You are here: Home1 / Exclusive Strategies

It comes as no surprise that markets can evolve and change over time, so when a change appears, it is best to listen. It may or may not amount to anything in the long run, but we take note of any changes anyway. That said, I have seen 'changes' in the markets this week in a couple of areas, so we will listen, discuss, and prepare. As I mentioned, they may not amount to anything permanent, but we still need to listen and prepare, so let's discuss some changes in the weekend report.

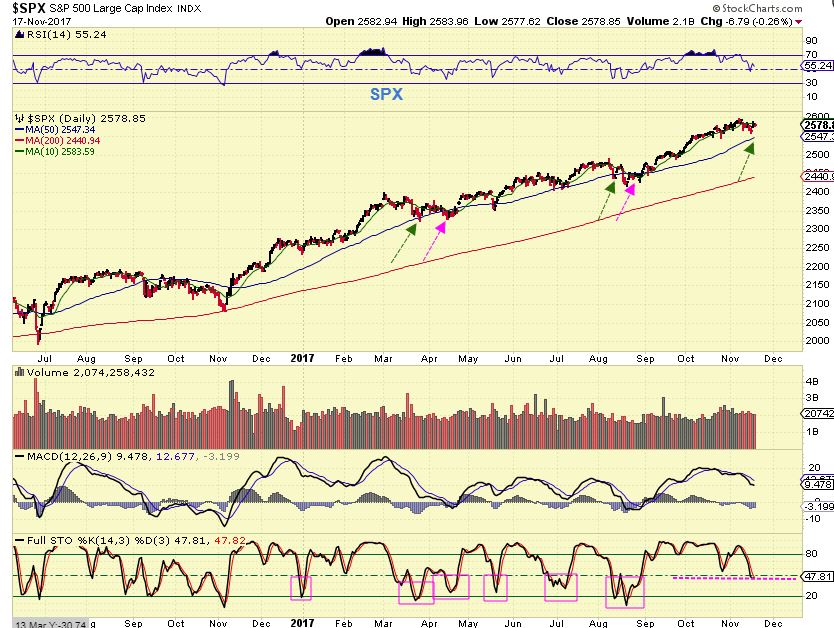

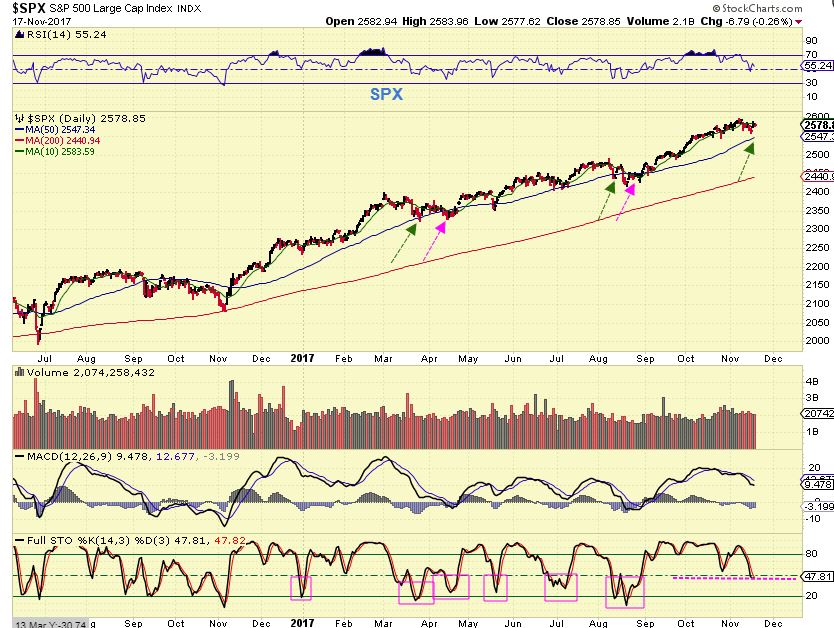

SPX - No change here, but I wanted to point out that in the past, the SPX did visit the 50sma a couple of times before moving higher. These were areas of ICLs that did not sell off as deeply as the ones in the past (see JULY & NOV 2016). So, will the markets just continue higher, or are we coming due for one soon?...

Read More

Read MoreToday is Friday and it is the last trading day of the week, so let's take a look at the markets and then discuss a couple more trade set up ideas.

Read More

SPX - The drop continues as the SPX is seeking out the next DCL. The trend line is broken and the 10sma has been lost. I actually thought that the 25th could have been a dcl, with the trend line break and close below the 10sma, so now I am simply watching for a swing low first, and then a close above the 10sma. Either I drew the trend line wrong and the 25th was not a dcl, or this is a very L.T. daily cycle on day 15. The divergence that I was pointing out over a week ago is playing out, so our 'caution' was warranted.

ALSO ...

Read More

Scroll to top

Read More

Read More