Archive for month: September, 2017

Sept 15- Friday Again

/133 Comments/in Premium /by Alex - Chart FreakJust 1 more day of trading and then we have the weekend. Let's take a look at a few things of interest ...

USD - The USD has a swing low in place ( unconfirmed, and the last one 2 weeks ago rolled over). We do see bullish divergence, but the proof would be in a close above 93 in my opinion.

Read More

Read MoreThursday September 14th- Energy

/130 Comments/in Premium /by Alex - Chart FreakSPX - ON day 16, The SPX has more time & space to climb higher. We still have gaps below that usually fill later on.

Read More

Read MoreSept 13th – Bottom Fishing

/122 Comments/in Premium /by Alex - Chart FreakAfter another short review, we will talk about some trade set ups and some 'bottom fishing'.

SPX - The General Markets are still moving up out of the recent lows. No change from yesterdays report, I would raise my stops to lock in gains if the gap below eventually fills.

Read More

Read MoreSept 12th

/131 Comments/in Premium /by Alex - Chart FreakNot much has changed since the weekend report, so todays report will have a short review and then I will discuss a few other important ideas.

Read MoreIs It A Melt Up?

/14 Comments/in Public /by Alex - Chart FreakI wanted to open up a slightly shortened version of this weekends report to the public. In the weekend report, I usually cover the action that we saw in all of the Sectors that we have been covering lately, and in the daily reports, these are updated and stock picks are also added, if the set ups present themselves. So even though the premium members will have a lot of additional information as things upfold, the Public should be able to get a solid idea of what we have been looking for, and how it has all been playing out. Enjoy this weekends report.

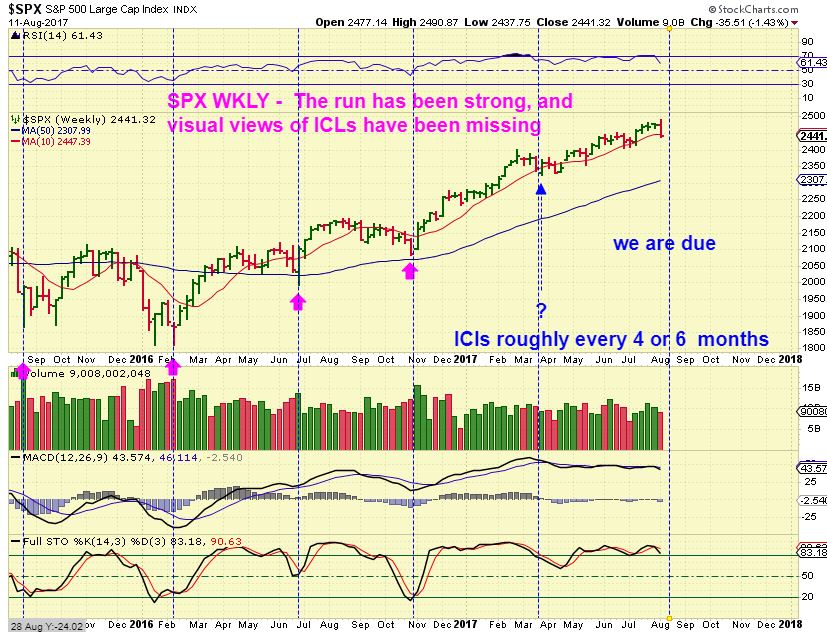

SPX- I will repeat, I never called the recent dip an ICL. It lacks the characteristics of one, but what I did say is that we have been overdue for one for a while. So we have a dcl, and similar to the last couple of dcls, the move higher has been a bit choppy, but we have higher lows and higher highs, so an uptrend continues.

SPX - In August I reminded readers that we were due for an ICL, but visually, I still do not clearly see one.

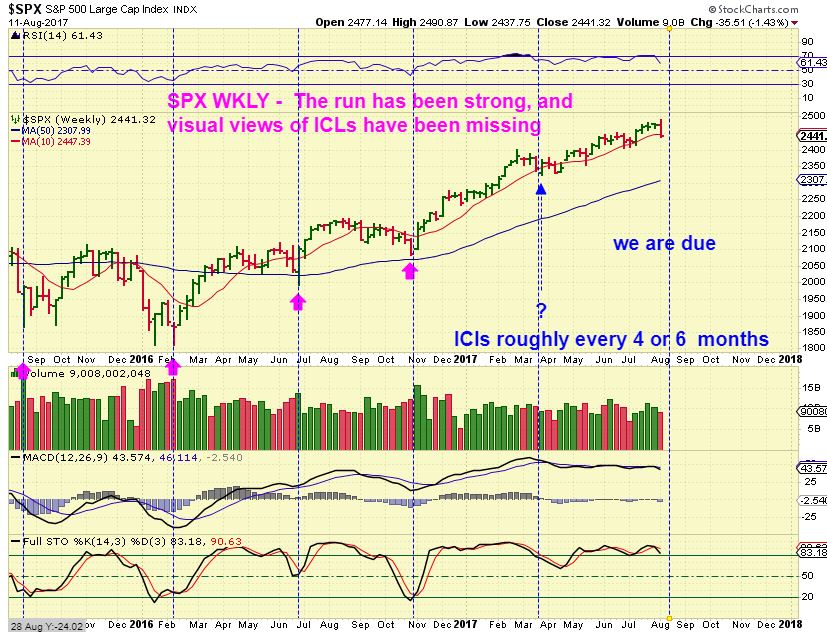

SPX - Then on Sept 1st, I posted this as a cautionary note for the future - a possible rising wedge and mentioned that OCTOBER can be tough for the markets, historically speaking. We have seen some pretty big crashes in October. Will we get the ICL then? We'll have to be alert going forward to any signs of weakness as this unfolds. So some are long from the recent dcl, I am just helping my readers to see a reason to stay alert, and I will monitor it along the way.

Read More

Read MoreSept 10 – Is It A Melt Up?

/124 Comments/in Premium /by Alex - Chart FreakSPX- I will repeat, I never called the recent dip an ICL. It lacks the characteristics of one, but what I did say is that we have been overdue for one for a while. So we have a dcl, and similar to the last couple of dcls, the move higher has been a bit choppy, but we have higher lows and higher highs, so an uptrend continues.

SPX - In August I reminded readers that we were due for an ICL, but visually, I still do not clearly see one.

SPX - Then on Sept 1st, I posted this as a cautionary note of a possible rising wedge and mentioned that OCTOBER can be tough for the markets, historically speaking. We have seen some pretty big crashes in October. Will we get the ICL then? We'll have to be alert going forward to any signs of weakness as this unfolds. So some are long from the recent dcl, I am just helping my readers to see a reason to stay alert, and I will monitor it along the way.

Read More

Read MoreFridays Ideas

/77 Comments/in Premium /by Alex - Chart FreakToday we are just going to discuss 'things'.

Read MoreSeptember 7th – Market Wrap

/166 Comments/in Premium /by Alex - Chart FreakOn this Thursday of trading, let's review what the markets are doing so far, and we'll have just a couple more interesting trade set ups.

NASDAQ - The NASDAQ put in a low that was a buy on August 21, and that has not been violated. It almost made new all time highs on Monday. It is still early enough in the daily cycle to break the highs and Tuesday & Wednesday looked like a back-test of the recent break out from the downtrend line. I would raise my stop to that point.

SPX - That sharp drop on Tuesday also looks to have back tested a break out. Day 11 and this can break to new all time highs too. Recently, breaking to new all time highs has not turned into a strong rally higher, the markets just keep rolling over into the next dcl, but it is slowly putting in higher lows and higher highs, and that is a trend higher. A bit of a rough ride for the BUY & HOLD investor.

TQQQ - So here is the TQQQ that many here trade. Tuesday, Wednesday, or even today you could add to your current position, with a stop below the 50sma. If you bought in at the DCL, I would raise that stop now that we've had the first drop out of the way.

Read More

Read MoreWednesday September 6

/108 Comments/in Premium /by Alex - Chart FreakSo far, the trades that we have been really focusing on have been excellent. We'll do a quick review and then discuss those trades and set ups.

DJIA - Wow, that wasn't a very healthy looking drop on day 9, was it? The DOW landed right back on the 50sma, so at this point, support is support. If this were to roll over and continue down, that means that this could still drop into an ICL. ( I never did call an ICL, just a dcl, but we are overdue for one).

SPX - As a cautionary note going forward, I mentioned that we had a buyable DCL in place, but using this weekly long term chart, it's easy to see a rising wedge in SPX. It is important to look ahead when we take on a trdae. That is called being alert and prepared, not biased , rigid, and foolish.

That way if we do get a sudden drop, we aren't surprised or overly biased and married to positions.

Read MoreContact Us

26 Broadway,

8th Floor

New York, NY 10004

admin@bigleaguefinance.com

admin@bigleaguefinance.com

Latest Blog Posts

accelerator diet pills goji berry diet pills ultra 90 diet pills keto meal replacement bar top weight loss diet pills for thyroid patients where to buy t lite diet pills keto friendly thickener diet fuel diet pills peanuts keto friendly rite aid diet pills that work envy diet pills diet pills for breastfeeding moms belique diet pills perfect slim weight loss pills calories in a bottle of white wine