OBSERVATIONS

I have been watching the various markets intently , examining internals and how they’ve reacted under similar circumstances in the past to try to get an idea of what to expect . I think that I have done rather well with the general markets and Metals and miners, but I must say…there are some extremes in some areas that I have just left alone until I get a clearer idea of how things may unfold going forward. What am I referring to? Well, specifically the ENERGY sector with OIL and NATGAS has been a little tricky, and of course the $USD has been very strong – now even higher than I anticipated. lets take a look at those areas. They that have been difficult to call, for Sure.

I know what I “Guess” they could do, but when it comes to putting advice in my premium reports on these sectors, I have decided to just wait until things clear up , and focus on some other very trade-able areas.

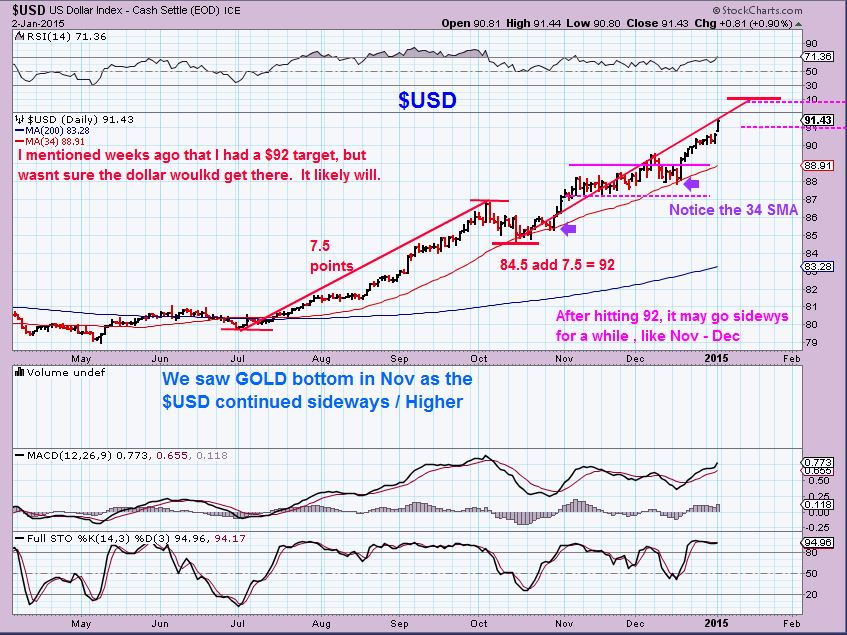

I expected the $USD to stop in the $92 area. ( Actually, I had that as a target, but I thought it may not make it there, I mentioned that it could roll over near 91 because GOLD began completely ignoring the $USD strength. I assumed GOLD was sniffing out Dollar weakening).

I posted this chart Jan 2- $92 target

Then on JAN 5 , I noticed this …

Look, a ‘topping candle”- my target had been met. A top?

Look, Jan 7th & the $USD is ignoring it again

However, I do still expect the dollar to start to slow down and pullback soon ( Or possibly consolidate sideways for a while ), but it has been difficult to time.

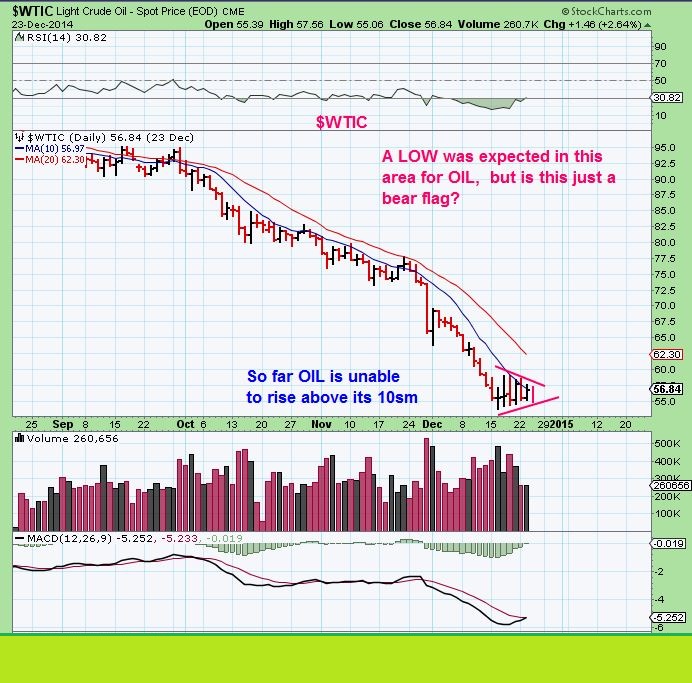

$WTIC / OIL

The $OIL drop. IT certainly has been spectacular too , Good for shorting. SCO was dynamite, but I didnt personally take that trade. Now I’ve noticed in certain Forums/ blogs that Many have been trying to catch a snap back rally / bottom in Oil. Some things to note in that area.

DEC 23 – I posted this as a possible bear flag warning, and noted that the 10 sma has held it down.

Then when it gave way , JAN 5 th this was noted for those trying to catch a falling knife. 10 SMA is again holding it back.

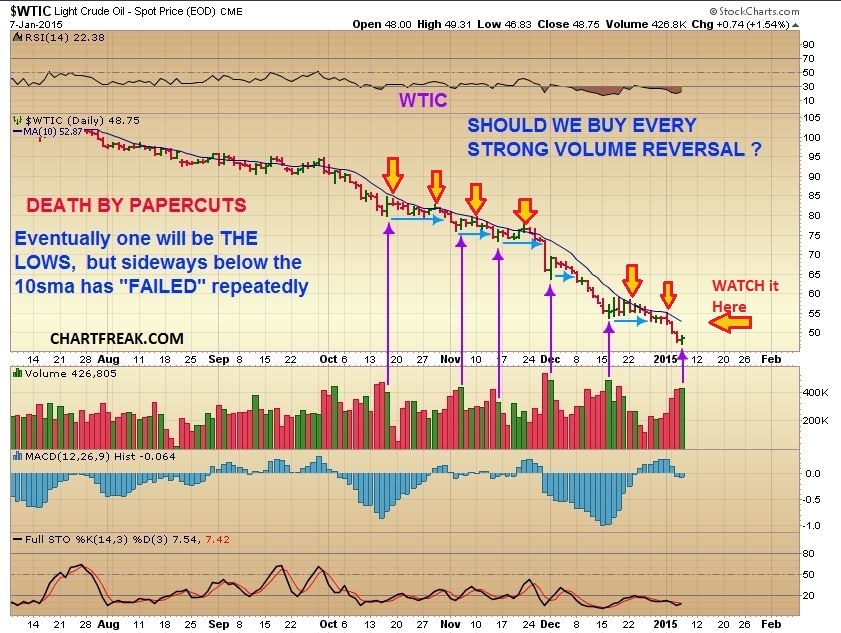

This was JAN 7 – A REVERSAL? Bounce to the 10 sma? possibly

Instead of fearing missing the lows on this one, Why not be safe and wait until it rises above the 10SMA for a change of character.

Many other strong looking reversals went sideways to the 10 sma gave it up. Leveraged longs were losses.

$NATGAS has fooled many too.

I heard a lot of thinking in forums that WINTER must be good for NATGAS. Notice that Last yr it was, but did you look at 2 yrs before that? See the chart, They sold off into Feb and March. Now this year winter has been a let down. It even Broke out from a wedge & dropped back inside. NATGAS could be at support here, but I think it needs to also prove itself.

Lets Zoom in on NATGAS for a moment. I actually think NATGAS could rally soon. I see bullish signs , some shown here, but to prove itself and be a safer buy, it needs to break above the descending wedge and 13 SMA I.M.H.O.

Like I said, These may turn out to be great trades after they bottom, but really, it’s tough to catch a falling knife. It may be best to allow them to first prove themselves. OIL will one day recapture that 10sma and you might find some nice ways to go long OIL and OIL stocks to take advantage of that. NATGAS could be at support here, but it really need to prove itself too. It could go either way at this point.

Right now , we here at chartfreak are currently looking at other opportunities that are proving themselves. There are definitely a few extremes in the markets right now , but also some nice trade set ups. I’m trying to stay focused and on top of decent opportunities to make some profitable trades. Patience often pays off. Thanks for visiting and why not bookmark chartfreak.com & stay tuned.

~ALEX

(Opening theme pic credit to RUSH Power Windows & HUGH SYME )

Thanks Alex for stressing Patience & Discipline. Agree on being close to a US$ top of sorts.

Thank you SuperOcean9 … The dollar is at a point of resistance and should pullback. I wouldnt be surprised if it goes higher later though. I was trading when it was $1.20 $USD. I guess we could return there.

Hello Alex!

Goood to see you back…you were missed and thanks as always

Thanks Liza – I’ve tried to post at least 1x a week here, glad you enjoy it. Thanks for your kindness

I appreciate your insight so much

Alex, please use a regular type style and drop the bold, it’s hard to read and comes across as yelling at us. You don’t need to yell, your excellent analysis is all the emphasis you need.

Ur funny Michael

I used BOLD PRINT as new subtitles for OIL and Nat gas. Are you really so sensitive that you felt I was yelling at you?

Every time I post for free , many say ‘thank you’. They are good appreciative people. I appreciate them too.

You always complain . I have a hard time understanding people who receive for free and feel the need to complain.

Alex…. thanks for updates and the premium site which I just joined…hey guys incredibly cheap for what Alex provides. I’m not that experienced a trader but definitely learning… Alex saved me on natural gas as I was looking at last year and the severe winter, however he had me look at previous years as it is not always the same, even with another cold winter coming NG headed lower because of the supply/withdrawal issue…. UGAZ has been a portfolio wrecker for many this year that bet all the way down from the teens to 3’s! Good take on miners also by Alex as extremely to sort that all out…

Ron ,

Thats really kind of you and I’m glad that you’re befitting from the service. I really do try hard to share what will help with , and I do appreciate your being here. Thanks for the kind words of endorsement!

Oil has tagged it’s long term secular trend line last week. No idea if that will mark a bottom or not but it does provide a low risk entry with a stop right below Wednesdays intraday low.