One Day Reversal

/86 Comments/in Premium /by Alex - Chart Freak

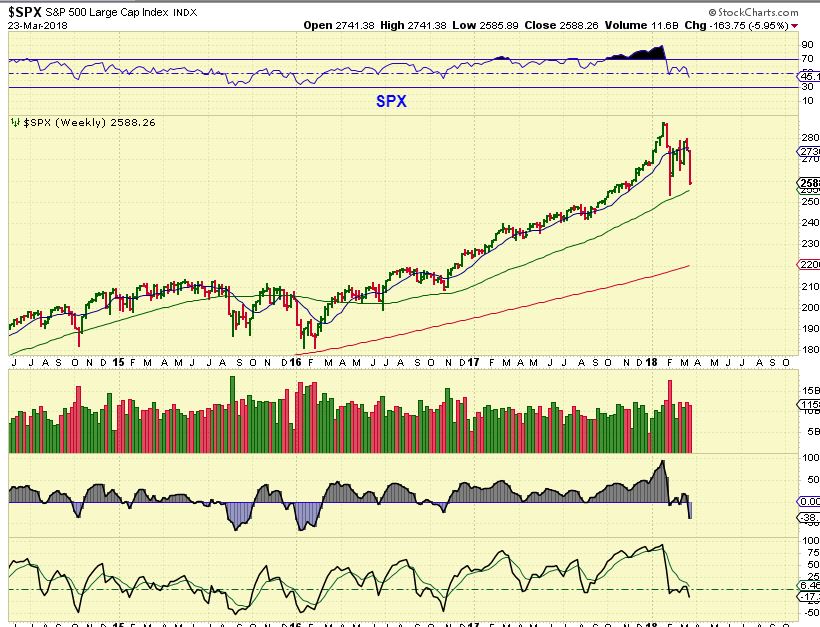

SPX FROM THE WEEKEND REPORT – This looked like a likely area to get a reversal, and after Monday we do have one in place. Question is, is it a Solid new low, or Just a bounce?

It may just be a good bounce, but it also may be a good bounce that is just another temporary bounce into the final low. Let me show you a few things

March 24- Weekend Report

/97 Comments/in Premium /by Alex - Chart Freak

SPX – The SPX is near the 200sma, and this was where I said that I would begin to look for clues of a bottoming process ( long term or short term will be determined later). Will this do a quick shake out? Maybe, we are on day 29 of this daily cycle, but lets take a look at a few of my indicators.

So this is what I also found…

March 23 – Fridays Trading

/78 Comments/in Premium /by Alex - Chart Freak

DJIA – The DOW was down 724, and THAT is scaring a lot of people. We have been expecting this and so far, it is what it is. At this point I am looking at us on day 27, markets can fall further, watch for support at the 200sma. It CAN BE BROKEN in a shake out, we wont be buying without a swing low in place. I will discuss my experience in later reports.

Thursday March 22

/129 Comments/in Premium /by Alex - Chart FreakAt times, subtle changes can lead to bigger changes. Yesterday some of the ‘subtle’ changes that I had mentioned in recent reports suddenly look a lot more important. Let’s discuss some FED DAY changes that may have taken place…

Well Fed

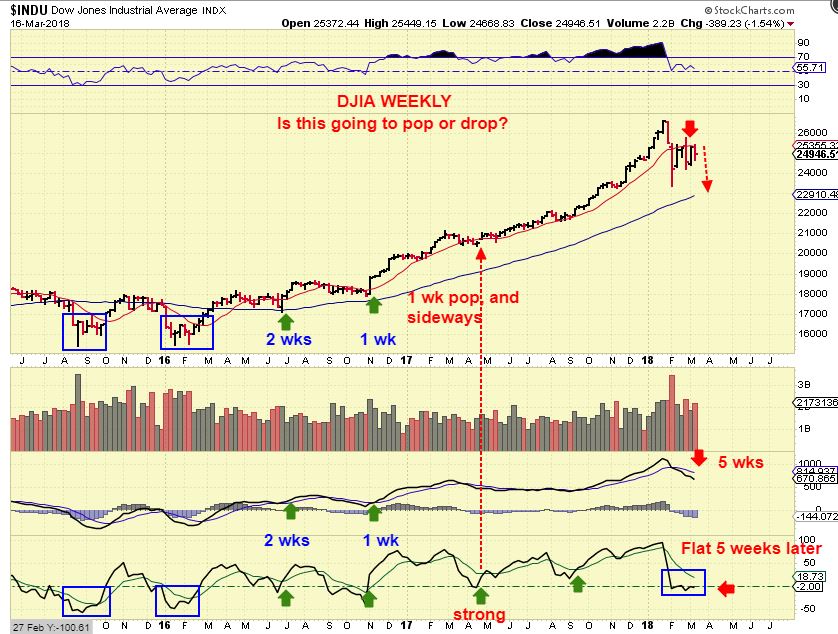

/169 Comments/in Premium /by Alex - Chart FreakWell, its our first Fed Decision with the new chairman Jerome Powell. One has to wonder if the Markets are going to be jittery, the way they did the first 2 times that he spoke, or will they rally on the news? He was sworn in on Monday Feb 5th, and the week leading up to his being sworn in, the markets crashed. On Feb 27, when he testified before congress, maybe it was just a coincidence, but the Markets did not seem to like it at all and dropped too. Let’s take a look…

You can see on the chart that on the week leading up to Feb 5th, the markets crashed down. Then, as shown in this headline, when he testified before Congress on Feb 27th, Markets sold off then too.

DJIA – On the week leading up to Powell being sworn in, The markets crashed. Then FEB 27th started a 4 day sell off after he gave what that headline called ‘ A cheery note on the economy’ 🙂

Tuesday March 20th

/91 Comments/in Premium /by Alex - Chart FreakWe are approaching the first FOMC MTG with the new Fed Chairman. So far, whenever he has spoken to Congress, the markets sold off. The deep mini-crash in February was actually the first time that he spoke to congress. So is Mondays sharp sell off a taste of things to come? Or is this just a little shake, rattle, and roll until after the FOMC decision? Let’s take a look at the action…

DJIA WEEKLY – I used this chart in the weekend report ( this weekend and a week ago), I mentioned that things were not exactly looking all bullish. I used my own indicators to show you internal weakness.

March 17th Weekend Report

/91 Comments/in Premium /by Alex - Chart FreakThis opening picture describes how the General Markets shot up, especially into the end of last year. With little else than a volatility pop here and there, they just kept climbing. Well, in the weekend report, I like to take a step back and look at that Bigger Picture. At times things stand out from a distance that I may not see when I am focused on taking the ride using daily charts. Let’s take a look…

Contact Us

26 Broadway,

8th Floor

New York, NY 10004

admin@bigleaguefinance.com

admin@bigleaguefinance.com

Latest Blog Posts

accelerator diet pills goji berry diet pills ultra 90 diet pills keto meal replacement bar top weight loss diet pills for thyroid patients where to buy t lite diet pills keto friendly thickener diet fuel diet pills peanuts keto friendly rite aid diet pills that work envy diet pills diet pills for breastfeeding moms belique diet pills perfect slim weight loss pills calories in a bottle of white wine