Men who can both be right and sit tight are uncommon. I found it one of the hardest things to learn. But it is only after a stock operator has firmly grasped this that he can make big money. – JESSE LIVERMORE

Jesse was a legendary trader in his lifetime. His experiences taught him that even though he was able to made good money trading, he also lost good amounts of money by over-trading. After decades of trading & investing, he offered the above advice, showing that patience can be rare, but also patience can be more rewarding if you know you are correct about a certain set up and patiently wait for it to unfold.

As a trader, I like to find & buy good set ups and sell them in a few days as they play out, but I also have tried to find proper set ups and allow them to play out until they are longer term rewarding. Let me give you a couple of examples of how “Sitting Tight when you know you’re right” can pay off.

I have Tweeted and written in my reports since Jan that the Tight Base in SZYM is the type that can explode higher. I have accumulated it regular along the 50sma and encouraged others to also. Accumulating low in this progressive base gives you strong hand . The sideways move through FEB was BORING! Then it popped and dropped back to test support.

SZYM today – it was boring but is up 20% today alone

TPLM- where will this be by the end of the summer?

I have been mentioning Steel as possible low risk type base set ups . We look for low risk entries , like X sitting on the 50sma, or the MAGENTA trend line below. AKS looks similar. If Commodities and Steel are setting up to run higher and you sit tight , you’d likely do well from this level. If they don’t run up, your losses are minimal.

For a couple of months I have been mentioning that SOLAR stocks are stealthily doing well.

TSL – From January it runs up / consolidates / runs up / consolidates. Now it looks ready to run up again. Oversold. It i possible ha as bumpy of a ride as this has been, If someone just Bought in January….they may be up 100% by this summer.

CSIQ– Jan lows to now almost 100% ( 2013 lows to now sitting tight ? 1500%)

SOL My recommendation Feb 11 at $1.41 . Another solar in a base. I bought the break out , but traded instead of sitting tight. Do you see where $1.90 is on this chart? It just went there.

SOL ( Today it just hit $1.89) If we buy now & sit tight, where might this be at the end of the summer? 2 yrs ago in April SOL was here and was at $6 by the end of the summer. Roughly 300% off the lows.

MACK– I love the chart for MACK. It has run up over 100% from under $6 last summer. Was it straight up? Or do you see sideways moves and consolidations? TOUGH to ride out, but it has paid off 100% in 5 months from AUG to DEC.

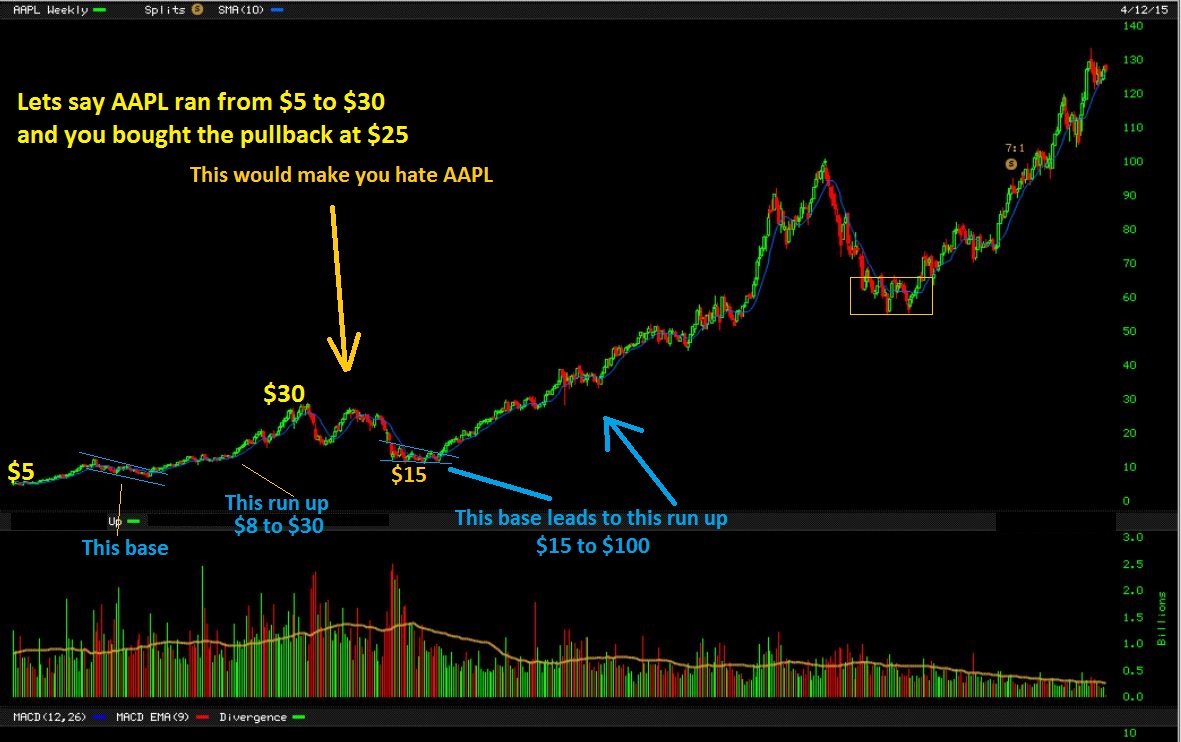

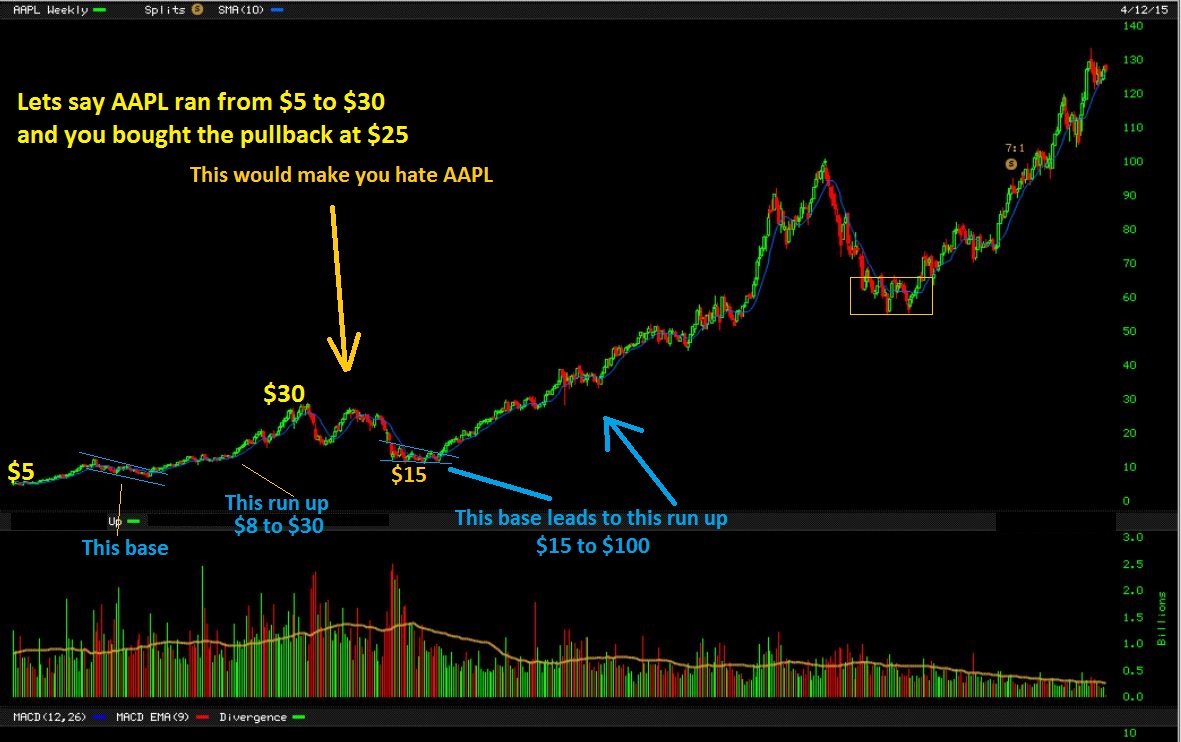

SO Now Lets look at AAPL. Was it a smooth straight up run the last 10 yrs as it went (split adjusted) from $5 to $130?? No, bases and consolidations were all along the way. It would be tough to just “Sit tight”, unless you bought low. it went up 2500% in 10 yrs! Could you ( or me) do that trading?

So ask 5- 10 yr holders of AAPL, GOOG, PCLN , TSLA, etc . Are they happy now? Oh yes. They talk about holding a 10 bagger , etc . Most of these investors could never have a 10 bagger without getting in low and sitting tight. They had to hold during consolidation phases and though this can be tedious, they were well rewarded.

WHAT IS THE POINT?

I am a trader , so I know that Traders love to trade. I will always love to find proper set ups and trade them , but Jesse was correct in his observation. At times, patience in the right situation is what pays off the most . You saw from those above examples that many were up 100% in 6 months to 300% in a yr. So lets honestly ask ourselves… ” I am a fast trader, and I consider myself good. Is my Account up over 100% in the past 6 months? 300% in the past yr?” Many stocks that we trade are, so it gives us food for thought about over-trading. I love trading and will always try to be nimble, jumping in and out of good set ups. Looking back , I have also found that I made better money in the past ( Miners , Energy , Tech , etc) entering undervalued, often beaten down & oversold stocks, buying low and riding them higher for weeks. I have been trying to focus on some opportunities like that , as well as good trade set ups.

It certainly doesnt mean we just want to buy & hold anything. Even Bull Markets can correct sharply, but at times … if we know we are right? It may be best to just sit tight. Thanks for visiting chartfreak.com

~ALEX

A Quick Look Underneath

A World That Runs On Energy

A World That Runs On Energy

Scroll to top

Hi Alex,

Agree excellent report….

I just bght. TEX at the 50 dma (ER on 4/29 !) any thoughts ?

Alex nice work. I guess we will know if the ICL is in on GDX based on how the wedge plays out. Soon enough. I have some cash freed up. What would you recommend as a low risk entry this morning? CVI, BAS, PEIX? PEIX looks promising?

ZIOP – Kaboom !! Good call Alex .Ugaz looking good too -NG need a break above 2.54 i guess coz my entry was 2.86 ugaz

OCN is interesting. Apparently fundamentals are awful. Just reported terrible earnings and yet look at the chart; not down that much and little vol.

Nice base forming (so far, it’s early) off a nasty 90%ish fall. Could be a good entry here with the 20/50 just below for a stop.

And could at least go to fill the gap at 12.

Energy stocks making higher highs, DQ,PACD,RES, CLNE. Many more breaking out. Good day to be invested in Energy sector.

Good post… Been holding ESPR since 20’s and tempted to sell all the way up.. Still holding

Wow Ron

That is a PERFECT example. It had a long solid base and once it launched, it started a nice uptrend. A little bumpy , so good for you holding on.

I used a 34 sma on a 1 yr chart. It has done well.

Awesome! Thank you! I miss your charts

LIZA! How are you : ) Thx , I know, I need to Tweet more, right?

Yes but I R tweeted you…Love this Jesse Livermore quote…was starting to believe there were only short or long biased peeps out there!

Oh Yes, I know what you mean.

I actually trade with part of my account, but if I find a nice set up ( there are various kinds) I will try to enter low and hold on & take the ride . SZYM was one that had a nice base with good potential, bouncing off of that 50sma repeatedly.

After thinking about Livermores experiences – it makes sense . I’ve owned stocks up 500% , but traded in & out and only made 30% . Its something to ponder anyways, you just need the right stocks : )