You are here: Home1 / Exclusive Strategies

In an earlier report I asked, "Are we still on track?" It would take time to know for sure, but things are still playing out well in some areas, yet a little trickier in others. Lets look at charts.

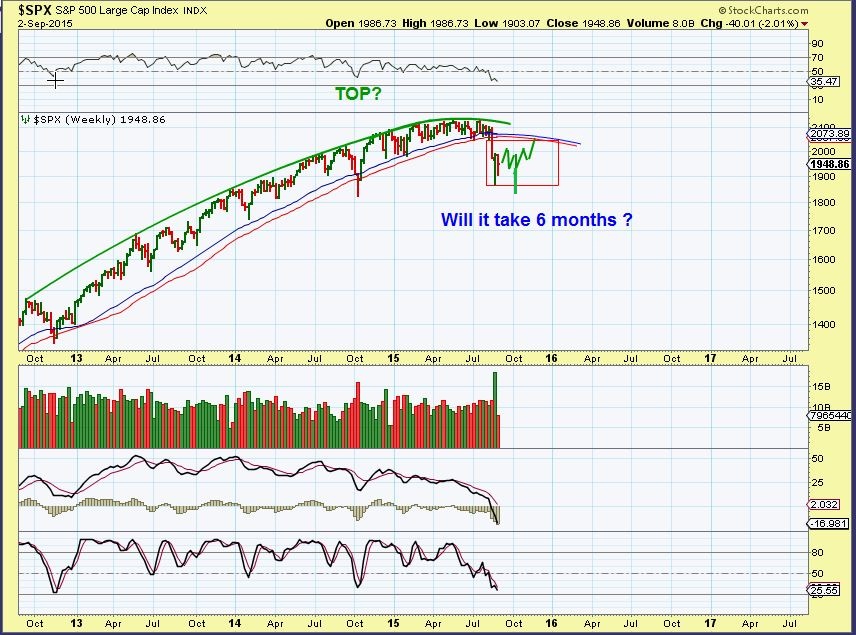

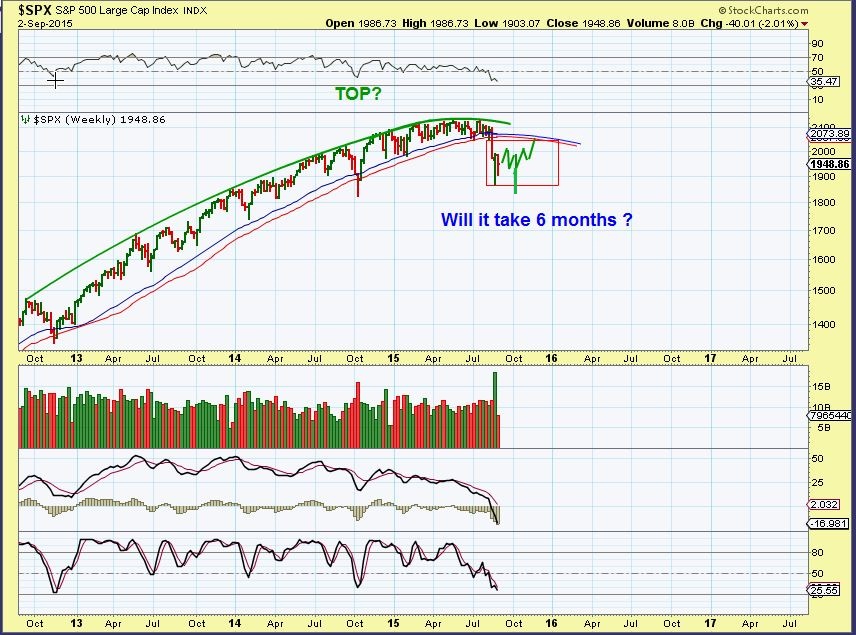

SEPT 2 - I pointed out this topping action and said to expect volatility, possibly even sideways for a long period of time.

I want to point out what I am looking for next...

Read MoreI wanted to post a picture of something where glue was just melting and everything was becoming unglued, because Wednesday morning I saw quite a bit of Green on my screen and by the close things become a little unglued. So it raises the question, "Are things still on the right track?" Lets look at the charts.

DJIA - Wednesdays rally hit the 20sma and back tested that down trend line, and then promptly gave it up. I actually think this type of action could lead to a nice post Fed rally next week. For now it is difficult to trade.

Read More

Read MoreNow that we have seen some steady selling in various areas of the markets, some set ups look ready to buy again. Before discussing these set ups, lets review the markets in general.

.

NASDAQ - After the steep drop, we usually see some consolidation and chart repair under the 10sma. Eventually if you get a break back above that 10sma, price often continues higher. We could break back inside this channel, but it was the start of a downtrend. Trading is no longer buy & hold for many.

Scroll to top

Read More

Read More