You are here: Home1 / Premium

.

I am releasing Thursday mornings report Wednesday Night...

Read More.

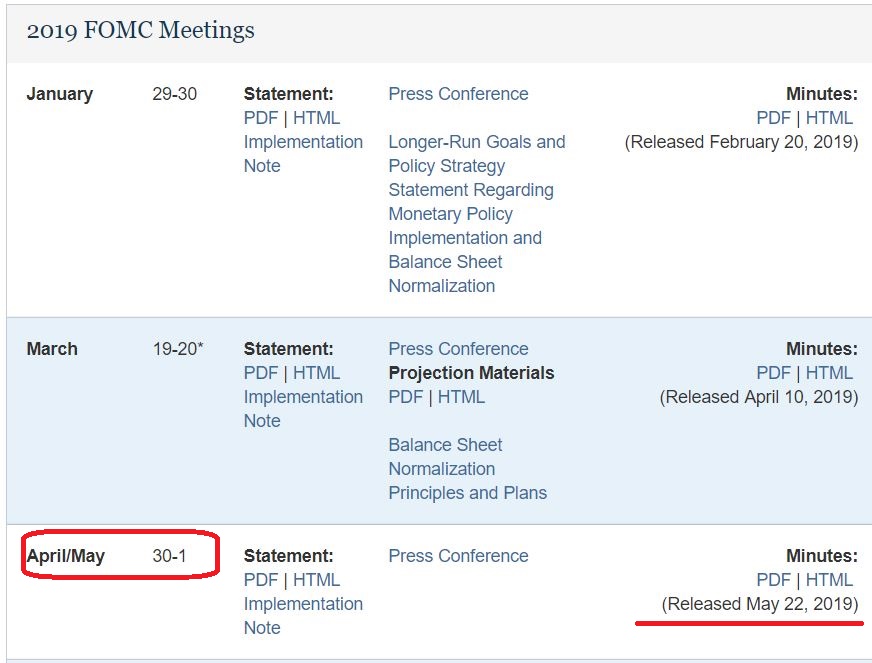

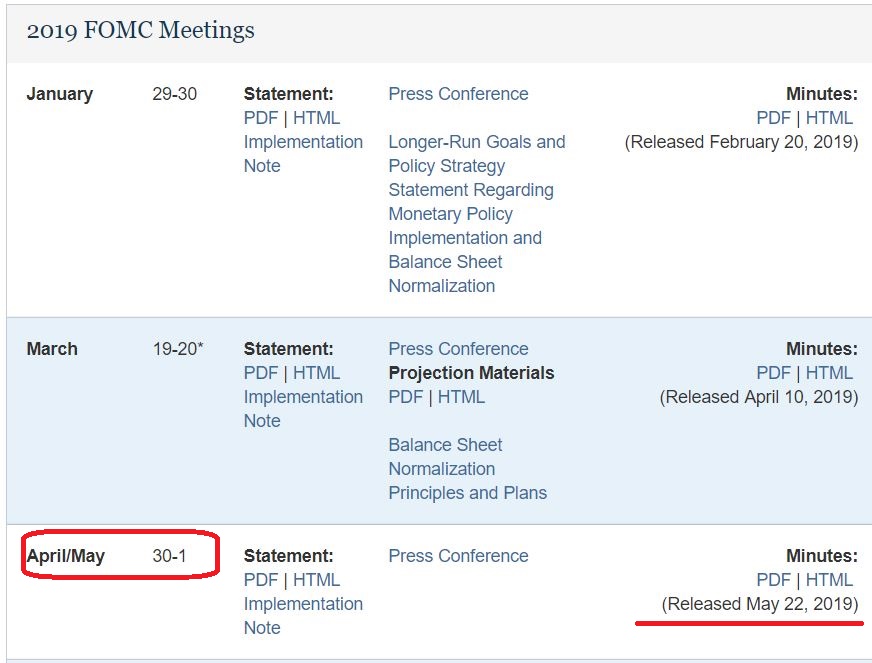

Today I want to run through some interesting reminders, and I will start with this schedule of the 2019 Fed Meetings and the release of the 'Minutes'. Notice that May 1 was a Fed Mtg, and the Minutes were released on May 22.

.

Read More

Read MoreI found some additional good news pertaining to the Precious Metals markets. I want to release my morning report tonight, since this information is helpful on a Fed week and an options expiration week ( Double Whammy) . Let's get right into the report...

SPX - So far we have the SPX holding above the 50sma after a strong push out of the recent sell off lows...

Well, It looks bullish but I do have something important to show you....

Read More.

Let's take a Bigger Picture View of our Markets...

Read More

Scroll to top

Read More

Read More