You are here: Home1 / Premium

Not much changed in Mondays trading , but I want to discuss something in addition to a quick review and possibly a new sector perking up. Let's get right into it...

.

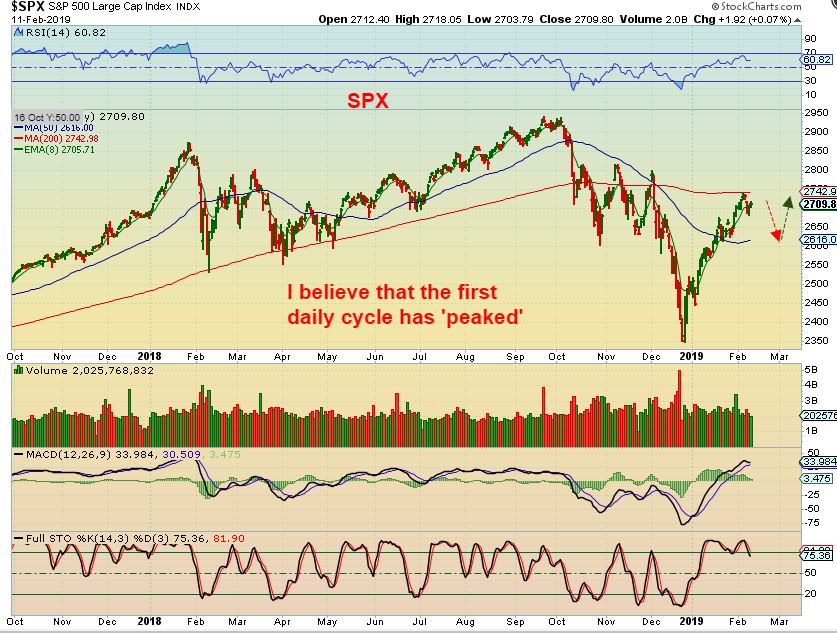

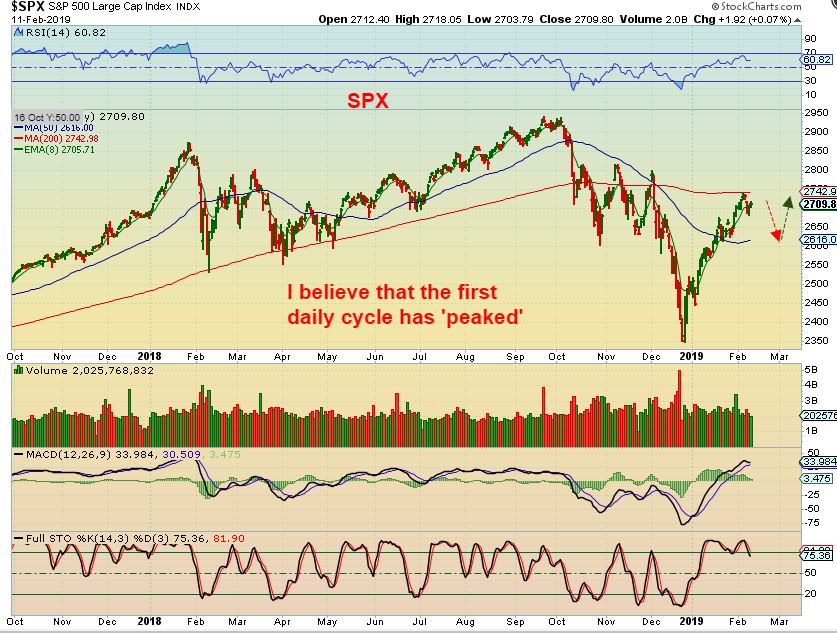

SPX - No change here, I think that the upside on the first daily cycle has run out of steam and a dip will come before another move higher.

Read More

Read MoreLet's discuss last weeks activities and the expectations of what is likely to come...

.

SPX WEEKLY - Here we see a weekly DOJI formed and it formed at the 50 week MA.

Read More

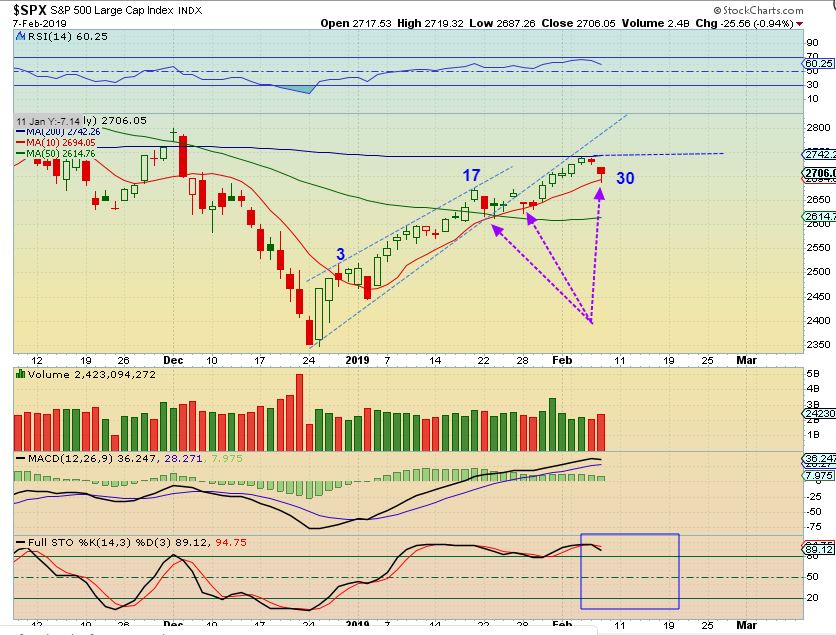

Read MoreWe have been expecting a bit of pull back in the General Markets, and it would likely start after the SPX tagged that 200sma. I am not expecting a wash out sell off, it will be more of a ' Buy the Dip' type of pull back into the first dcl, but if you want to hold on to most of your recent gains? Then at the first signs of cracks in the ice, you would certainly tighten stops or take some profits. You want to Stay Frosty for a while.

.

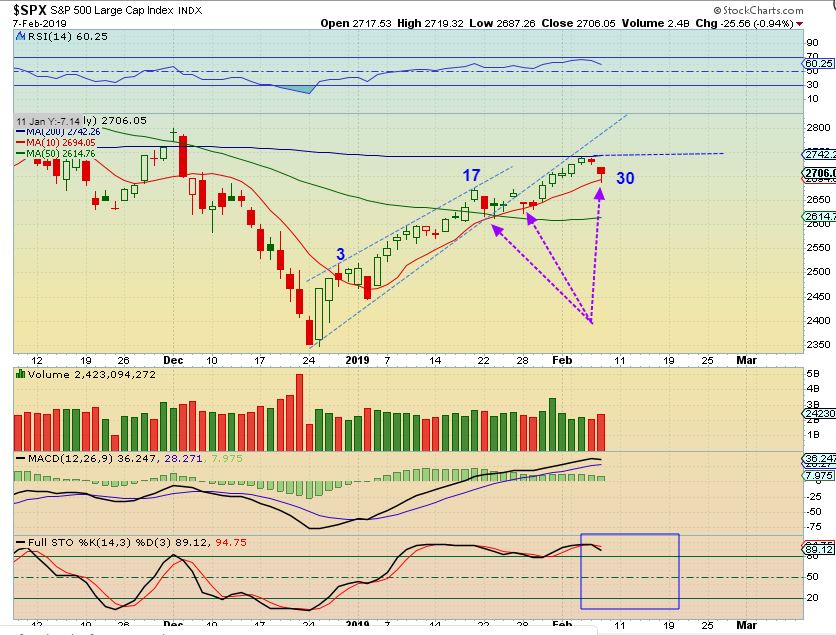

SPX - The SPX tagged that 200sma, dropped to the 10 sma, and bounced bit into the end of the day. We are on Day 30 and I expect this to eventually back test the 50sma.

Read More

Read MoreI've been mentioning that we could start to see some short term changes , possibly as soon as Wednesday of this week. Let's take another look at the reasons on the charts...

.

Read MoreNothing has really changed since the long weekend report, but I'm going to discuss why it might be time for a change. Let's begin...

Read More

SPX Weekly #1 - This is what I have said that I have been expecting out of the first daily cycle, and now we are hitting 2 resistance zones. We May or may not be at a top, but timing wise, we are close. We will dip to a dcl soon.

Read More

Read More .

It's the last trading day of the week. Let's see if the 'Things' that have been running like a Cheetah in the markets can give us one more up day!

.

Read More

We had some nice action after the FOMC Decision Wednesday. A lot of the sectors played our as expected, so lets discuss what to expect going forward too.

.

SPX - The General Markets broke higher with the Fed 'No Rate Hike" Decision. I expect a little more upside.

UPRO - UPRO, SOXL, TQQQ, etc are good 3x etfs for 'Fast Gains", since this daily cycle could peak after another run higher.

Read More

Read More Let's take a look at the markets current set up, as we wait for the FOMC Decision at 2 PM. Eastern today.

.

SPX - Basically still sliding sideways along the 50sma as expected, we had no real change in the General Markets. Are they waiting for the FOMC Decision too?

I wanted to take a look at something else here, to see if there are any clues as to which way the Markets may break after the Fed Decision...

Read More

Scroll to top

Read More

Read More