You are here: Home1 / Premium

Yesterdays report was entitled "Cross That Line", and the markets did just that! They crossed the lines that we were looking at, so I figured that it wouldn't hurt to name Fridays report, "How about some Friday follow through", to see if they would accommodate again.

Let's take a look at how accommodating the market action was yesterday...

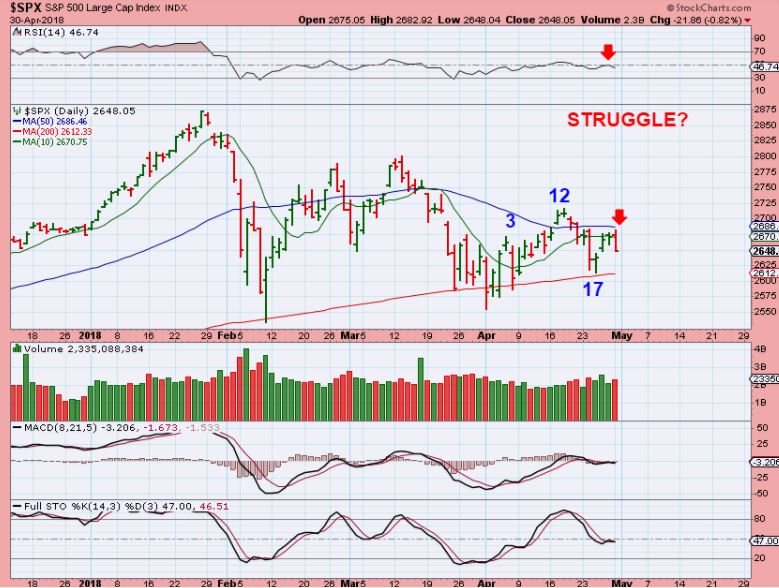

SPX - SPX crossed the line, breaking the down trend.

Read More

Read More

SPX - The General Markets are shaping up and as mentioned in yesterdays report- I expect the SPX to cross this line. That is ( at least short term) A bullish break out from a down trend. We also have been watching this triangle formation.

And this is why I mentioned that I would expect a break higher...

Read More We had a lot of movement in the markets on Tuesday, but we did not get the move that we were looking for. What was that?...

Read More

NASDAQ - The NASDAQ broke above the 50sma and has broken the down trend for now, this is short term bullish action ...

Read More

Read More Usually for the weekend report, I like to take a step back and see the Big Picture, but for this weeks report we will have several daily charts too. This will help us to focus on what to expect in the short term as well as keeping the longer term Big Picture in view.

Read More

SPX - We saw a reversal midday and I posted this daily chart in the comments / chat section at 1 p.m.

Let's discuss this further ...

When it comes to cycle timing, every step does get us closer to our goal.

.

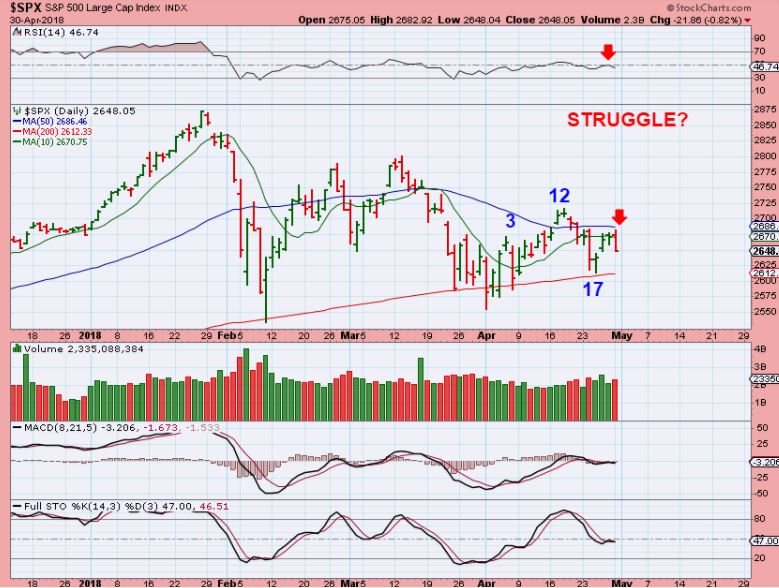

SPX DAILY - WEAK. We will be on day 23 Thursday, and the markets moved slightly higher after Wednesdays FOMC Decision, and then sold off into the close. This still looks weak, I remain cautious.

Read More

Read More I have been expecting this to be an active week, so as we approach FED Wednesday, lets review how Monday traded...

SPX - So far, the move out of the April lows has been weak and appears to be struggling at the 50sma. With the daily cycle count ticking away, this needs to break above that 50sma soon, or it will get caught up in a sell off when the 'time' is up.

And don't forget this...

Read MoreI have been covering the Big Picture in the weekend reports, and not a whole lot changed since the last weekend report really. That said, I will cover all of the market sectors that I usually do, and discuss the possibilities going forward. I expect this to me a week of increased activity (FOMC).

Read More

Scroll to top

Read More

Read More