Thursday May 24th

/in Premium /by Alex - Chart FreakSPX #1 - We saw the break out & Bull flag. This was Bullish.

SPX #2 - Here I mentioned the GAP open, and the gap may need to fill first...

SPX #3 - Now we got our gap fill and then a reversal higher after the FOMC Minutes release, so ...

Read More

Read MoreWEDNESDAY MAY 23rd – Hump Day

/45 Comments/in Premium /by Alex - Chart FreakREVIEW: SPX looked like a Bull Flag Last Friday, I expected a break higher.

After that break higher, This is copy pasted from yesterdays report. We should expect a possible gap fill. Markets could 'stall' to fill that gap.

SPX - The markets did move higher in the morning and then closed down, partially filling the gap. I am seeing short term weakness in some of my other indicators (Not shown), so I'm wondering if this is going to tag that 50sma again? The weakness at this point is nothing too serious and a push higher will help turn those back upward.

Read More

Read MoreTuesday May 22nd

/86 Comments/in Premium /by Alex - Chart FreakMondays Markets...

SPX MAY 18th - Last week I mentioned that we had a bull flag forming on the 10sma, so it should break higher...

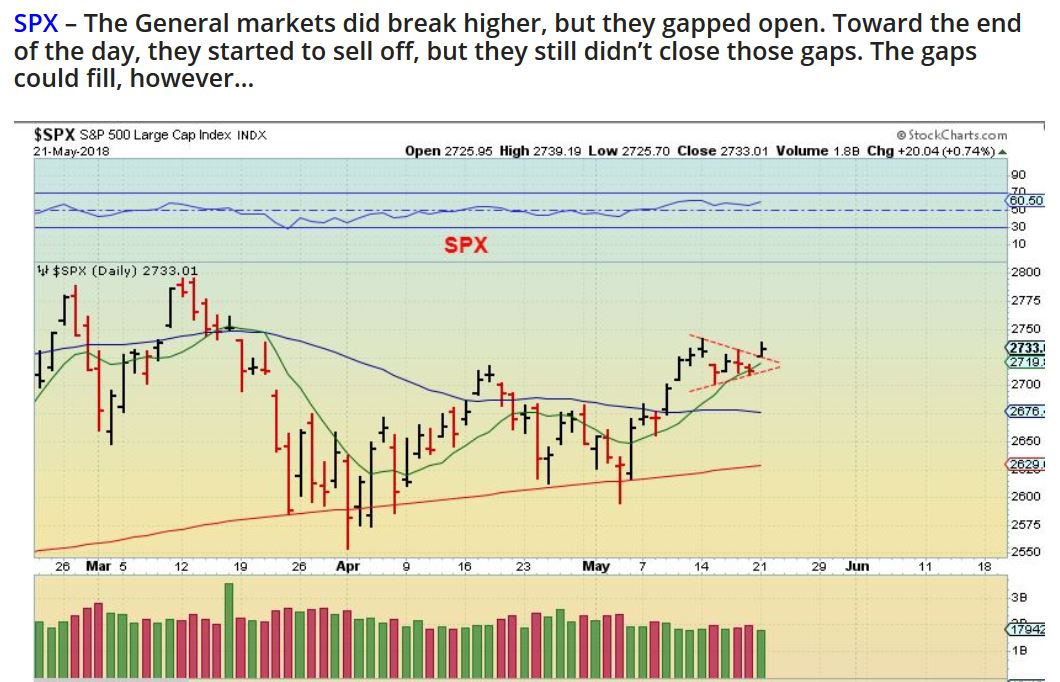

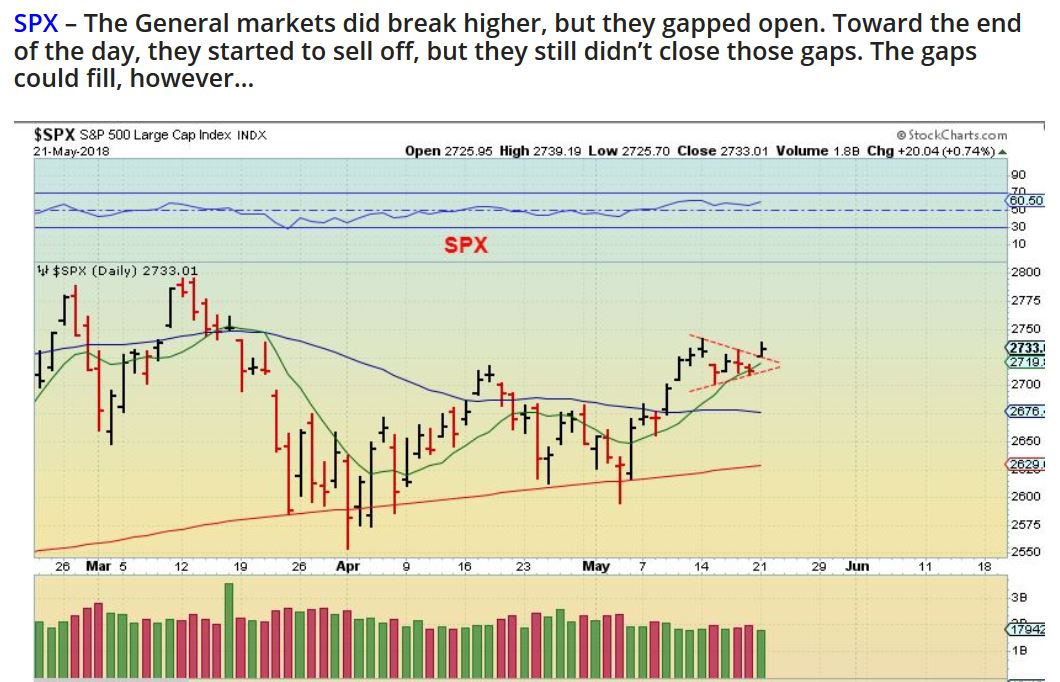

SPX - The General markets did break higher, but they gapped open. Toward the end of the day, they started to sell off, but they still didn't close those gaps. The gaps could fill, however...

Read More

Read MoreMAY 19 WEEKEND REPORT – REST UP

/84 Comments/in Premium /by Alex - Chart FreakRest up this weekend, and we'll review the markets and the action that we can expect as things move forward. I'm really loving the way the Precious Metals markets are setting up for example, so far very much as expected. Lets just get right into it and take a look at our markets...

Read MoreFRIDAY MAY 19th

/56 Comments/in Premium /by Alex - Chart FreakIt is Friday, the last trading day of the week, so let's review a couple of points of interest in the Markets, and then discuss a few more stock picks.

USD - The USD is heading toward resistance, but it can continue a bit higher. I will discuss this further in the weekend report.

Read More

Read MoreThursday May 17

/161 Comments/in Premium /by Alex - Chart FreakNASDAQ - I mentioned months ago that it looked like we could be starting a consolidation period ( or a topping process) in the General Markets. You can see that we are doing just that. I also mentioned that it is possible that individual stocks may do well, so we will briefly discuss some individual stocks later in the report. Also if this, over time, breaks out to new highs, it would be very bullish.

Read More

Read MoreWednesday – When Painful Cracks Appear

/147 Comments/in Premium /by Alex - Chart FreakDon't worry, we do have a remedy for that...

Read MoreMay 12th Weekend Report

/92 Comments/in Premium /by Alex - Chart FreakLet's review our market activity for the week. After enduring a lot of choppiness in various Market Sectors recently, this was a week of change, with out prior reports discussing 'crossing the line' and 'Follow through'. Let's take a look...

Read MoreContact Us

26 Broadway,

8th Floor

New York, NY 10004

admin@bigleaguefinance.com

admin@bigleaguefinance.com

Latest Blog Posts

accelerator diet pills goji berry diet pills ultra 90 diet pills keto meal replacement bar top weight loss diet pills for thyroid patients where to buy t lite diet pills keto friendly thickener diet fuel diet pills peanuts keto friendly rite aid diet pills that work envy diet pills diet pills for breastfeeding moms belique diet pills perfect slim weight loss pills calories in a bottle of white wine