You are here: Home1 / Premium

The 1st round of the French Elections are being held on Sunday April 23, and that may temporarily shake up the markets, but so far, things do seem to be lining up as expected in various sectors. Let's review ...

.

SPX - On April 19th we saw the SPX continue to be rejected at the 50sma. I mentioned watching that 2322.25, because a break out higher or lower is important.

SPX April 21 - No change yet. The RSI & MACD are improving, but no break out yet.

Read More

Read MoreIf you were reading the 'comments' or the chat area yesterday, there was a lot of talk about STEEL and the STEEL STOCKS, so Fridays report will discuss that area and some probable trade set ups in that area and other areas.

STEEL - We'll start with STEEL itself. We have a weekly reversal and a swing low has formed on the daily chart. After the long multi-month consolidation, the weekly RSI is again above 50% and the Stochastics has reached an oversold level. This all looks good.

STEEL DAILY - The daily chart had a nice bullish push higher too, and right off of the 200sma.

Read More

Read MoreIn yesterdays report, I was complaining about the boring 'put you to sleep' type of sideways action in the markets lately. Apparently that was the calm before the storm, because later that day we finally saw some pretty big changes take place all in one day. Something interesting occurred in the General markets, Oil had a big drop of almost 4% (!) and the selling in the many of the junior Miners that I had been pointing out picked up the pace too. Let's take a look at the markets and discuss the recent developments.

.

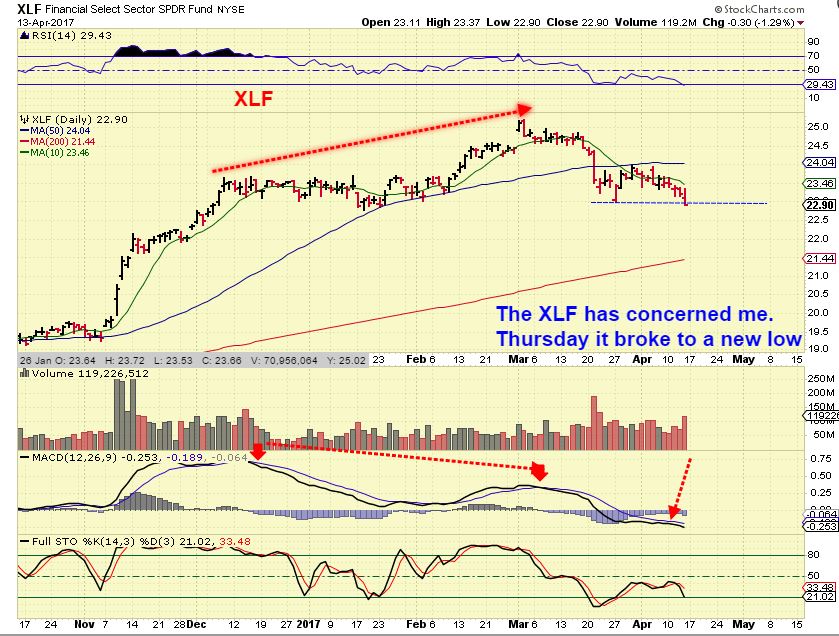

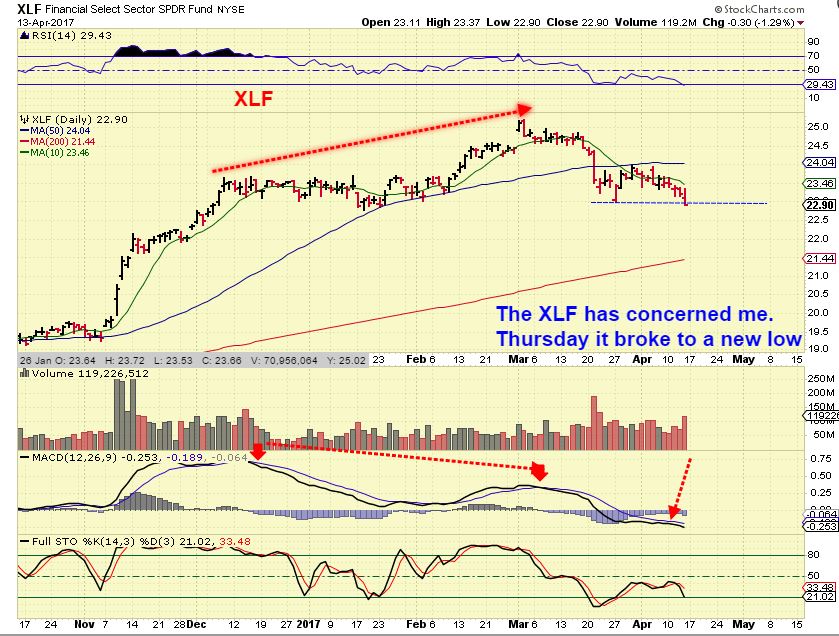

SPX - Not a lot has changed here, but I've mentioned that I'm a bit concerned with the XLF . Now there are new threats to the General Markets. The SPX remains under the 50sma and threatens to break below the prior lows. A break down could lead to a good sell off, and a break out higher could lead to a decent rally, but it is getting late in the 3rd daily cycle, so upside may be limited the longer time goes on.

This is interesting though...

Read MoreAs mentioned in Tuesday mornings report, the Markets have been absolutely fabulous lately ( If you needed to catch up on some rest that is). Boring action in almost every sector is putting traders to sleep. let's take a look at what happened on Tuesday!

SPX - Here we see that the SPX, oh wait, that's probably just a day trader as of Tuesday...

SPX - Here we see that the SPX has basically gone sideways for 2 months. Tuesday it was held back by the 10sma again. No real change here.

Read More

Read MoreSomething interesting taking place in the General Markets

SPX - Here we see the ICL in November and 2 dcls that followed. Obviously the markets have been relatively strong, because those dips down into their dcls have been shallow. Over the last 2 weeks I mentioned concerns about the XLF and then the SPX broke below the 50sma last week. The 'timing' dictates that an ICL is coming due and since the XLF has been weak, so I would expect more of a dip now or soon. At this point, I'm actually noticing some interesting developments taking place here too, so let's discuss that. Notice how the recent consolidation does look similar to the last one at the dcl...

Note: That last dcl has not been broken and a break out here is not out of the question, and here is why.

Read MoreLet's review what the markets have been doing and what that can mean for this weeks trading.

I have repeatedly said that the condition of the financials has concerned me when viewing the markets. Weakness there could bleed over into the general market.

XLF - Friday the XLF broke to a new low, taking out the last DCL. I now expect the financials to sell off over time.

XLF WEEKLY - The weekly chart shows the weakness too.

Read More

Read MoreAs stated before here, there are clearly times to trade and then there are times to just be patient. The best times to trade are after consolidations or bases finish forming , and then the trending moves out of those time periods can continue to carry positions higher. Until that time, trading inside of consolidation periods can be frustrating.

Read MoreToday I want to address how, even though we can see movement within 'cycle expectations' get stretched or a bit extended, it is still just a matter of time before Markets seek their lows. I will discuss this in the Precious Metals Section of the report.

SPX - Though this reversal can be viewed as bullish and be bought with a stop under the lows, We still need to see a break out and follow through.

Lat's look at the NASDAQ...

Read MoreThe markets remain a bit choppy, but some of the set ups that we have been discussing are beginning to play out nicely. I have a few more trade set ups for us too, so let's review...

.

USD - Starting with the USD, this may pause here for a bit. A short dip in the USD could cause a short pop in Gold & Miners.

Read More

Read MoreAs time moves forward, the Market big picture always become clearer, so let's see what has been happening this week, with a few added 'surprises'. I'll also add in 3 more trade ideas.

SPX - This is a possible inverse H&S forming now. The DCL would be the head, and whether or not you took a long trade while waiting to see how this develops ( I have had concerns based on the XLF and a few other factors) you can see that you have not missed any great move in these choppy markets. Notice that Price is STILL the same price as day 1, the first day after the swing low! That said, If you want to go long based on the possible inverse H&S and place a stop under the 50sma with a little wiggle room, this is as good a place as any to do that risk reward wise.

NYA - I was concerned with the dropping MACD , so I still have concerns there...

XLF - One of my main concerns was the financials and bank stocks like GS, BAC, JPM, etc. Until I see a recovery, I will still be concerned, but again, price is at a low risk reward area in some of the General Markets. I am not Long or short currently.

NASDAQ - We Don't want to get too bullish and forget this chart from Thursdays report of the NASDAQ on Wednesday. This is still in place and that MACD has dropped further. Markets have just been very choppy and volatile and I am still cautious on their ability to gain more upside at this point. They need to prove themselves and the Financials need to do that soon, in my opinion.

Read More

Read More

Scroll to top

Read More

Read More