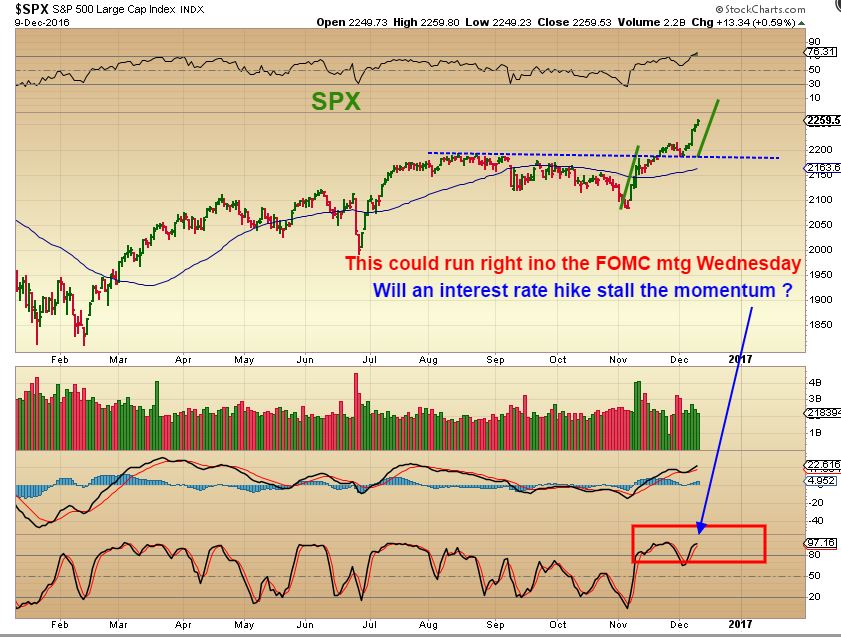

The Fed Hike Plunge

Many sectors began to sell off with the interest rate hike Wednesday. Some were sectors we expected to sell off, others were expected to snap back. Will we get the snap back on Thursday and Friday? Let's discuss what we should be looking for.

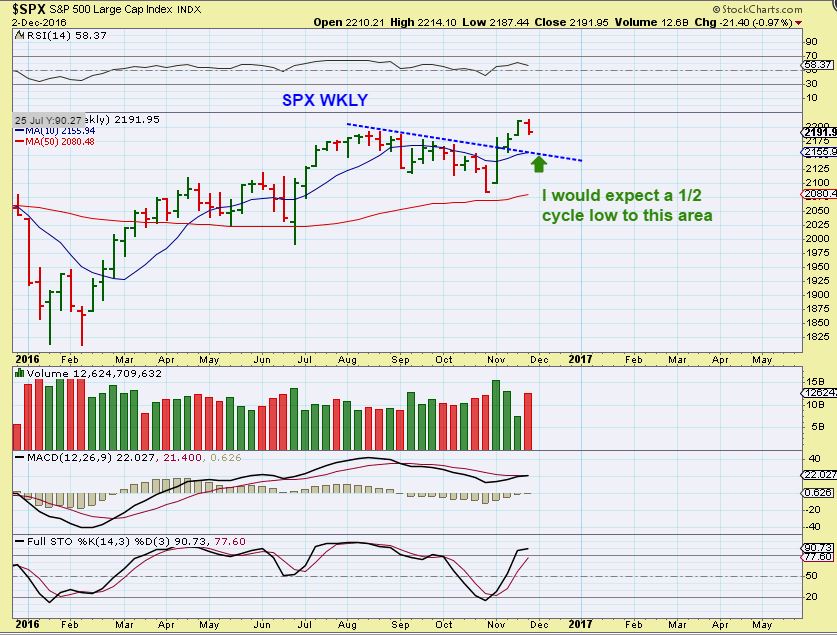

SPX - From Monday, the markets were outside the B.B. on a weekly basis, so I would have expected a dip by the end of the week.