Author Archive for: Alex - Chart Freak

About Alex - Chart Freak

I’ve been a full time trader for well over a decade and began trading in the late 1990s while working in management and sales at a well-known aerospace company. As my style evolved, so did my success, and it allowed me to leave corporate America to pursue my passion and trade full time.

Entries by Alex - Chart Freak

May 11 – Trading

May 11, 2017 /74 Comments/in Premium /by Alex - Chart Freak

NASDAQ - The NASDAQ continues to climb that wall of worry. If you were long, a trailing stop may work out well, this is now another right translated daily cycle in a Bull Market. As shown in recent reports, Some stocks are doing well with earnings, and others are getting crushed. Add NVDA & TSEM to the 'doing well' group. Yelp & SNAP to the getting slapped group.

This is a reminder - This was my My February thought showing a possible parabolic blow off top . The pattern is similar with a sharp sell off and then a ramp higher.

May 10th – Changes

May 10, 2017 /82 Comments/in Premium /by Alex - Chart FreakWe do see some changes occurring in the markets, so let's discuss them. They may be just temporary or they could last for a little while, so we will discuss that too.

SPX - This was an engulfing candle, but they bought it back toward the end of the day. Could this be the start of the dip into a dcl?

IWM - I like to use the Russell 2000 and the NYA to get a better picture of the general markets. We see the 2 gaps have already filled here, but the stochastics is still not oversold and therefore more downside is possible.

NASDAQ - The NASDAQ , which has been very strong, also seems to have put in a topping candle, so we could see some selling in the markets going forward.

5-8-17 Short And Sweet

May 9, 2017 /115 Comments/in Premium /by Alex - Chart Freak

Todays report will be short and sweet, there is no need to cover 'everything' after the weekend report, but it does still include over 20 charts to cover a number of ideas, some new and others that we have discussed in prior reports.

MAY 6th Weekend Report

May 7, 2017 /50 Comments/in Premium /by Alex - Chart FreakKeeping in mind that we have the French Elections on Sunday and the results can cause a short term reaction, let's review the market action from last week and our current expectations.

SPX WEEKLY - The SPX finally broke to new highs last week ( We know that the Nasdaq has been running like a bull).

SPX - The SPX will be due to drop down into its own ICL soon. In the past the 200ma has been rather reliable as a support. Since the 200 is rising, maybe the SPX will see 2300? As you can see from previous drops down into an icl, a drop like that can take a few weeks once it starts to roll over. "Sell in May and go away?"

Friday May 5th

May 5, 2017 /85 Comments/in Premium /by Alex - Chart FreakLets get right to the report...

Fed Follow Up Report

May 4, 2017 /129 Comments/in Premium /by Alex - Chart FreakHonestly, there was little permanent reaction when the Fed decision was made known, but we can't say that a lot changed. Expectations remain the same, so lets review these markets....

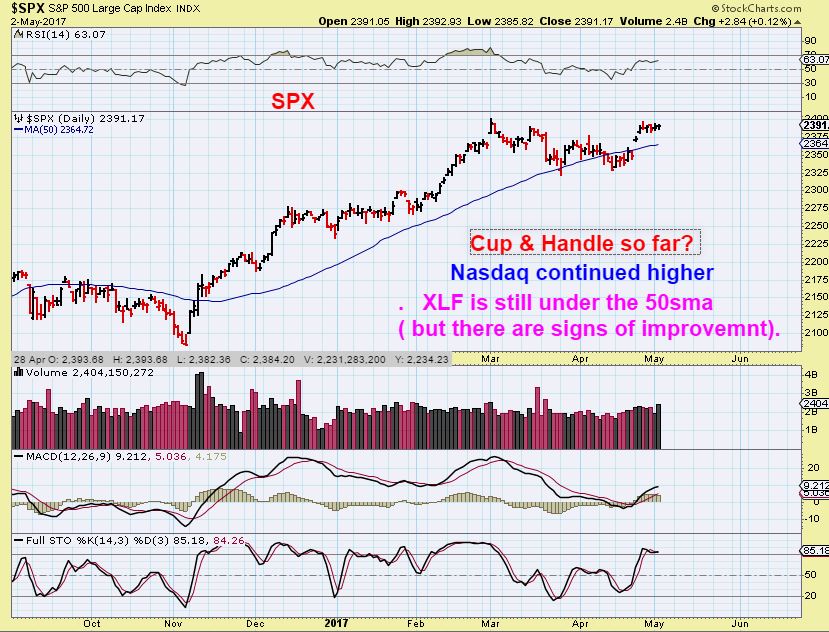

SPX - This was in yesterdays report, please read the chart. Also the signs of improvement in the XLF continued.

DJIA - I expected a dip, but this reversal after the Fed may have follow through upside. This consolidation could be forming an inverse H&S.

May 5th – Fed Changes

May 3, 2017 /80 Comments/in Premium /by Alex - Chart FreakAs the Fed Decision approaches, it is expected to be a non-event when it comes to an interest rate hike. It does appear that some sectors are lined up for some changes, however. Let's discuss why.

Tuesday May 2nd

May 2, 2017 /76 Comments/in Premium /by Alex - Chart FreakI wasn't really expecting a whole lot of change in the various markets sectors on Monday, Tuesday, and even Wednesday morning, but we do have the FOMC Decision at 2 p.m. Wednesday afternoon, and that may cause some 'changes'. Let's discuss the precious metals markets.

GOLD - We've been waiting for and expecting this drop, so that is nothing new. The stochastics isn't even oversold, so selling can continue Tuesday & Wednesday too.

“Where Have You Been?”

May 1, 2017 in Public /by Alex - Chart FreakI received a couple of emails recently from the public readers ( one was an old friend, Thanks Bob C. !) , either asking where have I been when it comes to my public posts, or asking me to review what I have been seeing lately. I've been very busy this spring with the premium reports and a private chat area that we have in there, plus other outdoor activities and responsibilities that I care for every spring, but as for a review? I would be happy to do that. 🙂

The General Markets became choppy in March and I was expecting a drop into a daily cycle low. I estimated that the 50sma would be a good target.

For over a month things were choppy and difficult to trade really, until we got a directional break. The drop was not as sharp as I had imagined, so some of the trades that I was taking were working out, but others lacked follow through, got choppy, and stopped me out. I admit that this was choppy and a difficult environment to trade in.

From April 25 - Currently we see a pattern of consolidation and then moves higher ( With pullbacks along the way). We do have a FOMC MTG this week, and there is a chance that that may cause the markets to dip into a low

Contact Us

26 Broadway,

8th Floor

New York, NY 10004

admin@bigleaguefinance.com

admin@bigleaguefinance.com

Latest Blog Posts

accelerator diet pills goji berry diet pills ultra 90 diet pills keto meal replacement bar top weight loss diet pills for thyroid patients where to buy t lite diet pills keto friendly thickener diet fuel diet pills peanuts keto friendly rite aid diet pills that work envy diet pills diet pills for breastfeeding moms belique diet pills perfect slim weight loss pills calories in a bottle of white wine