Trust Issues

Let's get right into the weekend report, and I will discuss all of the sectors and why I chose trust issues as a theme.

.

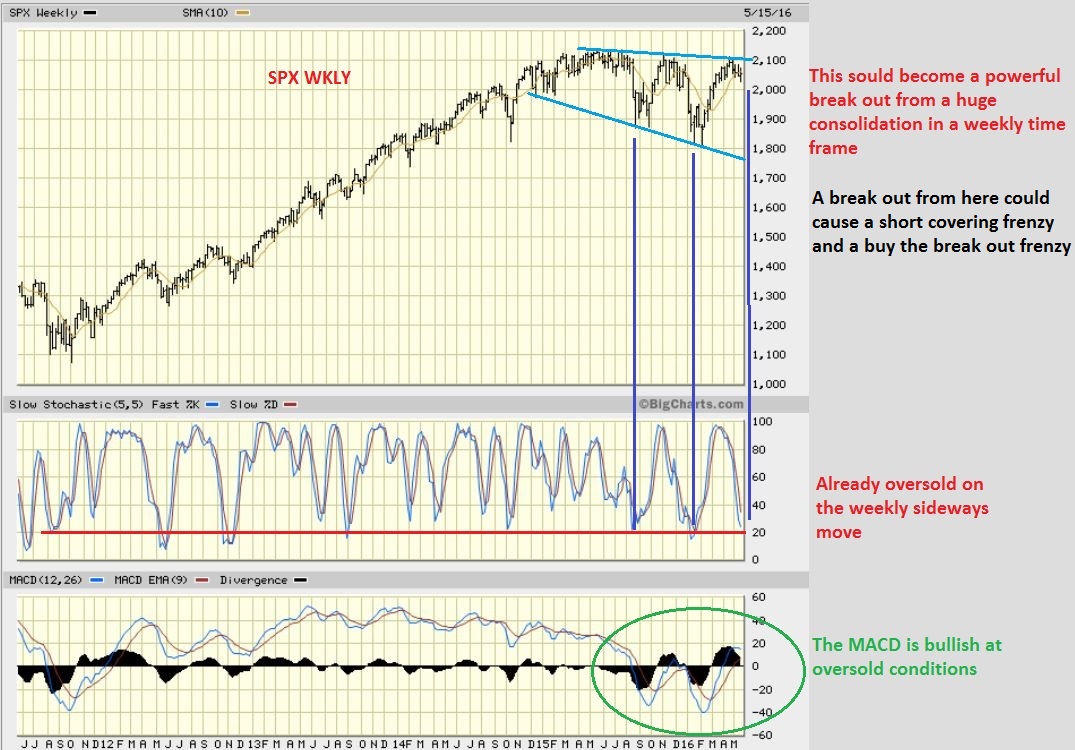

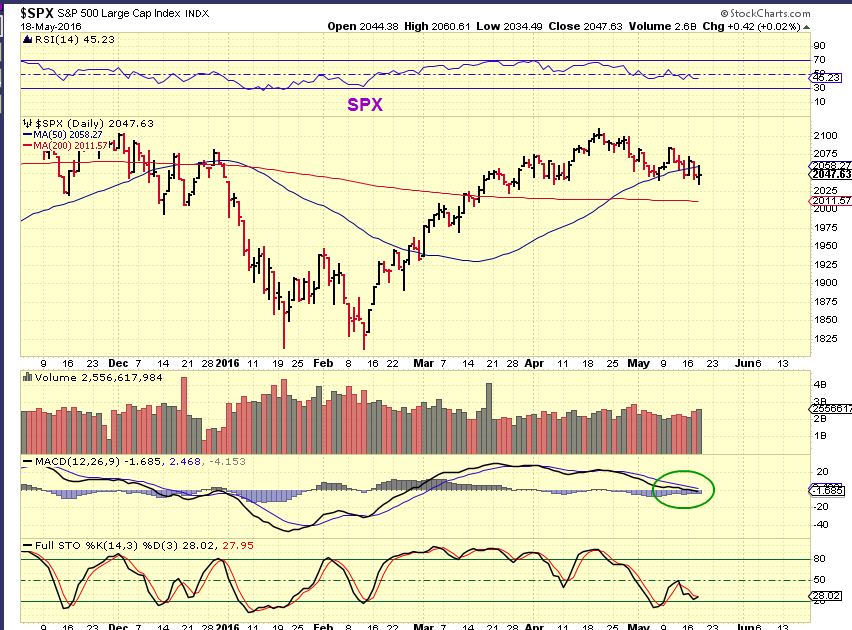

SPX- Last weekend I had been discussing the expected rally and the potential that it has to be strong since price is near the highs, but the signals that I was getting was saying that it was near term lows ( DCL). Since the markets did form a pattern known as H&S, I used this as one of my charts showing that we were at lows, not highs on a weekly. Would we have a strong week?