You are here: Home1 / Premium

This is the weekend report, where we can monitor the progress that the various sectors of the market have made, and what we may expect going forward. Since I give a more detailed day to day update in the daily reports, I often focus mainly on the Big Picture in the weekend reports by using the weekly or Monthly charts. This week , however, I will start with the daily charts in a couple of the sectors, to include a close up of where we are now, and then we'll get into our Big Picture Outlook.

.

QQQ Daily - We are pausing at the 50 sma, as expected. Will we go sideways or pull back? It really shouldn't matter, at day 12, I think that we should still break above the 50sma in the first daily cycle and maybe back test it on the dcl later...

QQQ WEEKLY - This is an area that POSSIBLY may eventually become an important topping point. We are watching this s things unfold. If the FED stops raising rates in early 2019, I wouldn't rule out that the markets can hang in there a bit longer. FED PROPPED. I still lean toward a H&S top though, with highs in place.

Read More

Read MoreToday is Friday, the last day of trading for the week. It really has been a great couple of weeks of trading , so let's discuss a few things...

.

This was in yesterdays report...

.

QQQ – I am also starting to see what look like rising wedges in The Nasdaq. This can push higher, but keep an eye on it. These can be short term bearish, and often break down, an example of this was seen last February and April.

QQQ - The QQQ tagged the 50ssma and the wedge remains in view. Read the chart.

Read MoreAs was mentioned in yesterdays report, a variety of the markets sectors have been climbing higher and trading has been excellent. Let's examine our current markets...

,

This was in yesterdays report-

SPX #1 – If this is an ICL, we should have a month or two off of the lows, but we are seeing price enter ‘resistance’ areas. It CAN push higher, but we are nearing an area that may offer resistance and stall price too. The markets have been straight up, but going forward they may get choppy.

Read More

Read MoreAs the various sectors bounce out of their recent lows, they continue to do pretty good on the Climbing Wall. Some may be climbing the so called 'Wall of worry'. Let's take a look at the progress...

.

SPX #1 - If this is an ICL, we should have a month or two off of the lows, but we are seeing price enter 'resistance' areas. It CAN push higher, but we are nearing an area that may offer resistance and stall price too.

Read More

Read MoreIn The last quarter of 2018, various areas of the markets began drying up and going stale. We saw the equity markets & Oil crashing down and many good set ups that would form would quickly fall apart. Trades in Miners and some of the Medical Marijuana companies were playing out ok, but there was definitely a choppy vibe in the GDX & GDXJ area too, into December.

.

Suddenly, we have seen bottoms develop (temporary or longer term bottom remains to be seen), and along with these bottoms are set ups that are finally working out, and many are working out very well. Let's take a look at Mondays action...

.

REMINDER: At the end of December, IN MY REPORT, I mentioned that this reversal candle on day 39, was a buy in technical analysis, with a stop under that days lows. If an ICL is in place (Day 1) , those lows will not be broken for weeks. So far, this is playing out well. You can see that I said that " This is a BUY" in that December report.

Read More

Read MoreWe have all seen changes take place in various places during our lifetime. The Theme picture highlights how things have changed from your parents day to today, or maybe even your youth to today. Changes can be gradual or sudden, and in the markets we have seen both gradual changes in character to sudden sharp change in market direction and sentiment. Bull to Bear and Bearish to Bullish. As we review our Big Picture of the Markets, we can keep the idea of those types of 'Changes' in mind.

.

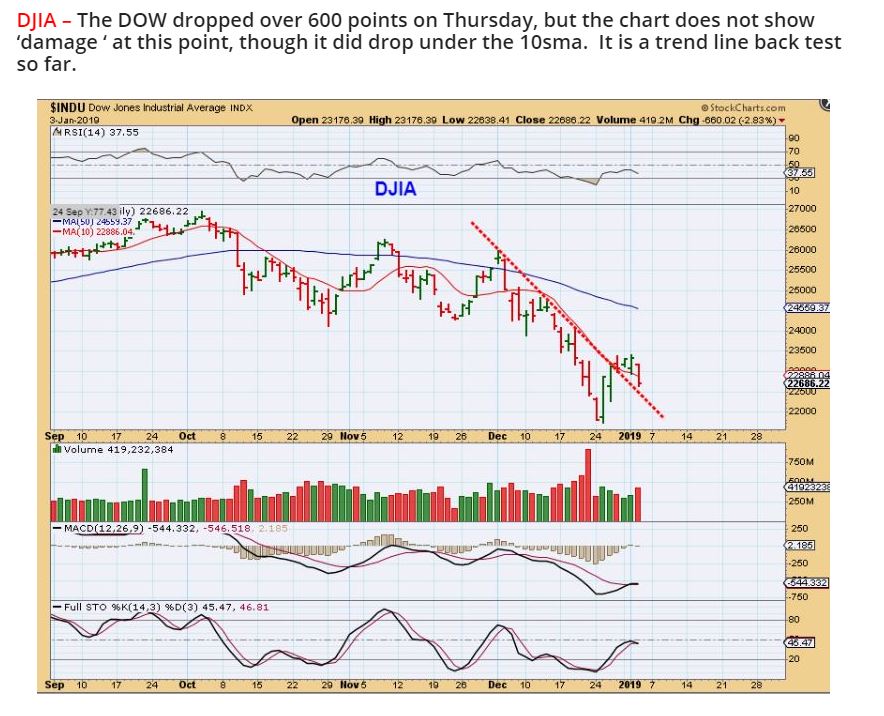

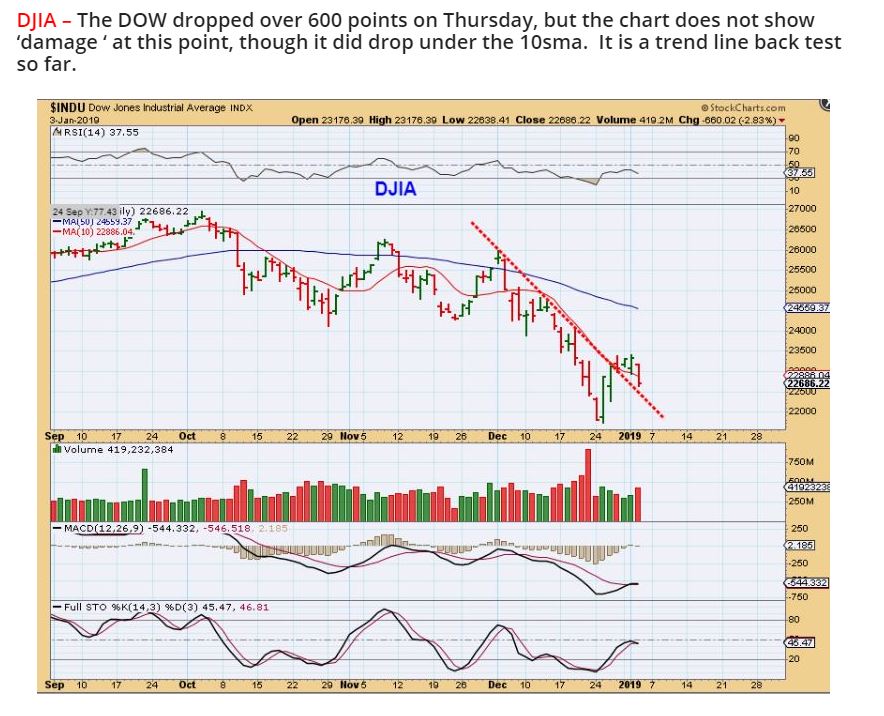

The 600 Point drop in the DJIA Thursday did not concern me. We caught the lows and I posted this after Thursdays trading...

SPX DAILY - We caught the lows with Decembers reversal and day 6 flipped higher off of the trend line & had nice follow through. I WOULD SAY THAT YOU CAN NOW RAISE STOPS TO THURSDAYS LOWS TO BE SAFE. The blue line resistance can be broken, I just drew it to show where we may stall.

Read More

Read MoreAfter a quick market review, Todays report will include a long section reminding us about a recent discussion that we had.

.

DJIA - The DOW dropped over 600 points on Thursday, but the chart does not show 'damage ' at this point, though it did drop under the 10sma. It is a trend line back test so far.

Read More

Read More

QQQ - Markets gapped down Wednesday, but reversed higher as the day went on. We have expected an ICL, and these lows should hold for a while, but it also may be choppy.

Read More

Read More I imagine that with this opening theme picture, you may think that I am going to start by discussing the burning Hemp Legalization topic or something? Well, actually, this report is going to focus on just one thing, and that is The Precious Metals Sector.

Read MoreI would venture to say that by now, after the past several weeks of choppiness and selling off, most if not all here know my thoughts on how things could play out going forward. It does seem that things are lining up now. let's let the charts speak for themselves. Let's get right into it...

.

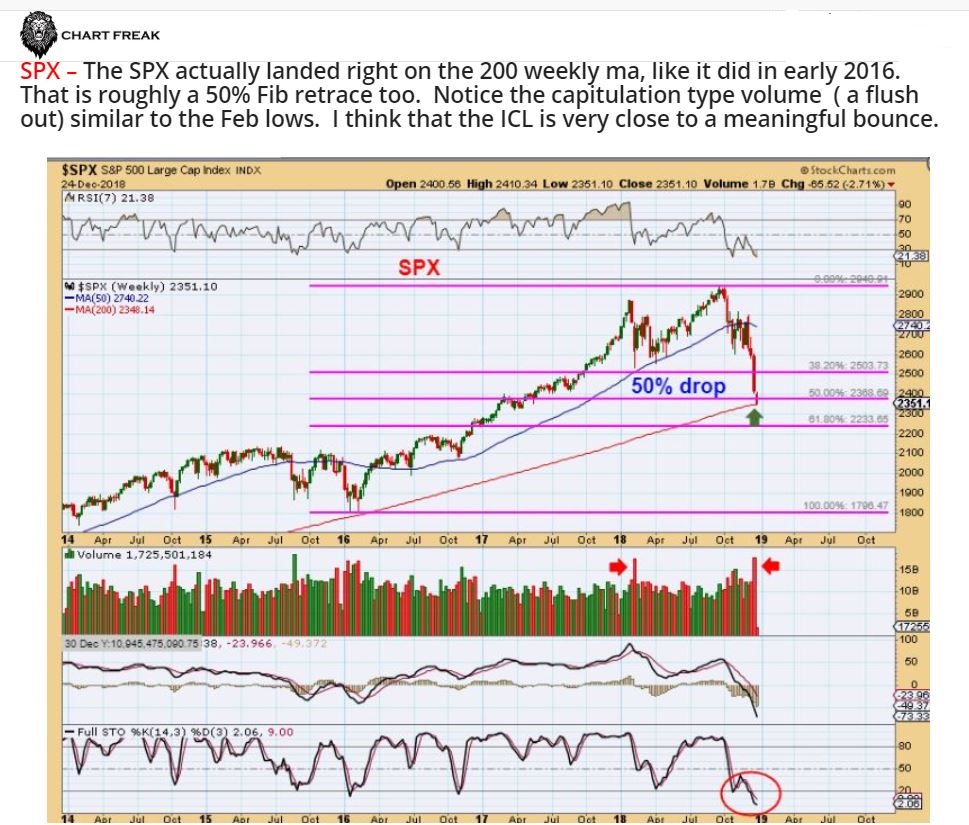

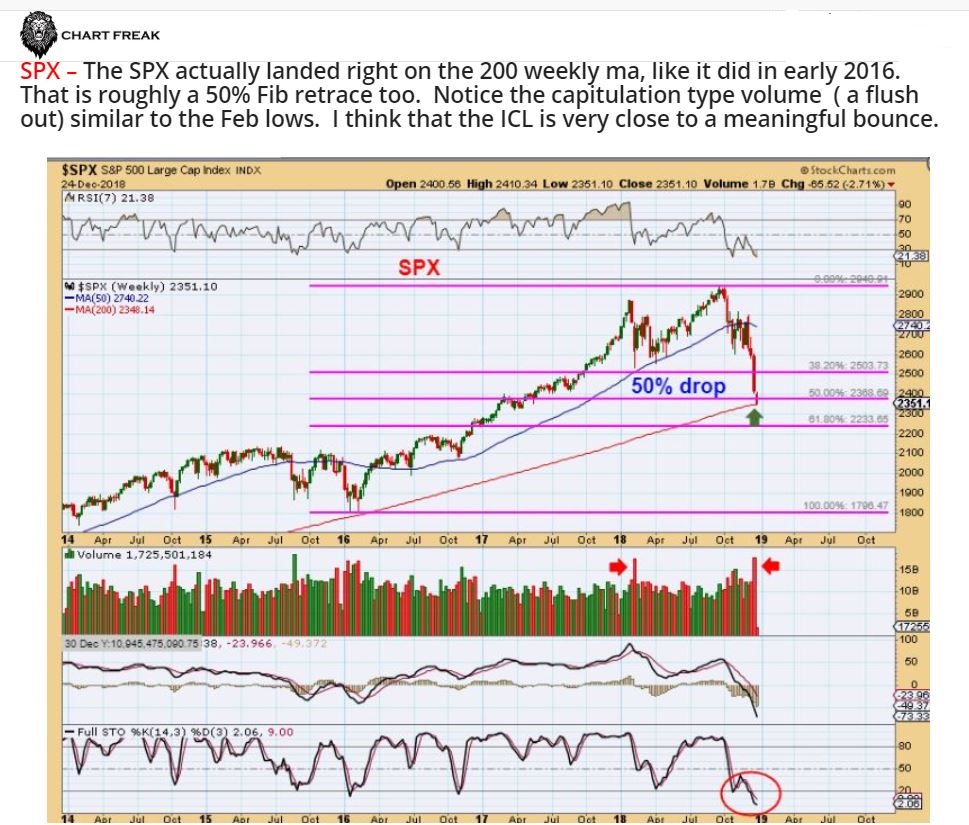

SPX - On Dec 24th, I gave several reasons that this should be the ICL that I have been expecting. I mentioned the PUT / CALL Ratio, Sentiment, etc, so a reversal here is a buy with a stop under the lows...

SPX - Capitulation volume came in on day 38, and that is good timing for a DCL/ ICL. The 3 day bounce is not even near 'Overbought".

This is where it gets important...

Read More

Scroll to top

Read More

Read More