SILVER AND GOLD

/in Public /by Alex - Chart FreakHere at CHARTFREAK.COM, we have been all over the buying of Miners and Metals related positions for many weeks now . Since pointing out the lows in Gold in Early Nov, some miners have gone up over 100% . It has been profitable, but Some were a little concerned about SILVER lagging. What did I think […]

Miners Are Acting Correctly

/9 Comments/in Public /by Alex - Chart FreakI posted for the public blog in Nov & Dec many times that I was expecting a strong move in Metals and Miners. It was Very unpopular and many were ( Understandably) quite nervous about entering and holding any positions, especially over the weekends. Others doubted the idea all together. In the premium strategies section of this site, I have been recommending Miners with proper 'Set ups' that were projecting strong moves higher and I was also giving strong reason in both Nov & Dec that buying then would pay off going forward. Bases were being built and could move up at any time. Still, it wasnt easy back then at the lows.

Some Miners have done very well since then. People are gaining confidence that maybe the move could be profitable for them too . Let me show you what we here at chartfreak have been looking at.

IAG , CDE , HL, AG were just a few that were recommended early on .

IAG ran from $1.40 to $2.50 and consolidated for a while. It ended up moving 100% off of the lows already. Last week it pulled back and reversed at the 10sma. These leaders are looking good and acting correctly , which adds confidence to our holding positions.

To further add confidence to the possible moves, lets review another set up recommended here .

Read MoreOBSERVATIONS

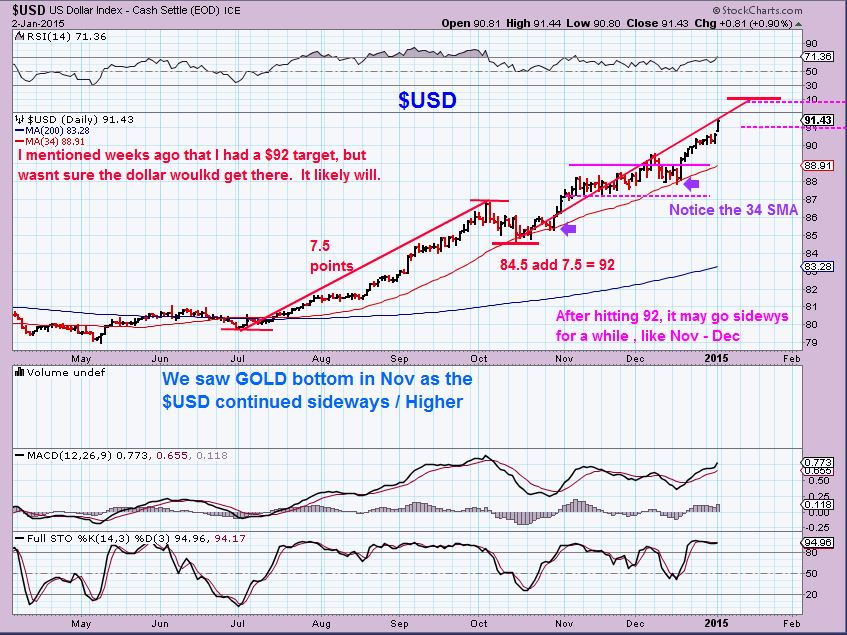

/10 Comments/in Public /by Alex - Chart FreakI have been watching the various markets intently , examining internals and how they've reacted under similar circumstances in the past to try to get an idea of what to expect . I think that I have done rather well with the general markets and Metals and miners, but I must say...there are some extremes in some areas that I have just left alone until I get a clearer idea of how things may unfold going forward. What am I referring to? Well, specifically the ENERGY sector with OIL and NATGAS has been a little tricky, and of course the $USD has been very strong - now even higher than I anticipated. lets take a look at those areas. They that have been difficult to call, for Sure.

I know what I "Guess" they could do, but when it comes to putting advice in my premium reports on these sectors, I have decided to just wait until things clear up , and focus on some other very trade-able areas.

I expected the $USD to stop in the $92 area. ( Actually, I had that as a target, but I thought it may not make it there, I mentioned that it could roll over near 91 because GOLD began completely ignoring the $USD strength. I assumed GOLD was sniffing out Dollar weakening).

I posted this chart Jan 2- $92 target