You are here: Home1 / Premium

https://chartfreak.com/wp-content/uploads/sites/18/2020/01/FLYer.jpg

733

782

Alex - Chart Freak

https://www.chartfreak.com/wp-content/uploads/sites/18/2019/11/Chart-Freak-site-logo.png

Alex - Chart Freak2020-01-24 12:45:262020-01-24 12:54:06Friday January 24th

https://chartfreak.com/wp-content/uploads/sites/18/2020/01/BUILDING.jpg

541

749

Alex - Chart Freak

https://www.chartfreak.com/wp-content/uploads/sites/18/2019/11/Chart-Freak-site-logo.png

Alex - Chart Freak2020-01-23 12:15:482020-01-23 12:23:49Thursday January 23rd

https://chartfreak.com/wp-content/uploads/sites/18/2020/01/STEPS.jpg

507

643

Alex - Chart Freak

https://www.chartfreak.com/wp-content/uploads/sites/18/2019/11/Chart-Freak-site-logo.png

Alex - Chart Freak2020-01-22 12:08:532020-01-22 12:08:53Wednesday January 22 – Progress

https://chartfreak.com/wp-content/uploads/sites/18/2020/01/CHANGE.jpg

509

624

Alex - Chart Freak

https://www.chartfreak.com/wp-content/uploads/sites/18/2019/11/Chart-Freak-site-logo.png

Alex - Chart Freak2020-01-18 20:56:112020-01-18 20:56:11January 18th Weekend Review

https://chartfreak.com/wp-content/uploads/sites/18/2015/04/Chart.jpg

450

675

Alex - Chart Freak

https://www.chartfreak.com/wp-content/uploads/sites/18/2019/11/Chart-Freak-site-logo.png

Alex - Chart Freak2020-01-17 12:26:322020-01-17 12:44:13Friday January 17th

https://chartfreak.com/wp-content/uploads/sites/18/2020/01/rocket.jpg

482

661

Alex - Chart Freak

https://www.chartfreak.com/wp-content/uploads/sites/18/2019/11/Chart-Freak-site-logo.png

Alex - Chart Freak2020-01-16 11:42:382020-01-16 11:42:38January 16th – What Launch Pad?

https://chartfreak.com/wp-content/uploads/sites/18/2020/01/TRADING.jpg

636

694

Alex - Chart Freak

https://www.chartfreak.com/wp-content/uploads/sites/18/2019/11/Chart-Freak-site-logo.png

Alex - Chart Freak2020-01-15 11:59:002020-01-15 11:59:00Wednesday January 15

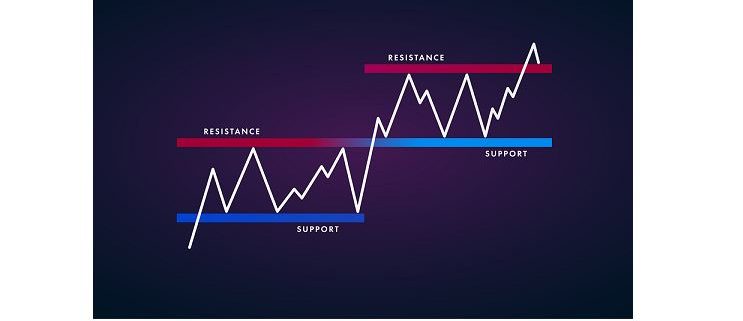

https://chartfreak.com/wp-content/uploads/sites/18/2020/01/support.jpg

575

743

Alex - Chart Freak

https://www.chartfreak.com/wp-content/uploads/sites/18/2019/11/Chart-Freak-site-logo.png

Alex - Chart Freak2020-01-14 12:15:492020-01-14 12:15:49Tuesday January 14th _ Things That We Are Watching

https://chartfreak.com/wp-content/uploads/sites/18/2020/01/JAN-1.jpg

830

1092

Alex - Chart Freak

https://www.chartfreak.com/wp-content/uploads/sites/18/2019/11/Chart-Freak-site-logo.png

Alex - Chart Freak2020-01-11 19:45:092020-01-11 19:45:09The January 11th Weekend Update

https://chartfreak.com/wp-content/uploads/sites/18/2018/05/FRIDAY.jpg

559

853

Alex - Chart Freak

https://www.chartfreak.com/wp-content/uploads/sites/18/2019/11/Chart-Freak-site-logo.png

Alex - Chart Freak2020-01-10 12:37:232020-01-10 12:37:23Friday January 10th

Scroll to top