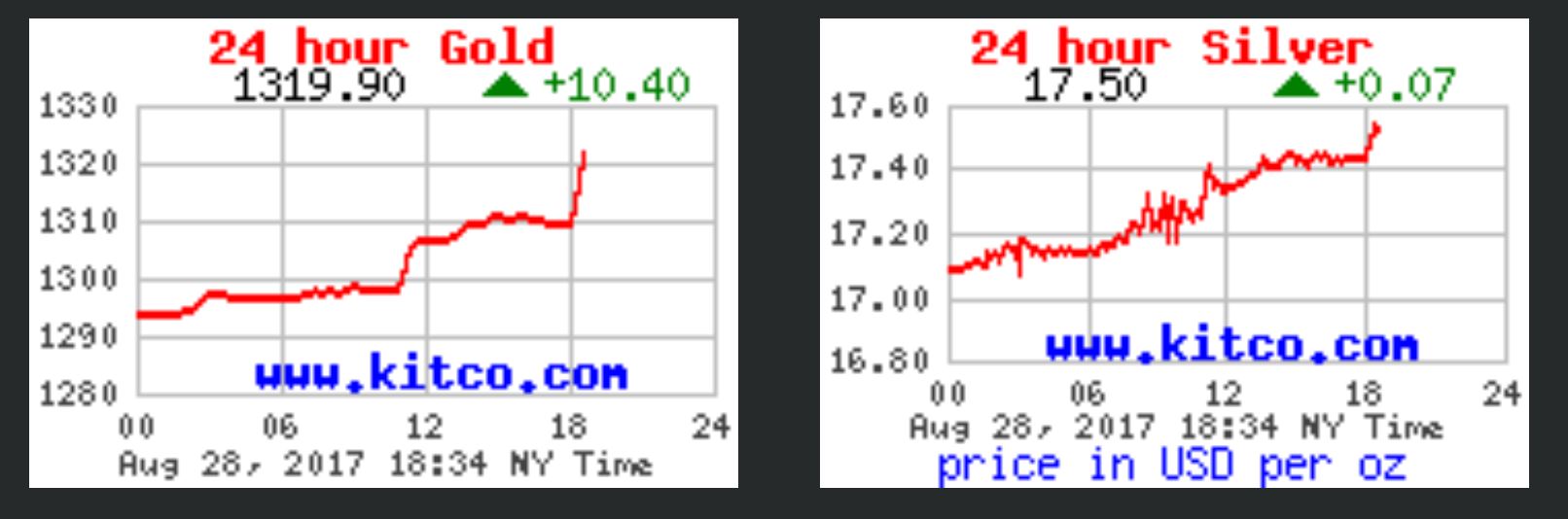

/117 Comments/in Premium /by Alex - Chart FreakThe General Markets are breaking higher as expected, and the Biotech sector is also acting Bullishly. After reviewing these sectors and the Precious Metals, we'll review some bullish set ups in various Tech and Biotech companies.

AUG 25th - This weekly chart reversal at support was a buy point, so I pointed this out last week, along with some Stocks in this sector.

IBB - The daily chart showed price breaking and holding above the 50sma on Tuesday too.

IBB - And we have strong follow through yesterday, so let's look at a couple of these stocks.

NASDAQ - On August 29th we saw a strong reversal after a drop filled that gap. The timing was right for a dcl too. This became a buy and a break out above the overhead trend line would add confirmation.

NASDAQ - We have the trend line break as of yesterday.

Read More

Read MoreAugust 30 – Multibull set ups

/108 Comments/in Premium /by Alex - Chart FreakSPX- Yesterdays reversal filled a gap and strongly moved higher. It is right against the down trend line, and a push higher above the 50sma and the trend line is a buy if you ask me( I would have taken a chance and bought here). A break higher should indicate that we have a dcl and the markets are done consolidating for now.

Let's take a look at the NASDAQ

Read MoreThe Weekend Walk Through – Aug 27

/172 Comments/in Premium /by Alex - Chart FreakLet's review the weeks market movement and see what is likely to happen next week.

NASDAQ -We still haven't dropped into our ICL, but you can see that the NASDAQ has basically gone sideways all summer. Price is where it was in May. Is this reversal ready to move price higher out of this consolidation?

Well, we are within the timing for a DCL on the daily charts, but look at that lower indicator on the above NASDAQ chart. This sideways move has internal weakness, so the next daily cycle could roll over too, if you buy the reversal here, use a stop.

Read MoreAugust 25th – The Waiting Is The Hardest Part

/188 Comments/in Premium /by Alex - Chart FreakSPX - So the SPX has a swing low in place, and the timing is right for a dcl, but at the same time, we are overdue for an ICL and this drop did not fit that definition. The SPX was rejected at the 50sma and it is good to note that a drop to 2400 now would give us a failed daily cycle and begin to fit the criteria for an ICL drop. A break above the trend line overhead would signal that we do have a dcl already in place and confirmed.

Read More

Read MoreContact Us

26 Broadway,

8th Floor

New York, NY 10004

admin@bigleaguefinance.com

admin@bigleaguefinance.com

Latest Blog Posts

accelerator diet pills goji berry diet pills ultra 90 diet pills keto meal replacement bar top weight loss diet pills for thyroid patients where to buy t lite diet pills keto friendly thickener diet fuel diet pills peanuts keto friendly rite aid diet pills that work envy diet pills diet pills for breastfeeding moms belique diet pills perfect slim weight loss pills calories in a bottle of white wine