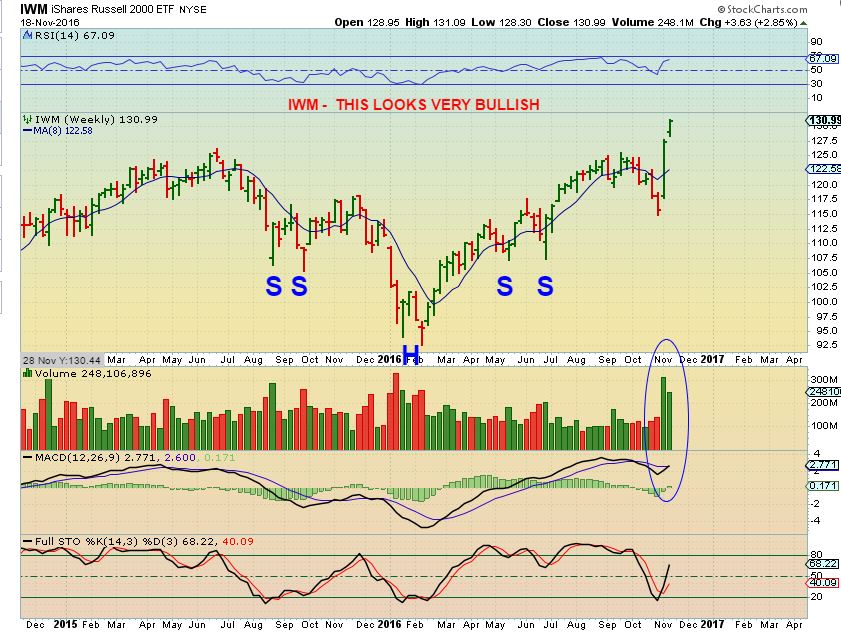

Is It Really Moving?

Sometimes things are moving so slowly that you can't believe that they are even moving at all. Well, We've seen this in the Precious Metals Sector over the past few days, but with the release of the Fed Minutes Wednesday, that just might change.