CAN GOLD CONTINUE TO RISE, SINCE THE USD IS MOVING HIGHER TOO?

.

That question and other ones similar to it keep coming up lately and understandably so. Gold usually drops when the USD rises, but lately we do see both rising at the same time. I called a low in Gold recently and have been trading in the Precious Metals sector, but some are having a hard time believing it when they see the USD rising too. Allow me to share my thoughts on this. The following 4 charts are from the weekend report, where I tried to help my readers see the answer that question.

GOLD AND THE USD

CHART #1 -The USD has slowly been approaching the Highs of 2015. The chart does look quite bullish, but it does also show prior lows being taken out and lower highs so far.

Read More

Read MoreLets get right to the weekend review.

.

SPX 1 week ago - It was struggling to move higher. Not a 'long' or 'short' play going forward, just sideways chop again.

SPX WKLY - No change, still looks weak.

Read More

Read MoreThere was a time when I only released reports Tuesday , Wednesday, Thursday and the huge weekend report would cover Monday. I felt that the Thursday report would cover both Thursday and Friday and that the weekend report caught us up for the Monday trading. With the Bull markets of Precious Metals, Oil, and Commodities coming alive this year, I have released at least a small Friday report almost every Friday in 2016. Why stop now?

.

So this is just another short ( short? 13 charts ) report to point out that Thursdays dip or slam down in Gold , Silver, and Miners actually may hint at some underlying strength, and that may be enough to encourage anyone that is a little too light to buy these dips. Lets take a look...

Read MoreThings have been falling into place step by step this week. In this report, I just want to point out a few things that I am watching when it comes to our positions in Miners after a brief review of the Dollar and Oil.

.

USD - This looks bullish really, but it is very stretched according to cycle timing. It should roll over into a dcl soon. The Precious Metals are ignoring the USD when it rises now, possibly a sign that the Dollar is ready to dip down.

Read More

Read MoreI wanted to title this report "We got it!", that was by request actually, but you will see as we go through the charts that I cannot say that quite yet. Dont get me wrong, I believe that you will like the ingredients of this report, so let's get right to it...

.

SPX - The SPX failed when it dropped below the Sept 12th lows, and has struggled under the 50sma and even the 10sma. It needs to prove itself, but it is struggling. The NASDAQ stocks GOOG, NFLX, AAPL, and others do look bullish, so I am just watching how this plays out over time. I am much more focused on the Gains that can be made in Miners.

Read More

Read MoreSometimes it is not enough to go shopping when things are on sale, we all like to get the rock bottom prices. In the Precious Metals sector we caught the lows in Mid January and at the end of May, when they experienced a serious sell off. Looking for certain signs of a bottom, we started to see it as it was approaching. As you probably know, the Precious Metals sector has again been caught up in a deep sell off. Here at Chartfreak we’ve been expecting this, as seen in my public posts as well as my premium posts. I had been mentioning as far back as July and August that we should be looking for a deep correction and then a trade-worthy bottom, likely at the end of September or October. Will this sell off continue, or are we near the bottom? Lets look at some of the charts from my weekend report and see what we’ve been looking at! We’ll skip right to the Precious Metals section.

.

GOLD, SILVER, & MINERS

.

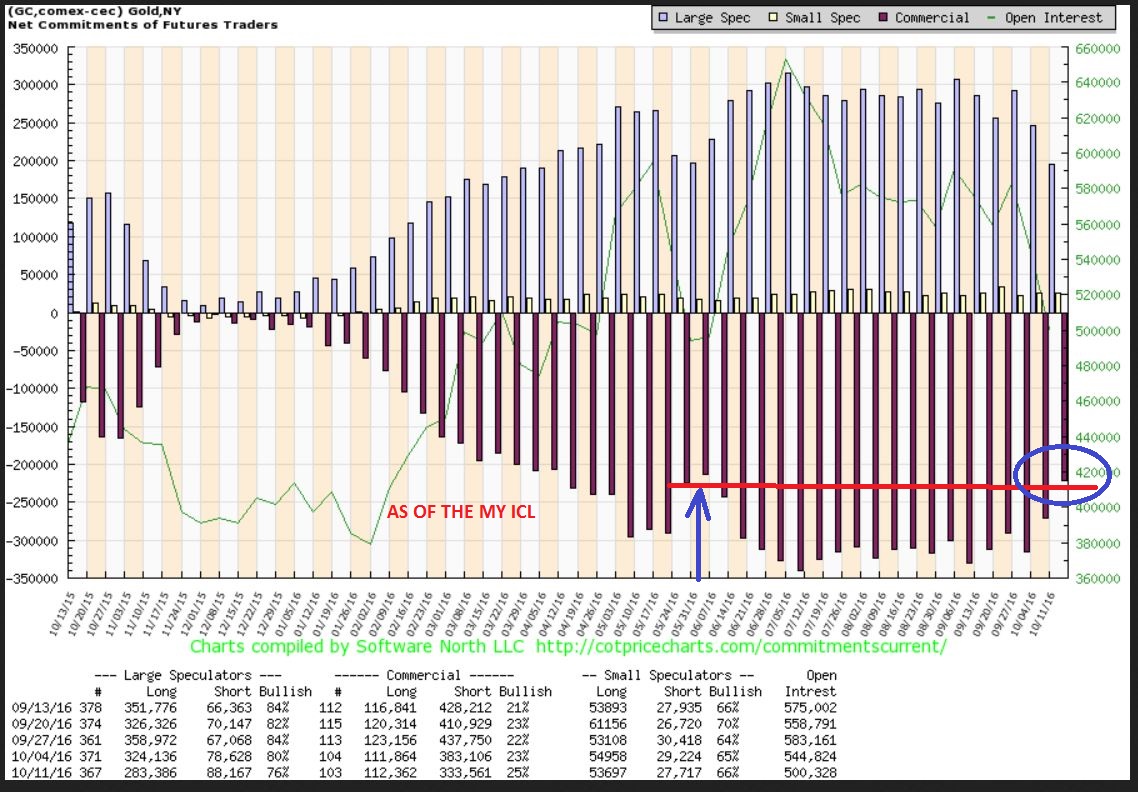

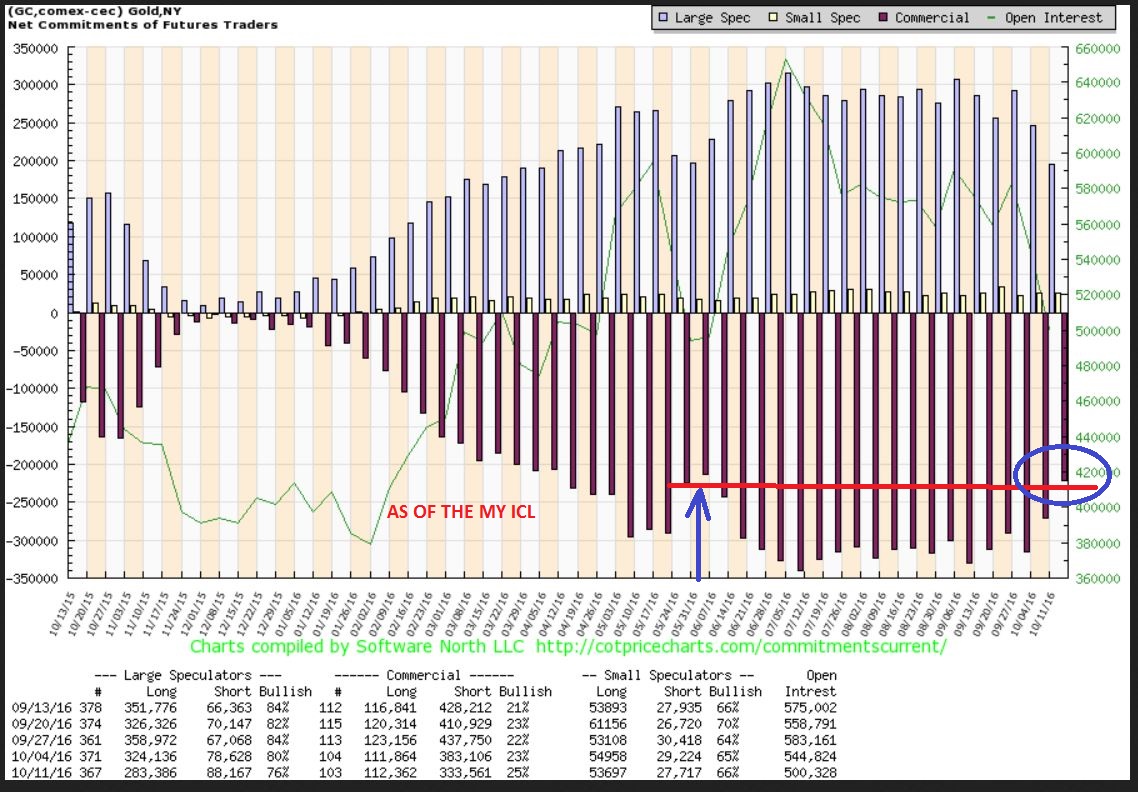

The COT levels are back where they were in May at that Deep trade-able low (ICL), and GOLD is now late in the ‘daily timing’ for a cycle low, so this starts to look good.

GOLD – Golds did not have a proper swing low in place as of Friday, but we do see signs of bottoming. Daily cycles do not extend much further than 25 -30 days, and we see that a low formed on day 25 so far. That means that Friday was either Day 30 of this sell off daily cycle or day 5 of a new daily cycle and lows could be in place at $1243.20. Follow through higher above 1267.60 places a swing low in place.

SILVER – Silver has a proper swing low, but it is not really ‘confirmed’ yet. I want to see a break above the 10sma as follow through.

.

NEAR OR AT THE LOWS? TIME TO DIG DEEPER

.

GDX – Looking back to Oct 6th, I started to tell everyone that often GDX bottoms in a way that looks easy to buy in hindsight, but it is NOT. Look at those May lows. I said that we could see the same type of bottom form around the 200sma, as we saw at the 50sma. It scares away buyers looking for support in that area…

And there you go, twins. Easy to buy, right? No. 🙂 On this chart I got 1 ‘buy’ signal that triggered Wednesay using an indicator that I developed over time (the lower section).

GDX OCT 12th – This system that I developed years ago triggered a ‘buy’ on Oct 12th ( see the lower section). It is at times scary, because it often triggers before a strong move higher. In the past it has been very accurate. Again, the progress since this Oct 12th chart is seen on the above chart in the lower section.

GDX – This points out that Day 27 was either the low and we saw Day 3 on Friday, or if we drop 1 more time, we extend this daily cycle to the limits. That in mind, I believe that any drop would be a shake out and then rebound.

Please recall that back on Oct 6th , I said that $22.08 was a measured move that is possible too, but not necessary. It also leads to a back test of that orange channel, but notice that we did back test that already in the May sell off. So another quick slam down and recovery is still possible, but that tag of that blue channel is usually enough in a bull market sell off. This sell off should be finishing up.

I used this chart in a report last week to show that the GDX:GOLD ratio was turning up. I wrote in the middle of this chart that a cross of the 8sma is a buy for some technical traders, but I find it a bit risky and not a low risk buy when used all by itself. We did not have a cross over yet at that point.

GDX:$GOLD UPDATE : We got that cross over. If Gold drops or Miners rise faster than Gold, we get the cross over. Monday we will look to see if this holds or gives way.

.

EDIT: This is Mondays chart, the cross over the blue line held and it looks like it back tested. This shows us that even though GOLD hadn’t places a proper swing low in place, Miners are leading.

WEEKEND REPORT CONCLUSION: We are waiting for a confirmed swing low and a push higher. Oil and NATGAS remain bullish, but I sold my energy positions to focus on the Precious metals. We are deep into the timing for a low in Gold, Silver, and Miners, and I think that this is where some nice gains will be made next. I expect a run higher very soon, and I will cover set ups and entries in Miners when those lows are confirmed.

.

Are you ready to go shopping in the precious metals sector? Back in May 2016 at the lows, we entered what I considered to be low risk bullish set ups in VGZ, MUX, and TRX and these ran up 100-250% in 2 months! Why not sign up at chartfreak and add this analyses to your own method of trading. If this run is anything like the run we saw out of the January lows or the May lows, 1 trade will more than pay for your monthly or quarterly membership. In Monday evenings report, I discussed a few Miners that had low risk set ups.

.

Chart Freak Premium

Chart Freak members receive up to 5 premium reports per week covering a wide array of markets, as this public post illustrates. Come and join the ChartFreak community as we trade the new Gold Bull Market and various trending sectors.

~ALEX

.

SIDENOTE: BPGDM

People have asked me, “Does the BPGDM have to drop further like in Aug 2015”? No, not if we are in a re-newed bull market.

In the summer 2015, Miners were TRASHED and the BPGDM was about as low as it gets, then some Miners started to recover before the GDX lows were really in place. So when we were looking for the LOWS in GDX last year ( they actually came in mid January 2016) BPGDM was rising, not falling. Some Miners were already being accumulated BEFORE THE ICL.

.

Look at the MAY 2016 ICL. If someone says that the BPGDM has to drop lower now, before an ICL can be in place, then why did it hold up so well at the May ICL? We are already lower than the May ICL, isnt that enough? We are almost at the January 2015 ICL level (but we do not have to go there).

.

Currently, the BPGDM has dropped as much as it needs to to remove bullish sentiment. Many people are no longer interested in ‘taking a chance on Miners’. THAT IS BULLISH.

When I am preparing food on the grill, I'm checking the temperature, watching for grill marks, looking for a change in color, and several other signs to know when the food is ready. In a similar manner, we have been watching various aspects of the precious metals markets and also looking for a variety of signs indicating when they may be ready for consumption. 🙂

.

How do things look? Lets take a look...

.

SPX -I believe that the general markets are going to roll over soon.

Read More

Read MoreThe SPX ( Left Translated) dropped to break the prior lows and then put in a shake out reversal. It has struggled at the 50sma, and now that it faled, I expect it to roll over, possibly after tagging that 50sma again.

Read More

Read MoreWhen hunting for good set ups, just keep in mind that every day that passes brings us closer to the target.

Read More

Scroll to top

Read More

Read More