Public Post – Energy on the Move

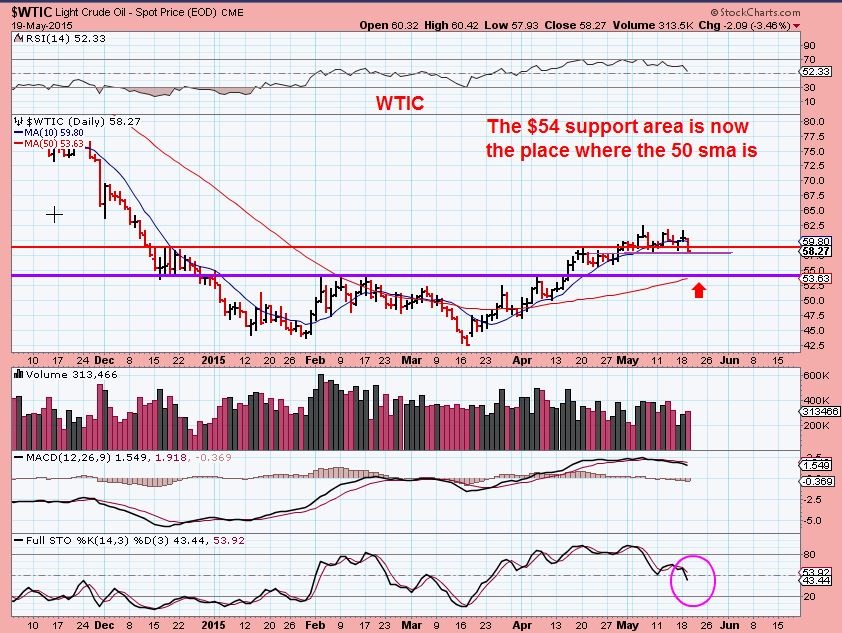

WTIC– I have mentioned all along that a drop to test the break out could come. The 50sma is in that area. OIL has been strong, and it did start to dip. Click on the chart & look closely, It is at recent consolidation lows, but could drop further.

XLE– this is near / at the target that I had for it. It is quite oversold too. If oil drops to the $54 area, will some energy stocks break down? Or will the XLE lead , and reverse higher? Lets watch it.

NATGAS – remains bullish in my opinion, still above the 10sma. A high volume reversal in overbought conditions can indicate further selling however, so if you are trading NATGAS with leverage ( Many here use UGAZ) you likely sold. I still think NATGAS is going higher, but it does look like it can drop further from here. If so, I think it will be buy the dips.

So much has changed , but nothing has changed. Things look bullish as they rise, and bearish as they drop. I am trying to remain unemotional and just see how things play out. I am watching the dollar and commodities for further clues going forward with Commodities. The FOMC minutes from the end of April are released at 2 p.m. That can trigger reactions in any sector too. As always honor stops and dont worry if you take a small loss, it preserves funds for future set ups when the selling dies down.

Happy trading

~ALEX

These are just 3 of 27 charts posted in the premium section today. Consider a quarterly membership at just $95, which equates to around $1.50 per report or just 8 cents per chart!

“The Greatest Risk in Not Taking Action!”

Click Here for Membership Options

Any opinion on bitgold, XAU.V ?

Hi Mm

Sorry, I really dont. I pulled up a chart and it only showed 7 days of trading. Stockcharts is down, so I cant loook it up there right now. I’d need more history.

Thanks for reading here though.

Thanks, yes its only been around for 1 week or so and gone up and down like crazy-too wild for me! It is a service like bitcoin but gold backed so very interesting and unique.