PUBLIC POST : Are The Pieces Falling Into Place?

Most people realize that you can’t solve a puzzle by forcing together pieces that dont fit. As time goes by, however, various pieces do come together, and the big picture becomes clearer. That may be happening now, so lets look at some of the pieces of this big picture puzzle.

SPX WKLY- I had pointed out a bearish rising wedge forming in the SPX since last spring & last summer. After a break down this summer and back test, we had further selling as 2016 began. Is it done?

$RUT – The TRAN and RUT look to be starting lower highs and lower lows. We could get a bounce soon, but you can see that with further selling this could easily drop to the 800 area.

Might a falling market help Miners, or do they all fall together?

SPX & MINERS – Please note that when the markets got a bit overextended in the 1990’s and everyone was bullish, we got a correction to balance sentiment. It was at this point that Miners bottomed ( OCT 2000). Note: GOLD & SILVER BOTTOMED LATER in 2001, so Miners bottomed first.

.

SPX & HUI – It would be normal for the SPX to test that break out. Notice the box covering the HUI too.

.

Do you remember when Gold would drop $8, and miners would just flat out panic crash? Well in 2015 the Miners ( HUI, GDX, GDXJ, ) actually bottomed in July & Sept, even though both Gold & Silver crashed to new 5 year lows in November & December. HMMM?

GOLD , SILVER, MINERS

I believe that Gold will continue to move higher into January after a brief rest. Gold testing the 50sma at $1080, or even testing that triangle wouldn’t bother me.

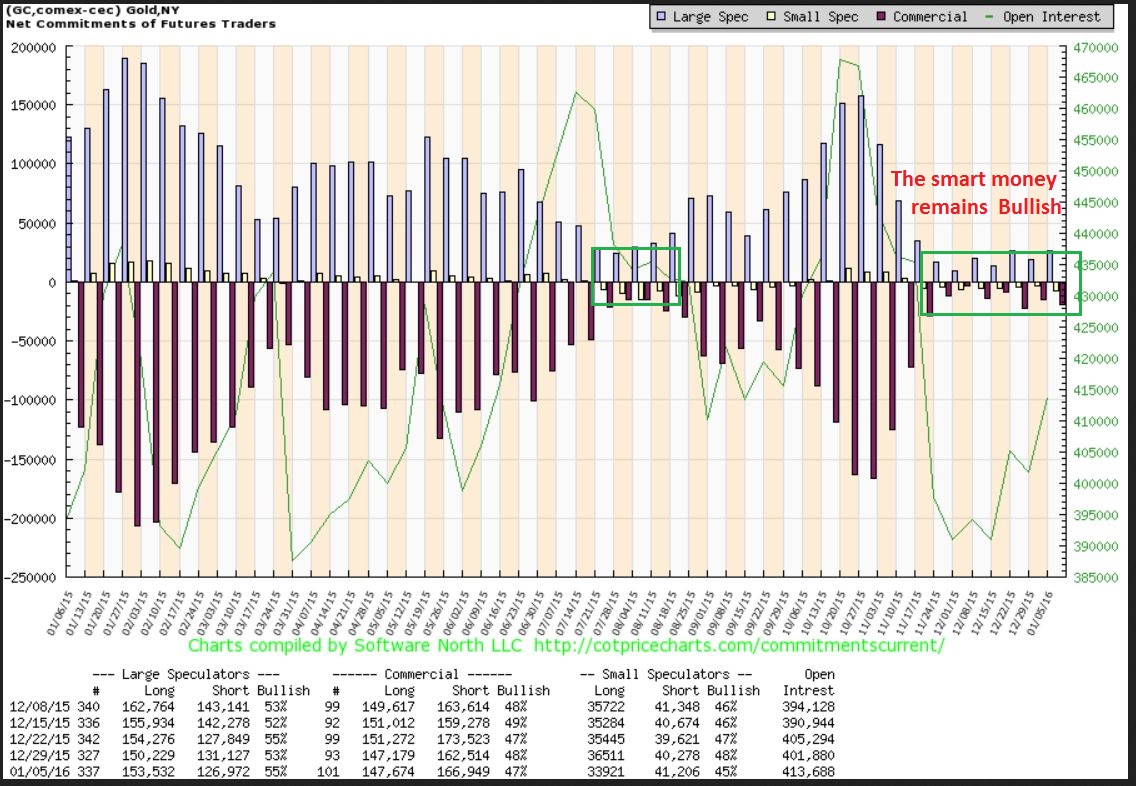

The COT for Gold remains bullish.

I pointed out in my weekend report that quite a few Miners actually already bottomed. I will post 2 examples below.

Picture them returning to former highs over time, when the Gold Bull resumes.

SO I say that the pieces may be slowly coming together, where we have a topping stock market and possible bottoms forming in Miners and Natgas, as well as GOLD , Commodities, and Oil ( soon?) Many Miners ( 2 shown above) look to have bottomed already, but it can be a bit of a slow process when looking at weekly charts. Those charts and others in the weekend report show promising signs when we consider that GOLD & SILVER just broke to new 5 yr lows and Miners ignored it. What if Gold does dip to $1000? Some Miners may already have their lows in place, so it could be a buy the dip scenario.

Does this analysis interest you or might it help you in your trading routine? This public post had 8 charts from the weekend report, while the weekend report itself has 32 charts. I discussed this big picture possibility and why I think things are unfolding that way, and also covered OIL, NATGAS, and more with Gold, Silver, and the miners. A monthly membership is only $37.50 , and you’ll have access to the weekend report and every report prior to that. I also have 4 or 5 reports a week to cover areas of interest. Why not give it a try for a month? If you are unable to join right now, you can sign up for our email alert to notify you when I post a public report here. I hope everyone had a great weekend, thanks for being here at Chartfreak!

~ALEX

Alex,

I would love a chart on FCX, which seems to be self destructing also due to a slow down in the economy (china?), together with copper it might be the barometer of things to come.

wow! Platinum -$30 U$847

Need to start looking there for something to buy – maybe?