You are here: Home1 / Exclusive Strategies

Knowing that my readers are both short term traders and longer term investors, I want to always look at the charts and view them with a long term, medium term, and short term perceptive. At times all 3 views are sunny or all are murky, but in times like these, I also get a mixed bag. Lets review the charts and you will see some good and some questionable things in various sectors. This can help to sort out our short term and longer term investments.

.

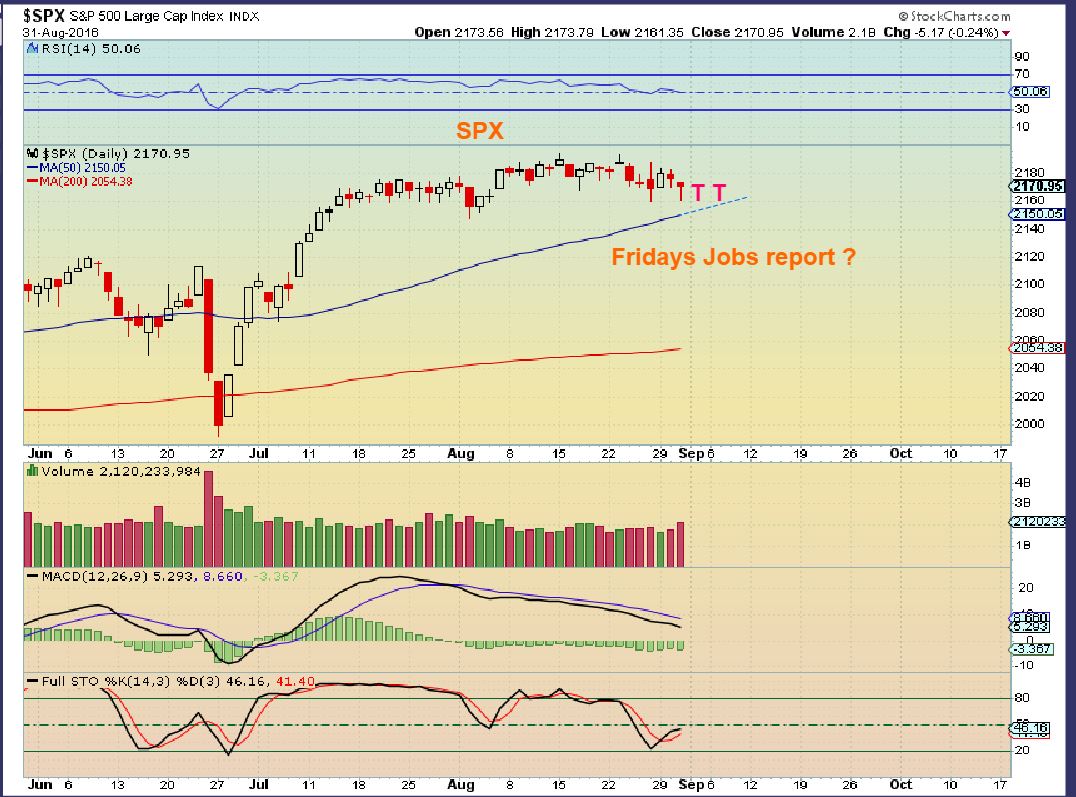

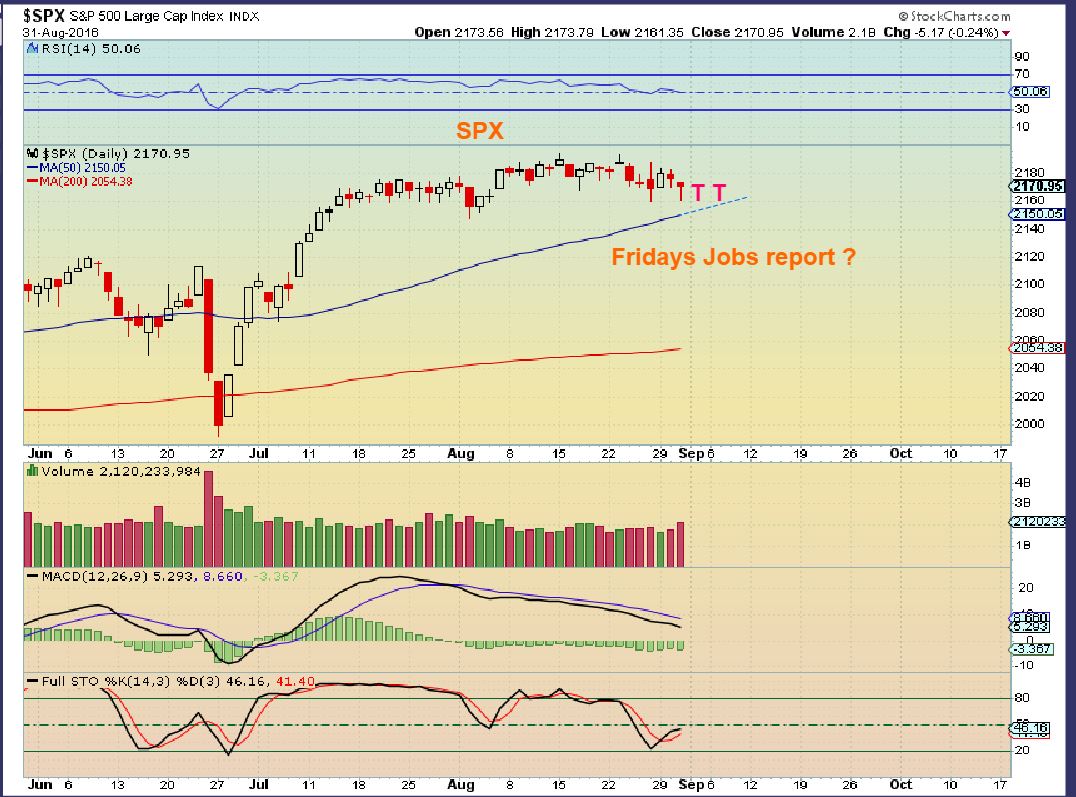

Back before Aug 26th and on this Aug 26th chart, I mentioned that we could see price continue sideways until it tags the 50sma, or maybe even break it in shake out fashion.

SPX - Each sell off is met with buying reversals, so this reversal with the Jobs Report "might" be enough to put in the daily cycle low. If so, this should break out & continue higher, instead of more of this 2 month choppiness.

Read More

Read MoreFridays jobs report may change a few things, but so far the charts are showing the same old song and dance...

.

SPX - Not much change here (I added a Thursday candle and a Friday candle as a possibility of tagging the 50sma).Jobs report Friday may give us our directional move. Many expect this to burst higher and run, but at this point, the Vix Chart looks rather bullish.

Read More

Read More

Scroll to top

Read More

Read More

Read More

Read More Read More

Read More