Back in Dec, I noticed some interesting activity in the charts of 3D printer stocks, and pointed it out in my reports. Often after a large sell off, when selling gets exhausted , you get a period of short covering. Sometimes that can turn into a mini rally, but the inevitable pullback is to be expected . What can we look for then? Is there a way to tell if they are a Buy? Lets review:

I noticed a strong high volume POP in VJET

SO I decided to look at other stocks in that sector and see if anything was interesting …

XONE had formed what looked like a possible double bottom , shown here

DDD was also interesting , stuck in a wedge, just breaking out? Interesting sector.

It was a little confusing that these looked like they wanted to bottom here , because I was seeing signs of weakness in the Nasdaq and SPX, etc , so while it got my attention as a possible opportunity, I had mixed feelings about the overall mkts going into January 2015.

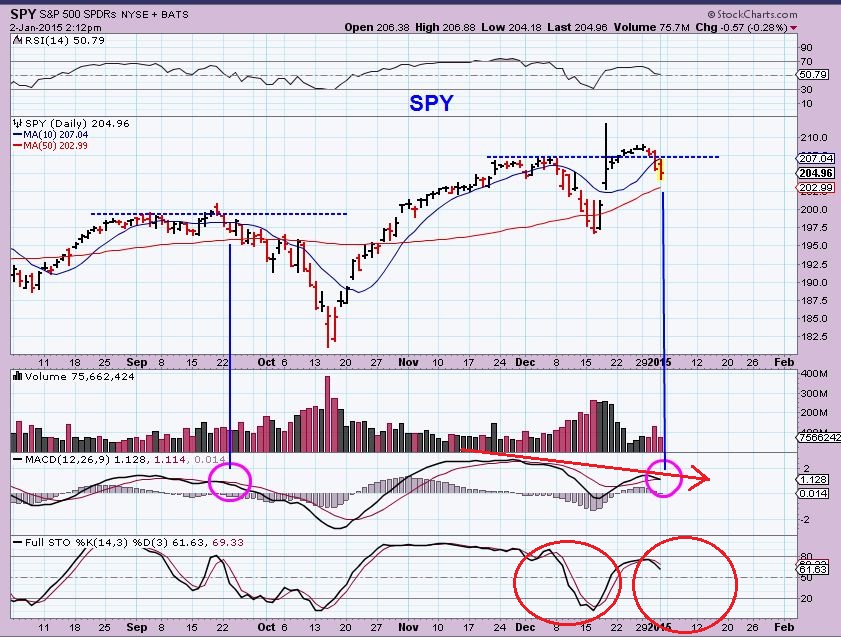

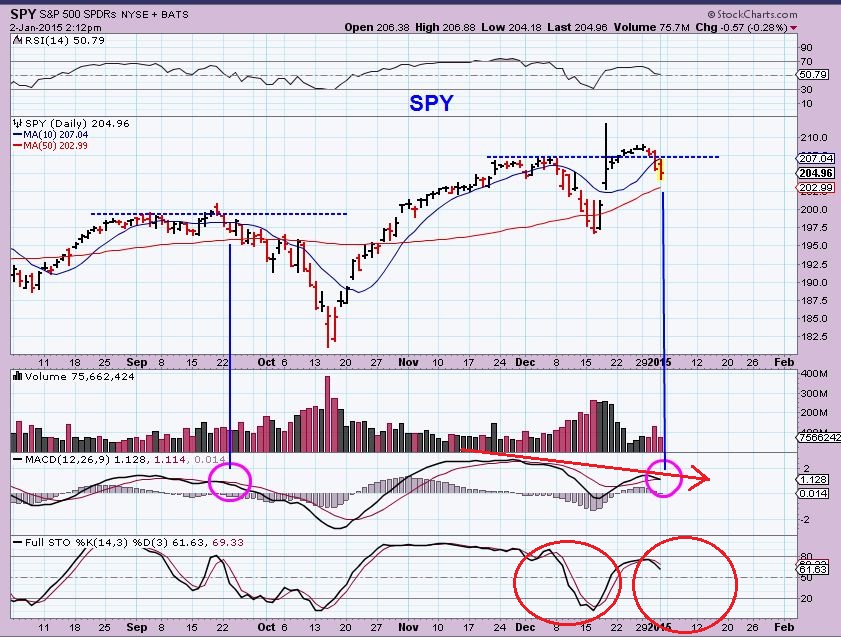

My Jan 2 chart for the SPY showed a little weakness creeping in, I was cautious.

Well, fast forward to February . The markets have been consolidating and although I had been buying TZA at the blue arrows on the chart below , I recently posted that I did not want to short these mkts anymore. I am now seeing signs of strength inside the consolidation.

SO maybe we should go back to the 3D stocks. If the markets could be strengthening , lets see what has happened since the 3D group popped up on my radar.

VJET – That POP in VJET back in Dec was the initial short covering that would start building a base through out the January consolidation. VJET just broke out above that downtrend line and is back above the 50sma.

DDD- It finally DID break out from that blue wedge. It then back tested the trend line and proceeded to form a ‘Base’ too. Now it has broken out again, and re-gained the 50sma. That’s a decent Base.

XONE – had that possible double bottom and during the Jan consolidation, it has formed a wedge and broke out . It has even re-gained the 50sma.

Does this make then BUY candidates right now? Not necessarily. DDD and XONE may not be too extended , but from a risk/reward standpoint for the average investor, it may be best to wait.

For fast trader, someone may jump in and try to scalp a quick gain. ( but note that VJET just ran from $7 to $11, it could pull back in the near future).

For medium term investors with a time frame of buying and wanting to hold for a week or a couple of weeks? A better entry may present itself later.

I will be discussing possible entries to these and other set ups in a future premium report. Honestly, we have been very focused on Metals & Miners in DEC & JAN . Now we have been focused on ENERGY , as I mentioned in my last public report posted here. And since then , a few other sectors began bullish set ups and are also ready to be bought, so we have been busy looking at a variety of sectors.

I thank you for reading along here and if you like this report and analysis , why not consider signing up for a month to try the service out? Its $37.95 per Month, you’ll likely make that back on your first trade. If you cant join us in the premium side, I still appreciate your being here and thanks for reading along. You can sign up for email alerts to be notified anytime I post in this free public section. Best wishes and happy trading!

~ALEX

Did You See It? Traders To Your Stations

FRIDAY – We Have Another Sign

FRIDAY – We Have Another Sign

Scroll to top