July 5th – Gradual Change

With only 1/2 day trading on Monday, did anything really significantly change for todays report? Nothing has changed from my expectations, but we did see some decent moves, and they are worth discussing, so lets begin...

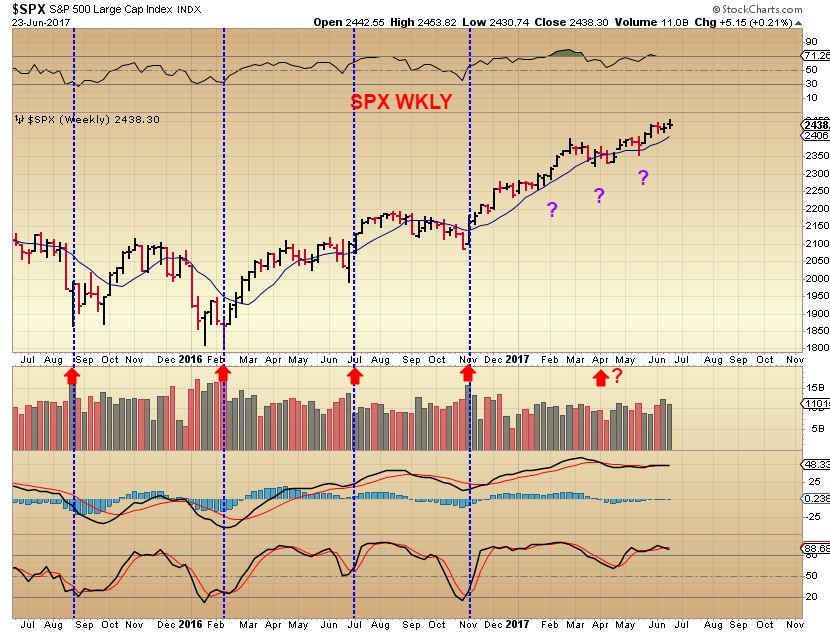

DJIA - This was in the weekend report. An eventual drop to the 50sma or more.

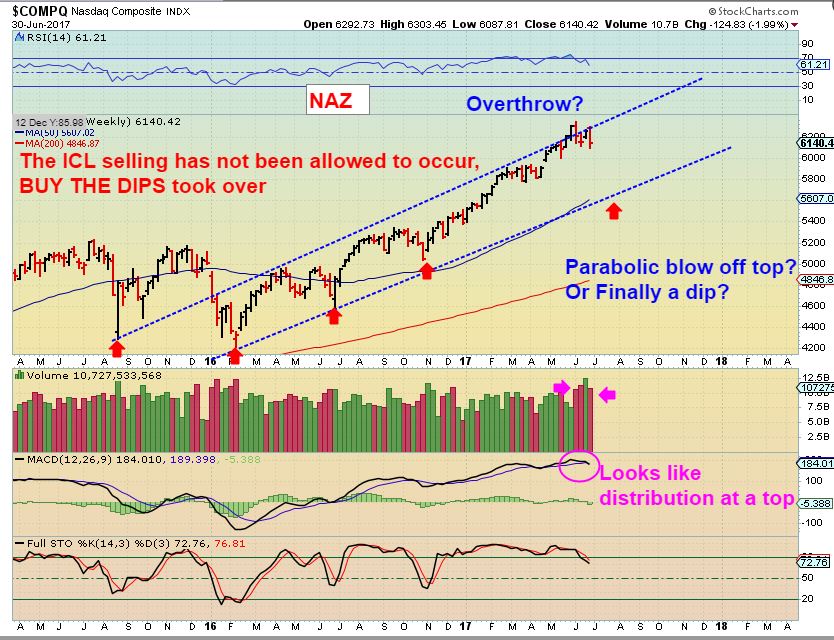

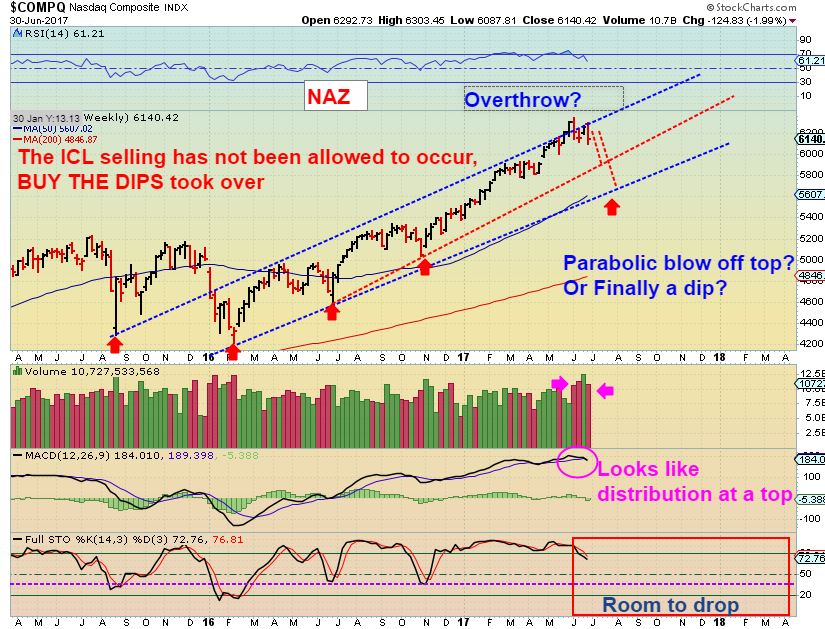

The NASDAQ was what was really looking rather toppy. We have not seen the kind of deep selling that I would be expecting now ( ICL).