You are here: Home1 / Exclusive Strategies

One trading day after the weekend report and expectations have not changed, except that almost everything improved, so let's take a look...

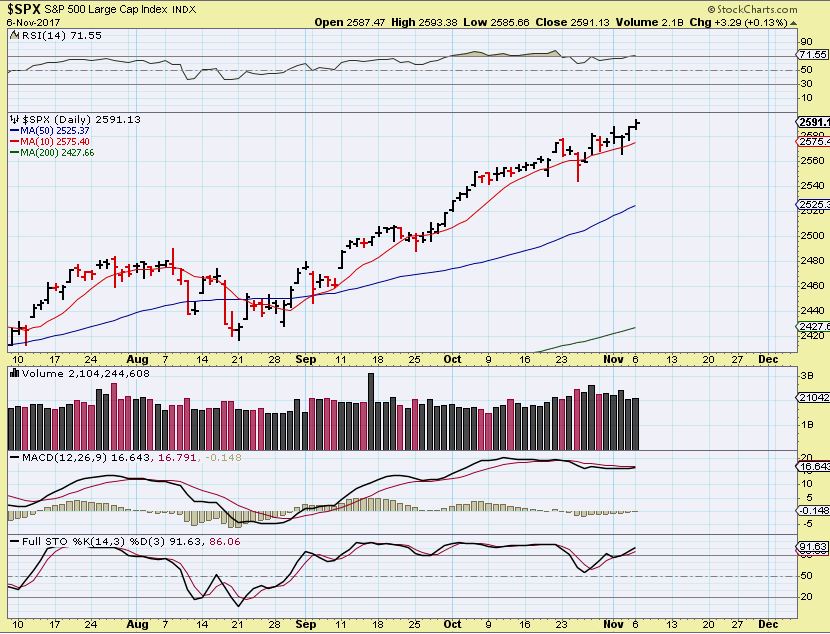

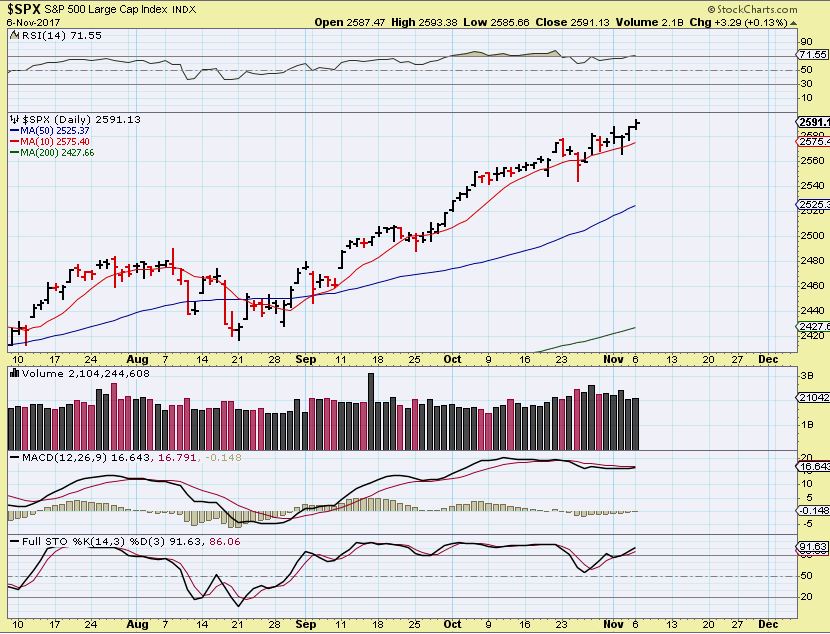

SPX - No change from our expectations

Read More

Read MoreThe various Market sectors acted as expected this week, so let's take a look and see how things continue to line up in a way that we can profit from.

SPX - The General Markets put in another high DCL, and we've discussed how the pull backs are more shallow lately and what that implies. This would only be day 7 of a new daily cycle. That dip was sharp , but shallow, so 'longs' may not have even been stopped out with a trailing stop. If one was stopped out, this sideways stall has allowed many to re-enter long positions.

Read More

Read MoreIt's Friday, there is only one trading day left in the week, so I want to cover a couple of questions that I get from time to time in todays report. I will do a short review of a few things first, and then I will just cover everything else in greater detail in the weekend report. For now, this report contains a brief review, a couple of trade ideas at the end, and a lesson or two in the middle.

SPX - No change here from our expectations. This looks like day 6 of a new daily cycle.

Read More

Read More

Scroll to top

Read More

Read More Read More

Read More Read More

Read More