I’m looking at $NATGAS

/12 Comments/in Public, Uncategorized /by Alex - Chart FreakMAY 23 $NATGAS

I am looking at $NATGAS after its extremely bullish run up January & February. Last week a friend of mine POLY of The Financial Tap.com mentioned it as a possible short candidate a week ago, but I saw things a little differently . I was looking at $NATGAS close up & shared this chart,showing possible support & MACD divergence . Notice also, however, the 50sma overhead "Could" act as possible resistance. I was obviously thinking it could be a "Long".

I've said this many times...you cant argue with the markets, you must change with them if what you think you are seeing changes. Well POLY may have been early & correct in what he was seeing. Another friend of mine, Steve Chapman of The Refined Investor also noted NATGAS as a possible short , so I re-visited the charts and low & behold I noticed that NATGAS was rejected at the 50sma & the RSI 50% also turned down. (See the chart below, click to enlarge) .

Read More

I've said this many times...you cant argue with the markets, you must change with them if what you think you are seeing changes. Well POLY may have been early & correct in what he was seeing. Another friend of mine, Steve Chapman of The Refined Investor also noted NATGAS as a possible short , so I re-visited the charts and low & behold I noticed that NATGAS was rejected at the 50sma & the RSI 50% also turned down. (See the chart below, click to enlarge) .

Read More

I've said this many times...you cant argue with the markets, you must change with them if what you think you are seeing changes. Well POLY may have been early & correct in what he was seeing. Another friend of mine, Steve Chapman of The Refined Investor also noted NATGAS as a possible short , so I re-visited the charts and low & behold I noticed that NATGAS was rejected at the 50sma & the RSI 50% also turned down. (See the chart below, click to enlarge) .

Read More

I've said this many times...you cant argue with the markets, you must change with them if what you think you are seeing changes. Well POLY may have been early & correct in what he was seeing. Another friend of mine, Steve Chapman of The Refined Investor also noted NATGAS as a possible short , so I re-visited the charts and low & behold I noticed that NATGAS was rejected at the 50sma & the RSI 50% also turned down. (See the chart below, click to enlarge) .

Read MoreComputers are painting charts?

/14 Comments/in Public, Uncategorized /by Alex - Chart FreakMay 22

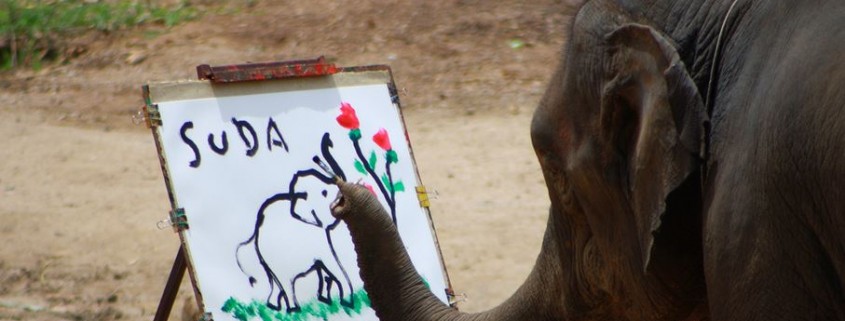

Computers are painting the charts? I'll believe that when I see Elephants painting Elephants! Oh wait- I HAVE seen that. So 'IF' they have hired a bunch of tech savvy students to run algorithms to "Paint the Charts" into forming Head & Shoulder patterns that break upwards and the MACD crossing down only to see prices spikes up after many go short, etc , then they're doing an AWESOME job in the P.M. markets. I've been Bullish ,flipped to bearish , and now I'm seeing signs of bullishness again. Lets look at the charts and then review some OTHER areas of possible trades setting up too.

$GOLD

So far, when it comes to the expected drop , they haven't been able to sell it off. PRICE , RSI & MACD in GOLD have formed higher lows so far. A close above the 50sma is Bullish I.M.O.

Read More

So far, when it comes to the expected drop , they haven't been able to sell it off. PRICE , RSI & MACD in GOLD have formed higher lows so far. A close above the 50sma is Bullish I.M.O.

Read More

So far, when it comes to the expected drop , they haven't been able to sell it off. PRICE , RSI & MACD in GOLD have formed higher lows so far. A close above the 50sma is Bullish I.M.O.

Read More

So far, when it comes to the expected drop , they haven't been able to sell it off. PRICE , RSI & MACD in GOLD have formed higher lows so far. A close above the 50sma is Bullish I.M.O.

Read MoreCAN WE TALK?

/17 Comments/in Public, Uncategorized /by Alex - Chart FreakFRIDAY MAY 9

Hi , This is me  - Above you'll see a picture of a Bear. See the difference? I am not a bear. I just thought that I should clear that up, because after my last report I was asked , "Why are you a bear?"

Really I am not a bear when it comes to Gold & Miners, but taking things step - by - step , there was simply a little downside coming and I'm not so sure that its done yet. I DO see both bullish and not so bullish things in the charts at the end of this week, so how about a quick review.

GDX WEEKLY - Everybody is staring at this pattern, so I almost feel like it wont quite play out the way it seems...but here is how it is set up anyways. Inverse H&S. For now, I must say that a weekly chart with price UNDER THE 10WMA struggles. Notice what GDX did the past few weeks under the 10WMA.

And what does that Stochatics tell you?

- Above you'll see a picture of a Bear. See the difference? I am not a bear. I just thought that I should clear that up, because after my last report I was asked , "Why are you a bear?"

Really I am not a bear when it comes to Gold & Miners, but taking things step - by - step , there was simply a little downside coming and I'm not so sure that its done yet. I DO see both bullish and not so bullish things in the charts at the end of this week, so how about a quick review.

GDX WEEKLY - Everybody is staring at this pattern, so I almost feel like it wont quite play out the way it seems...but here is how it is set up anyways. Inverse H&S. For now, I must say that a weekly chart with price UNDER THE 10WMA struggles. Notice what GDX did the past few weeks under the 10WMA.

And what does that Stochatics tell you?

And there is more...

Read More

And there is more...

Read More

- Above you'll see a picture of a Bear. See the difference? I am not a bear. I just thought that I should clear that up, because after my last report I was asked , "Why are you a bear?"

Really I am not a bear when it comes to Gold & Miners, but taking things step - by - step , there was simply a little downside coming and I'm not so sure that its done yet. I DO see both bullish and not so bullish things in the charts at the end of this week, so how about a quick review.

GDX WEEKLY - Everybody is staring at this pattern, so I almost feel like it wont quite play out the way it seems...but here is how it is set up anyways. Inverse H&S. For now, I must say that a weekly chart with price UNDER THE 10WMA struggles. Notice what GDX did the past few weeks under the 10WMA.

And what does that Stochatics tell you?

- Above you'll see a picture of a Bear. See the difference? I am not a bear. I just thought that I should clear that up, because after my last report I was asked , "Why are you a bear?"

Really I am not a bear when it comes to Gold & Miners, but taking things step - by - step , there was simply a little downside coming and I'm not so sure that its done yet. I DO see both bullish and not so bullish things in the charts at the end of this week, so how about a quick review.

GDX WEEKLY - Everybody is staring at this pattern, so I almost feel like it wont quite play out the way it seems...but here is how it is set up anyways. Inverse H&S. For now, I must say that a weekly chart with price UNDER THE 10WMA struggles. Notice what GDX did the past few weeks under the 10WMA.

And what does that Stochatics tell you?

And there is more...

Read More

And there is more...

Read More