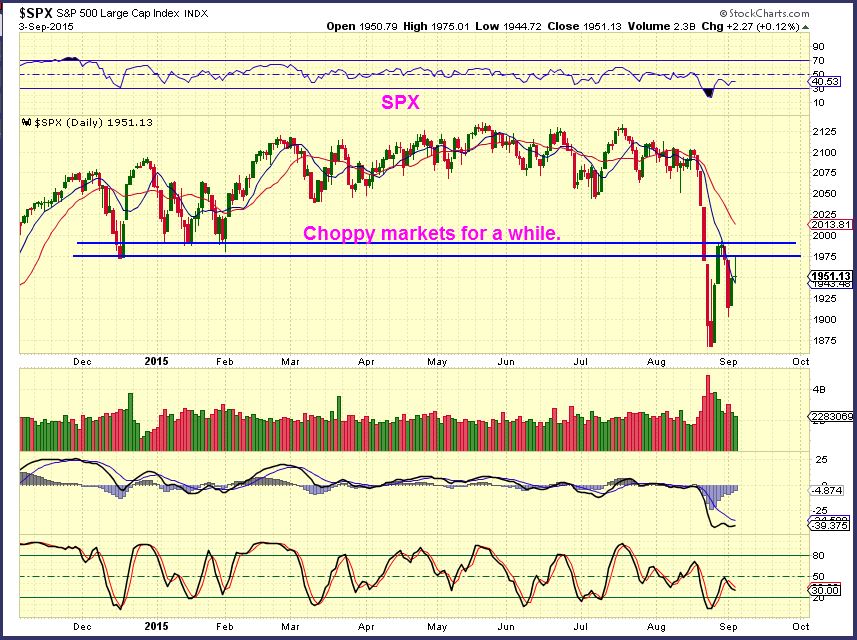

A Slow Motion Run To Nowhere

After watching the markets yesterday, I get the feeling that this week may be a sideways slow motion move that goes nowhere fast...until after the Fed Mtg. Lets review some charts.

.

I’ve been a full time trader for well over a decade and began trading in the late 1990s while working in management and sales at a well-known aerospace company. As my style evolved, so did my success, and it allowed me to leave corporate America to pursue my passion and trade full time.

.

.

The following are a few of the charts I’ve posted in recent Premium section of the website. I believe we may be seeing a major shift in the markets and the recipients of future money flow just may surprise many. Hint: They have been targeted on the short side for many months and in some […]

.

.

accelerator diet pills goji berry diet pills ultra 90 diet pills keto meal replacement bar top weight loss diet pills for thyroid patients where to buy t lite diet pills keto friendly thickener diet fuel diet pills peanuts keto friendly rite aid diet pills that work envy diet pills diet pills for breastfeeding moms belique diet pills perfect slim weight loss pills calories in a bottle of white wine