Dec 24th – Gold

Hello and welcome back to Chartfreak. It has been a while since I did a public post, so what have we been busy with? While we have traded a variety of trade set ups, like AMD, MU, ENPH, VSLR, and other stocks like it in the General Markets, but we have also been watching the Precious Metals Sector very closely. Why? Well we caught the lows in May and rode many Miners higher into September. Some stocks like EGO, SBGL, HMY, DRD, etc doubled and tripled. After a strong rally, you often get a top and a consolidation period, so we exited leverage in August and sold many Miners in September, anticipating a consolidation period and then another strong run higher. Some individual Miners are still running nicely, like SBGL, SVM, HL, CDE, etc, so we continued to trade those, but we have been watching the correction in GDX, GDXJ, SILJ, etc closely, and I wanted to share what I am seeing now.

Monday Gold pushed a bit higher and it has closed above the 50 sma. On what would normally be a light volume week of holiday trading, GDX pushed away from the 50 sma with decent volume. We now wonder: “Is Gold about to rocket higher?” As mentioned, we have been anticipating that possibility for weeks as the sector churns sideways. The Bullish action in Miners on Monday seems to indicate that it is time to go higher and that this consolidation period will end soon.

Let’s just take a look at some of the recent charts from past reports along with the current set ups, and discuss further what we have been looking for.

.

GOLD – I pointed out the Big Picture chart in the weekend report and showed that the indicators that I use are bullish and during the 2008-2011 bull run, we had a similar set up that we are seeing form now. A dip to the red line was normaland acted as support.

.

GOLD – I also posted last week that Golds sideways chop could just be a normal crawl under the 50sma before a break out takes place. We saw that in may 2019, so we would Stay Frosty and continue to look for clues.

.

GOLD – Monday Gold popped and closed above the 50 sma & above that down trend line. This is a bullish development.

.

It is important to note that we could have a new high this week if Gold continues just a little higher. I have also mentioned that with triangle – like consolidations, Cycle counts become less important to me. These can break & run higher despite cycle count. With that thought, this could break higher & just run.

.

SILVER From 2 weeks ago – This was Silver rejected at the 34 sma & upper trend line over a week ago. I still considered this Bullish. Notice the DOJI CANDLE on day 3 and …

.

SILVER – You can see that DOJI CANDLE over a week ago here too. Price just moved sideways. Now we see SILVER has made good progress and broke out from that triangle or wedge consolidation convincingly Monday. Silver Miners are WAY AHEAD of this move. We have discussed and owned CDE, HL, SVM, PAAS, etc as they ran bullishly to new highs again and again.

.

SILVER DEC 13 – I posted this chart over a week ago on Dec 13 too, to point out that the short term wiggles can distract us from the Big Picture. This is a large bullish base and has the potential to run from $17 to $26ish. What will these Silver stocks that are already so bullish do then? 🙂

.

GDX – Back on Dec 13 I was also pointing out that we got what is usually a bullish break out & back test on GDX, and then we also made a new high on day 21. This was a Bullish development too. We could have still seen an eventual dip into a dcl, but it should be a higher low, and this should indicate that an ICL formed in November. Those lows should hold up.

.

GDX WEEKLY- DEC 13 also had the weekly chart to point out a bullish break of the down trend and an oversold stochastics that was now turning up. Miners looked better than Gold at this time.

.

GDX – Thursday of last week we saw GDX reverse off of that 50sma , so for Fridays report I discussed 2 things.

1. GDX could either take off higher, so you do want to be invested, but

2. Since GDX could also drop into a daily cycle low, you’d want to be sure that you can handle that if you are loaded up with leverage.

3. The blue line was the Nov lows and it should not have been broken either way if an ICL is in place.

.

GDX – I also discussed how I got a rare buy signal in Miners back in November, and this usually points to an ICL being in place. Things were really lined up nicely.

.

GDX – I also reminded readers Friday that in MAY, we were already positioned for that ICL but price just went sideways back then too. That is similar to what we were seeing from the November lows to now. Once it gapped open on day 20, many traders were hesitant to buy. They expected a gap fill, but that break away gap would not fill. At Chartfreak, we loaded the boat in May and we needed to be ready to at least be comfortably invested in Miners in case we see that again. SO we remained invested over the weekend.

.

GDX Dec 23 – Monday morning saw GDX open without a big gap, but it climbed higher & higher as the day went on. Volume was very good for a holiday week, so I mentioned that in the live trading area too. The MACD & RSI are bullish and I know many traders on the sidelines due to the High Short positions by smart money in the COT.

.

GDX – They may get left behind, because we have a Right Translated daily cycle with a new high and we could take that out as soon as Tuesday if GDX moves higher. CAN THIS DIP? Sure, we could drop to the blue wedge again, but that was already back tested and that drop is not necessary.

.

Now look at how choppy the trading in GDX has been. This chopped sideways for weeks, so…

.

GDX From Dec 13th – Here I just pointed out that Big Picture again. We have had a choppy somewhat frustrating period of weeks in GDX & GDXJ ( And leverage if you had it), so the Big Picture was to remind my readers that the future move could make the last run look rather small. We made a lot of money from May to September, but the move is really just beginning if this continues.

.

Let’s quickly discuss a few Miners to build confidence too…

.

SVM – We were re-entering SVM as a cup formed and earnings were released. Were the lows in place?

.

SVM – The lows were in place and the Buying continued. This was a great run, unfolding much like the run out of the May lows. There were others too.

.

HL – HL was a buy as it broke the 200sma, but many of us bought it above the 50 sma as it crawled along that area. This has been a great run too.

.

HL – This chart highlights the potential in Hecla if we have re-entered a Bull Market in Precious Metals.

.

PAAS – Paas was a buy as a back test of the break out. Since it was continuing higher, I used this chart to show where GDX could have been back when it broke out & back tested in November. Did PAAS continue higher? …

.

PAAS – Very much so. It formed a cup, and became a buy again as a cup & handle. And since GDX looks similar to where PAAS was back in November, we can hope for this kind of move in GDX & GDXJ too. 🙂

.

WE WERE SEEING OUR SILVER STOCKS RUN HIGHER, SO RECENTLY I WENT TO the LAGGERS, SEARCHING FOR THOSE THAT MAY PLAT CATCH UP.

.

FSM DEC 2 – I posted this as a Buy for the Chartfreaks as it broke that 200sma.

.

FSM – And it is moving higher and will likely form a cup soon. I expect it to continue much higher over time, as explained in previous reports.

.

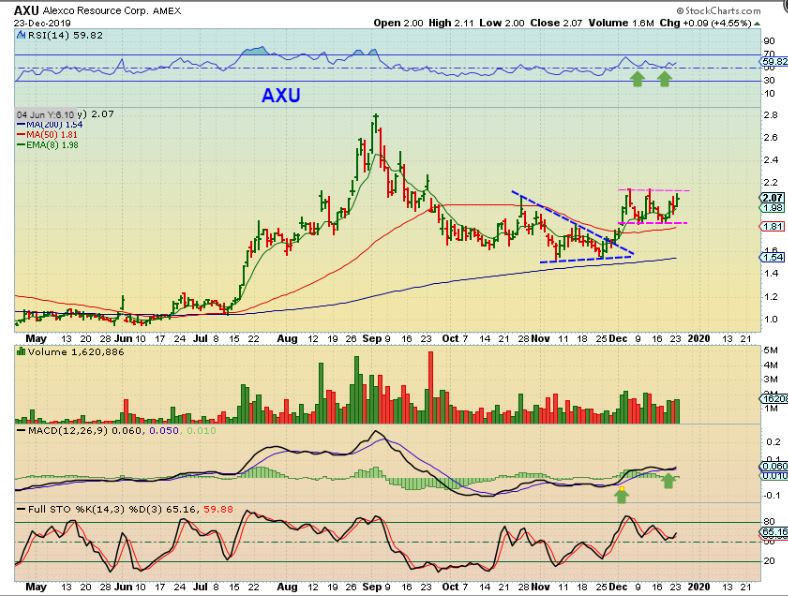

AXU – This was also recommended as buying a ‘Laggard’ weeks ago, but I think that this is also still a buy now and can continue higher.

,

AXU – You could add on a break out or just add now and know that it COULD dip to the lower magenta line to test that 50sma, but I think that it wants to break higher and form a larger cup. I also discussed …

.

AXU BIG PICTURE – The potential in AXU is excellent after it breaks from the long multi-year base.

.

WHAT ABOUT NOW? Well, AXU & FSM can still be bought, but let’s look at a few more.

.

USAS – USAS is just breaking out from a downtrend, so it can be bought here. I also wanted to point out the big Move that came from that long Yellow base. I’m pointing that out because I am seeing one in ‘AG’ too. Let’s take a look…

.

AG – First Majestic has not ramped up like other Silver stocks, but when it leaves this consolidation, it should have the energy to really run.

.

AG – I posted this big picture chart of AG in November to show the potential here too. A run to $18 or $20+ will be very rewarding.

.

BTG – BTG Popped Monday and is above the 50 & 100 sma . I used the 100 sma because BTG seemed to bounce off of it a few times in the recent climb higher.

.

IAG – IAG did a bit of a shake out last week, closing under the 200sma, but quickly reversing higher & regaining it on Monday.

AUY – I posted these 2 charts at the end of November too. It could be bought in the box or when it breaks out.

It has been climbing higher recently too, and could break out & run at any time.

.

Usually I cover all of the Market Sectors in my reports, but with Tuesday having one 1/2 day of trading in it, I wanted to just cover the new developments in the Precious Metals Sector. As a review: We have had an increasingly Bullish set up in Gold, Silver, & The Miners over the past few weeks. We have enjoyed riding some of the Silver stocks that already set up bullishly, broke out, and ran to new highs well ahead of GDX & GDXJ ( SVM, PAAS, CDE, HL, etc.) . Now yesterday we saw solid volume pushing GDX & GDXJ higher away from the 50 sma, along with Gold closing above its 50 sma and Silver breaking out from that large Triangle consolidation. This is all Bullishness backing up the Big Picture charts that we have been discussing too.

.

We have discussed that a dcl in November could be an ICL, similar to the one in May. By last week I mentioned that I was now heavily invested, since GDX above again the 50 sma, but I know that some wanted to be more conservative, so I discussed that in Fridays report. There was always the possibility that we could begin to start a drop to that dcl for a few days as the daily cycle aged, but triangles formed & often break upside. At this point, This looks to be what we have before us. The sector could just break higher like we saw in May, and it could run higher and leave people behind. I used this chart and discussed the similarities of the MAY Low and the sideways chop with the current set up.

WHY MIGHT IT BREAK OUT & RUN?

.

The idea behind that is that so many people were watching & Discussing that COT Smart Money Short position. If those traders were joining in and shorting Gold & GDX at the 50sma, they may now have to ‘cover’ those shorts and a short cover rally could send this sector higher. Along with that, Buyers would start jumping in and push it higher also, and the rally would then unfold in a similar manner as the May ICL . It would leave many behind flat footed.

,

We have been expecting another strong rally higher to begin in the Precious Metals sector after this sideways consolidations finishes frustrating both the Bulls and the Bears. With signs that the ICL is in place, I think that that rally is beginning now. It may be choppy, but it will be rewarding for those that stay alert to the opportunities. Many Silver stocks are leading the way and have already been very rewarding, so it may be time for others to play catch up. This set up will lead to some great gains now & going into the 2020 year. Along with Energy and other market opportunities, 2020 looks to be a good year of trading and investing.

.

Thanks for reading along here at Chartfreak! 🙂

..

~ALEX

.

If you think that my analysis can help you with your current trading, especially if you just don’t have the time to do all of the research, then why not consider signing up for a month? We also offer a discounted quarterly rate and yearly rate. Just go to the ‘sign up’ tab at the top of the page, or click the link below for more details.

Trackbacks & Pingbacks

… [Trackback]

[…] Read More: chartfreak.com/2019/12/dec-24th-gold/ […]

Comments are closed.