Archive for month: February, 2018

My weekend report was extremely detailed as to what I feel we are seeing. I am going to try to keep todays report a bit more simple, since we have only had 1 trading day since that weekend report. The Theme Picture? What are we looking for, and for some more conservative traders, what are we waiting for...

SPX #1 - Please read the chart. Using cycles, the safer add point is after confirmation since volatility has been so high ( in the blue circle).

Read More

Read MoreIn the recent bull run higher for the General Markets, I advised almost daily using a trailing stop to lock in gains just in case we saw a deeper drop. A deeper drop to an ICL could cost you weeks of gains, a stop would lock in your gains. The goose that laid the golden eggs in the General Markets seems to have been sold on auction (for now). Gains from November forward wiped out in just a couple of days. Let's take a look and see what the markets did this week. This report also takes an intense look at the Precious metals market, and I am encouraged by what I have put together!

NASDAQ from my last report - The markets could drop to the 200sma as they have done in the past.

I pointed out that prior ICLs had done just that, sometimes even breaking that level.

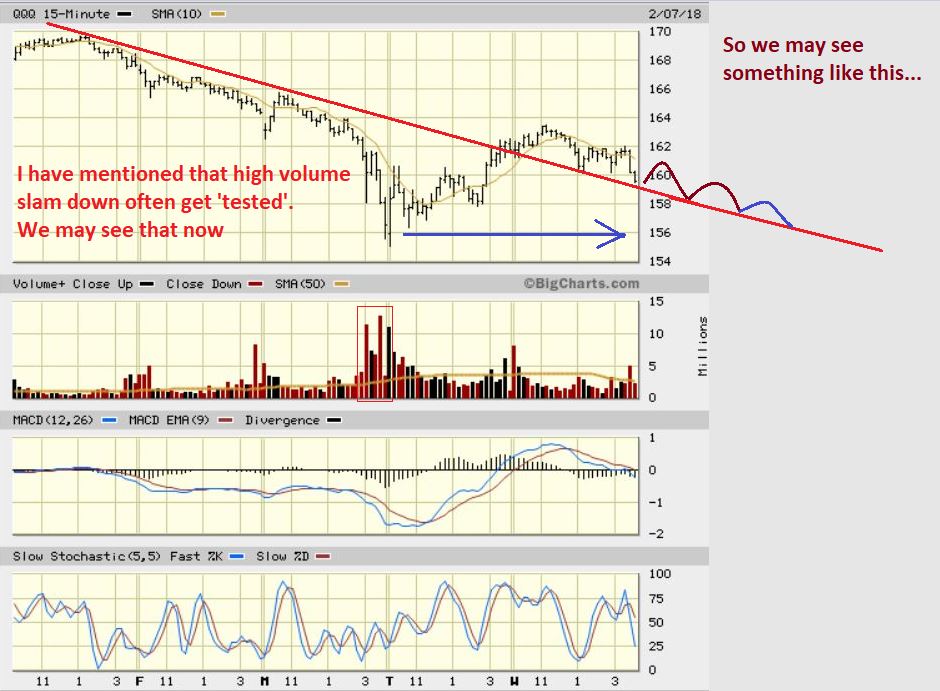

In a report last week, I mentioned that way too many people were diving back in, it seemed too easy for the Bulls to just quickly 'Buy The Dip' again, so We should expect some volatility.

NASDAQ - 1. Importance of the stop - Notice that all gains from November to now would be taken back without a stop. 2. After such a plunge, Many want to buy the ICL at lows and ride it back up ( I totally get that, I buy reversal candles too). 3. If it rockets up in a V-Bottom, the gains can be very strong quickly, but often for most I advise waiting for a swing low for those looking for 'safe' & less sleepless night investing. Understandably, many tried to buy that 1st reversal despite risk. It failed. Now we have a 2nd reversal, and many were buying that one on Friday too. Again, I often enter on reversals too, but it is higher risk. That said, let's just discuss this so we understand what we are looking at...

Read More

Read MoreWhen the Ice begins to get too thin to support you, you would proceed with caution and maybe even take the safer route. When the markets experience a serious 2 day slam down, it isn't always the best time to just jump ' all in' with leverage. That is a trade that may or may not work out, and so it has higher risk. Leverage has probably robbed more people of their soul than thin ice has. Let's discuss that in todays report after our recent market sell off ...

NASDAQ -I covered the general Markets extensively yesterday, review that report if you need reminders. We had a strong reversal, and it did stall today. It is an unconfirmed swing low.

Read More

Read MoreThe recent flush down of the markets is viewed by some as alarming and even terrifying, but in a bull market, it's often just a necessary flush of excess bullishness and a re-set to a fresh start. It takes time to see exactly how this will play out, but let's take a look at the recent flush down and discuss those possibilities...

SPX #1 - After a strong reversal, the SPX had a large 'sell on strength'. My thoughts? We just might not get the V-Bottom that many expect. This still may be our 'Lows' for now, and I will show you what I am thinking shortly. This was a massive flush down compared to any other pullback on this chart. Please read the chart.

Read More

Read MoreThe markets have spoken. They have been ripping higher for weeks and they said, "I need a rest!", and so we had another scalding drop in the markets on Monday. We were expecting a drop into a dcl, but it looks more like a drop into an ICL, since we are overdue for a good ICL too. Let's take a look at Monday activity...

.

DJIA MONTHLY- Recently on this chart I pointed out the accelerate rate that the Markets jumped in 1 month. That Monthly candle was a lot bigger than the rest, like panic buying in January.

DJIA- Now the Dow dropped 666 points on Friday and was down almost 1600 points at one point on Monday, wiping out January & Decembers trading. You can see the benefits of a trailing stop when these markets climb relentlessly.

Read More

Read MoreFriday gave us what looked like a Melt Down across the board. Like the Theme picture, melting does not necessarily mean that it is time to throw it away. We may find some good buying opportunities when the selling dries up. Let's take a look at the Markets...

DOW JONES #1 - WEEKLY - I was just pointing out this week that we haven't really seen a 2 day sell off in a long time, but we were due for a DCL ( Sell off). Well, the Dow dropped 666 points on Friday ( No, I don't ready ANYTHING into that ) 🙂

Read More

Read MoreAfter a quick market review, I was to discuss a bit further the risk reward in front of us in the Precious Metals Sector.

Read More

SPX - We are actually pretty late in the timing for a dcl, so even though this drop can meander like the one in November did, it may just be a brief dip.

Read More

Read More

Scroll to top

Read More

Read More