You are here: Home1 / Premium

Tonights report is going to be a great lesson on how we can view things as the markets ebb and flow , breathing in and out. We're at the end of the week and we saw a little selling in Precious metals Wednesday followed by an immediate reversal Thursday. Does that reversal mean that the selling is over? We will look at a number of things that help to give us confirmation as to whether a short term low is either in, or may not be in place yet. Also buying the dips tips.

.

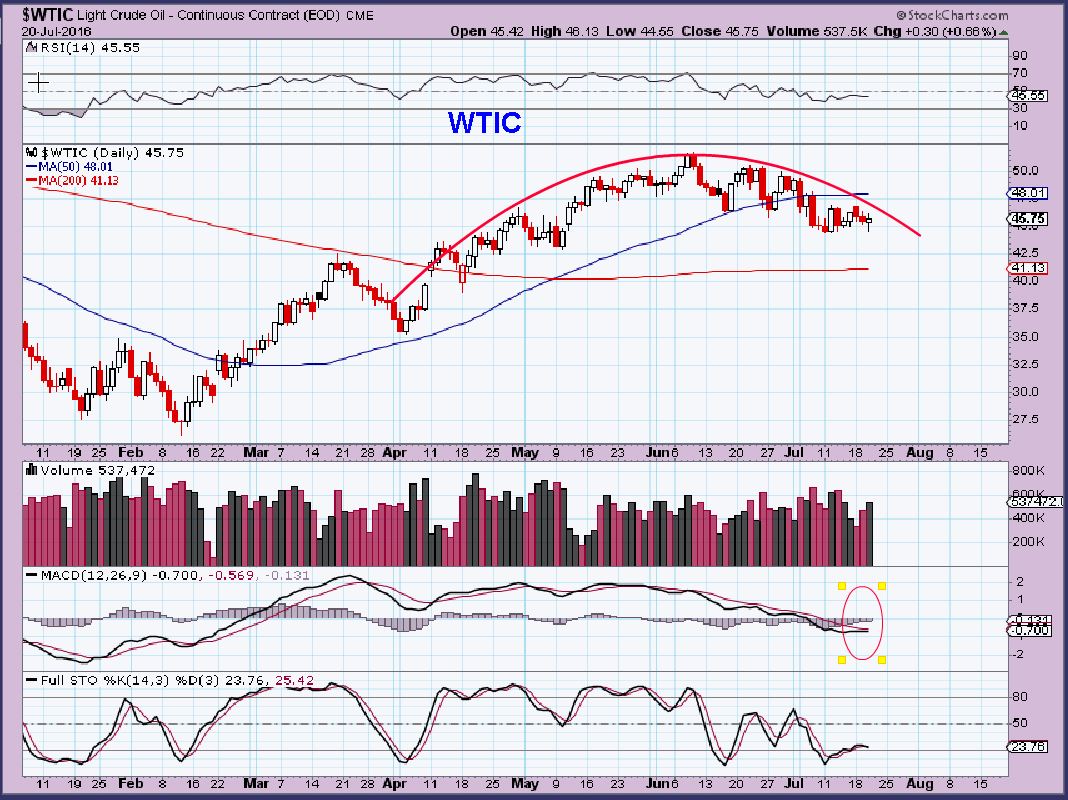

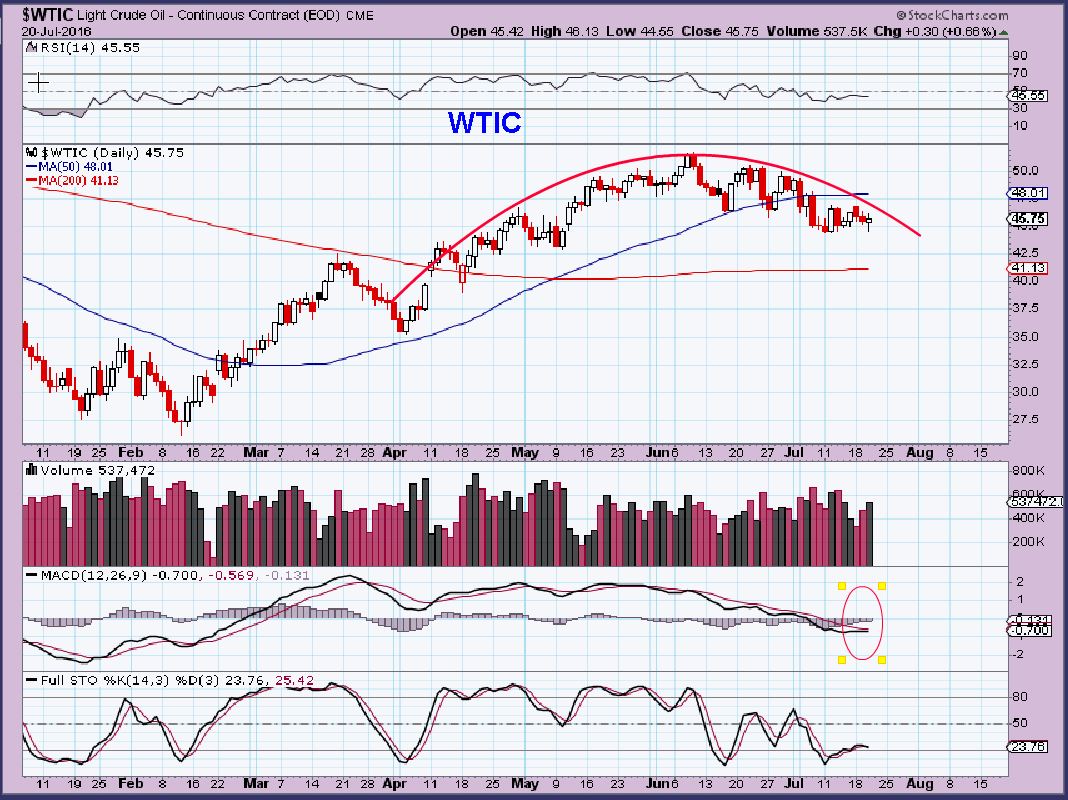

WTIC - First a chart of oil, since many do ask about the energy sector that we were trading over a month ago. We had a reversal Wednesday, but I pointed out that I still see weakness going forward. Patience is needed here.

WTIC - That reversal vanished on Thursday. This needs to prove itself, and it is still proving to be weak.

Now on to Precious Metals...

Read MoreWednesday we saw the Miners (GDX, GDXJ) gap down and close near the lows on fairly high volume. What can we expect going forward? We'll discuss that after a quick market review.

.

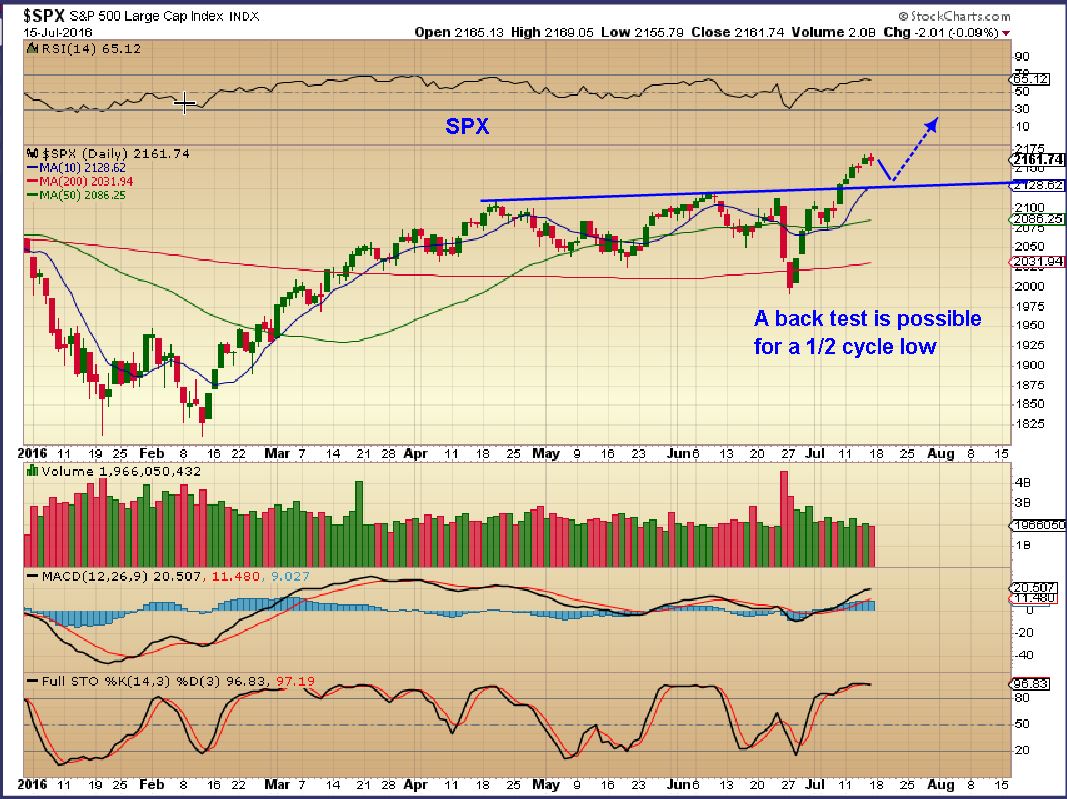

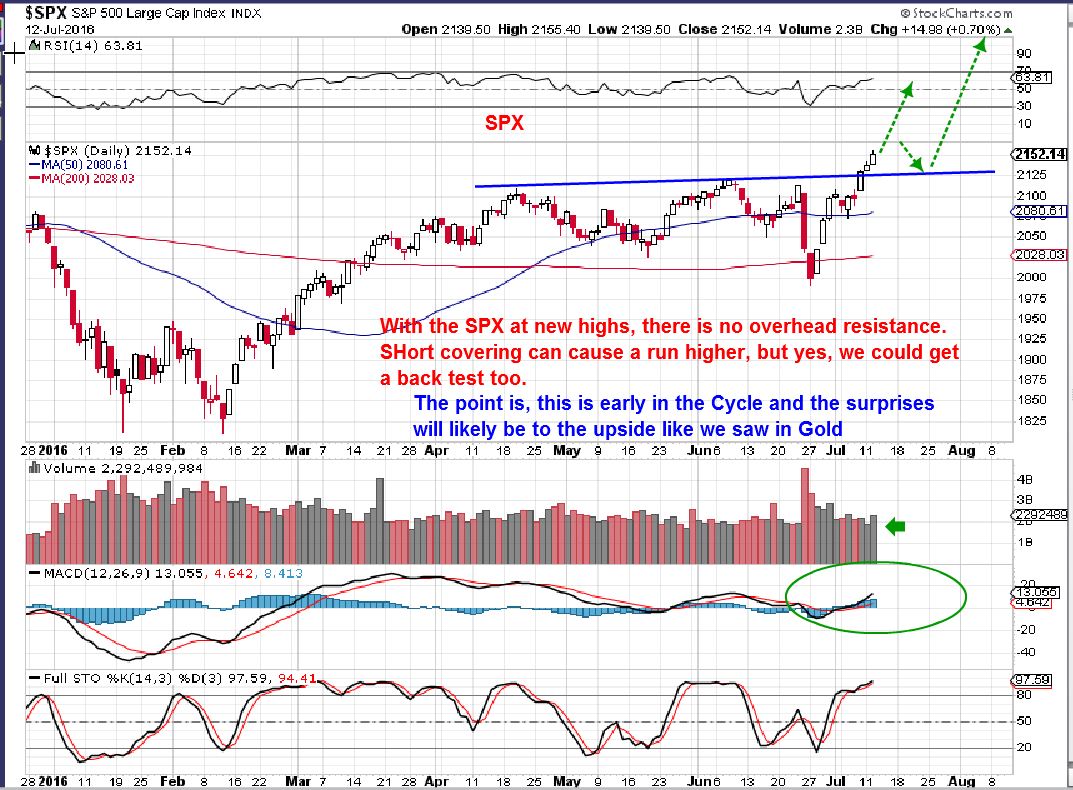

SPX- The general markets broke to new highs and since there is no resistance here, they have just continued higher. I do expect a dip soon, maybe this measured move will be close enough?

3 reasons that I am expecting a dip...

Read MoreI want to FOCUS on a few things in this report

.

Read MoreNot a whole lot has changed since the weekend report, so lets just do a quick review and then discuss our expectations.

.

SPX - As expected

Read More

Read MoreIn a recent report I was discussing what I called Giraffes. These are the 'STARS' of the Miners that explode higher giving the chart a look of a giraffe neck. Certain set ups form during consolidations and lead to this price explotion, giving us some big profits. Obviously finding them BEFORE they pop is the key to maximized profits. Lets take a look at some of our Giraffes from past set ups, then I want to discuss what I think will be the next ones.

This was our set up in XRA at when it was just under $1.00

2 days later we were up over 30% with the giraffe neck 🙂

Lets look at another explosive POP that we caught, and then I'll point out our next candidates...

Read MoreWe've been investing in and trading Miners, singing by the fire and enjoying the gains...

Read MoreJust about everything lately. It has become a traders paradise!

.

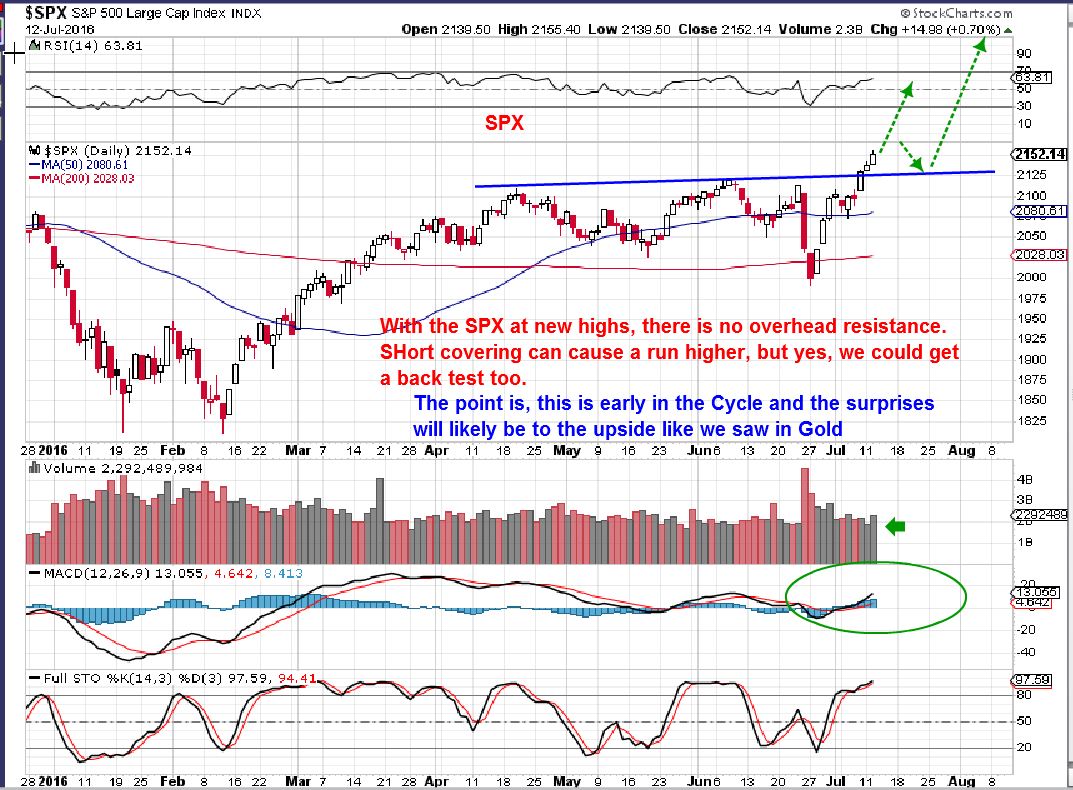

SPX - If there were a lot of shorts shorting this high, they may have to cover and push this further along.

.

Read MoreAnd I dont think that the ride is over in certain areas, so let me discuss that after a market review.

.

SPX- Looking for a break to new highs, early in this daily cycle.

SPX - We got the break to new all time highs.

.

What might we expect on Monday, based on Fridays charts?

.

SPX July 6th from my last report- The SPX looked good and a break would be sweet I thought that the MACD and other things looked to be making a bullish move.

Read More

Read More

Scroll to top