You are here: Home1 / Premium

It's Friday, there is only one trading day left in the week, so I want to cover a couple of questions that I get from time to time in todays report. I will do a short review of a few things first, and then I will just cover everything else in greater detail in the weekend report. For now, this report contains a brief review, a couple of trade ideas at the end, and a lesson or two in the middle.

SPX - No change here from our expectations. This looks like day 6 of a new daily cycle.

Read More

Read MoreEvery now and then the Markets give us a bit of a conundrum, and it takes a little extra time and meditation to get to the bottom of things. After the Fed Decision was released and I began to review the charts, I ran into that very situation. Lets discuss the markets and I will show you what I mean...

.

DJIA - This is not the conundrum. We got a Gap open in the morning and then the markets sold off a bit into the close post fed. Nothing has changed here yet, this looks like day 5 of a new daily cycle.

Read More

Read MoreTrading was going rather smoothly recently in many areas. We were trading some Biotech, Steel, Copper, and Fertilizer stocks, and TECH stocks were also acting correctly. Suddenly this week seems to have turned various areas a bit choppy. We saw some Bullish Earnings for the big Tech stocks, yet other areas became a bit shaky. Take a look at charts of TGB and IPI and you'll see crazy shake out type moves that are not normal price action. On top of that, we are now on Fed Wednesday, so what can we expect? Well, the Oil and Energy trades still look good to me, so I want to discuss that a bit more. Let's also discuss how a Fed Wednesday could possibly affect other areas too.

This is a market scan on Fed Wednesday Morning - Just about everything is green really. Click to enlarge

Read More

Read MoreDid you know that this is a Fed Week? I don't think that anyone is expecting any changes, and so far, not much has changed from the weekend report. Let's have a quick review and discuss the Oil / Energy stock patterns too.

Read MoreLast weeks weekend report showed what the BIGGER BIG PICTURE expectations are. This weekend I want to cover the various sectors and explain in a short clear manner what the expectations in the near term are, going forward.

DOW - As mentioned last weekend, The weekly chart makes it clear that the DOW is not pulling back as much as it normally would during daily cycle draw downs into the Daily Cycle Lows. See the chart.

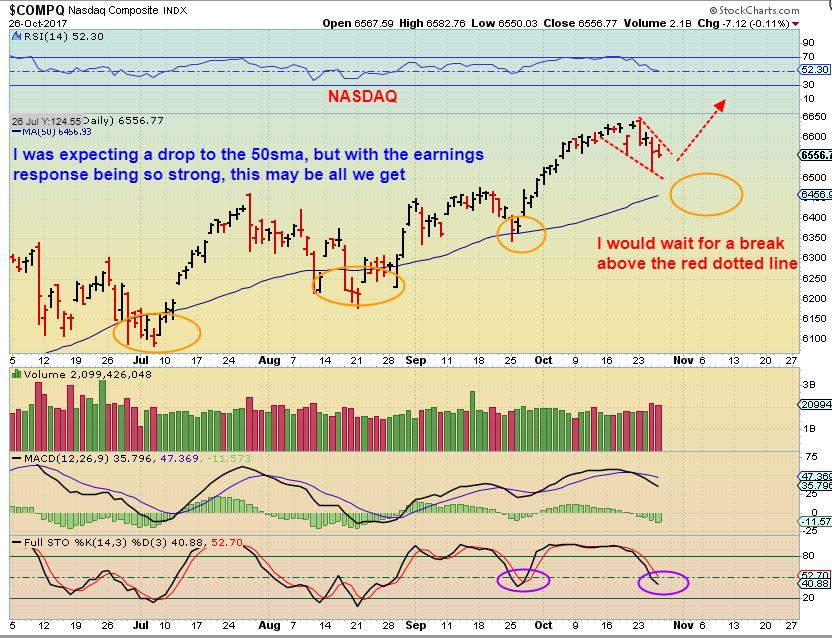

Read MoreAfter the closing bell Thursday we had a number of companies release their earnings reports. Some of the Big companies like GOOGLE, AMAZON, MICROSOFT, FIRST SOLAR, etc were among the group and received positive reactions, with their stocks shooting up in after hours. Will this usher in the next leg up in the markets ( or maybe we should just say a 'continuation' higher) ? Let's take a closer look...

DJIA - I was expecting a bit more of a correction, but this flag consolidation may simply be a pause in the run higher.

SPX - I would have expected a drop to the 50sma, but if these markets are in a parabolic run, this may be all we get as it also just continues higher. Let's see what Friday brings.

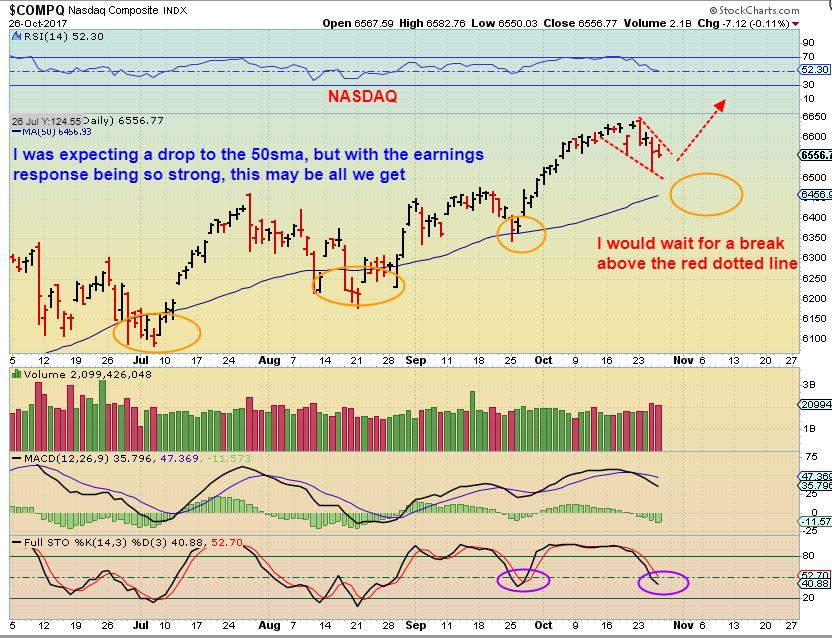

NASDAQ - I expected a drop to the 50sma area, but all those positive earnings last night in GOOG, AMZN, Etc. could get the NASDAQ going again too. Look for a break above the 10sma or this red dotted trend line.

Read More

Read MoreAre the markets starting to roll over? If so, will it be a deep dip, a 'Buy the dip", or is this just another 'one day sell off and recovery'? Let's take a look at the charts and see what we can take note of...

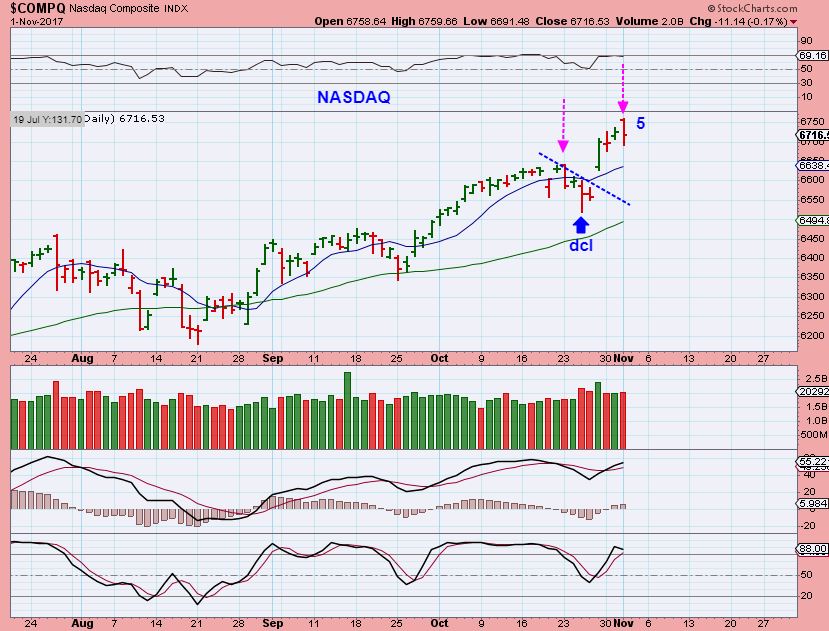

NASDAQ - So here we see that the NASDAQ sold off yesterday, but by the end of the day, some buying came in and gave us a reversal candle. Does this mean that onward and upward we go?

Read More

Read MoreLet's do a NATGAS & MINERS review and discuss a few trade ideas, since we didn't have a chance to do that on Tuesday...

Read MoreThis weekends report is going to be a bit different. I often give the Big Picture review, and with that, we have been discussing since last January the possibility of a Blow Off Top / Parabolic move resulting from the general markets' bullishness. Well, this is going to be an even Bigger Picture discussion, with a few shorter term charts at the end for update purposes. It is a long detailed report designed to answer many emails that I have received about the bigger big picture , so grab some coffee or tea and let's begin...

NASDAQ - This chart was from last May. I posted this idea of how the current rally that we were seeing could be becoming parabolic. Parabolic moves seem like they will never end, and you'll hear that "Nothing can kill this market", and it feels so true. Then suddenly, they die a brilliant death as you can see in the year 2000. See the chart below, where we examined similarities of a final shake out consolidation, a ramp up with somewhat choppy trading that would still having higher lows, higher highs, and then the final Ramp higher...

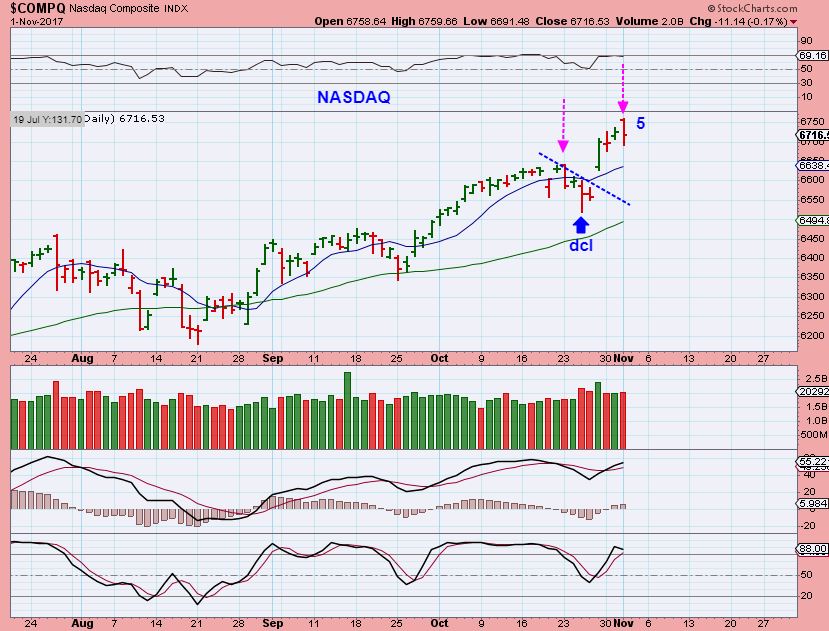

NASDAQ - Here we are now and the choppiness with higher lows and higher highs seems to be playing out now, and a blow off top would follow. OR, is this the blow off top in play as it just continues higher? This move is verticle and could lead to the blow off top. Just ride it long. I have drawn in a post blow off top scenario with a normal 'back test' of the break out. Let's dig in further...

NASDAQ - Currently, the 'choppiness', when examined close up, is normal. I have advised buying with a reasonable trailing stop. Each dip to the 50sma can be bought as a low risk entry. Was that tiny dip the DCL, because we are so late into this current daily cycle? I'll show you why that could be possible later using the RUT AND TRANNIES. If it isn't a dcl, and we get a dip to the 50sma (even with a shake out there), that would obviously be a 'buy'- please read the chart. THis is a healthy strong bull run.

Now let's also look at the BIGGER PICTURE SPX, RUT, TRAN, DJIA

Read More

Scroll to top

Read More

Read More