You are here: Home1 / Exclusive Strategies

In this weekend report, I want to review the markets as usual and discuss where they are at. Things look very interesting in many ways. I also wanted to discuss a few things about my personal view of trading around cycles. In my analysis, many are aware that I incorporate a variety of helpful techniques. I Mainly use various forms of Technical analysis, and along with that I add Cycles, Sentiment, a little Elliot Wave and so on. In this weekend report, I want to also briefly discuss a few things regarding Cycles and some of the trading that goes on around them. To the charts...

.

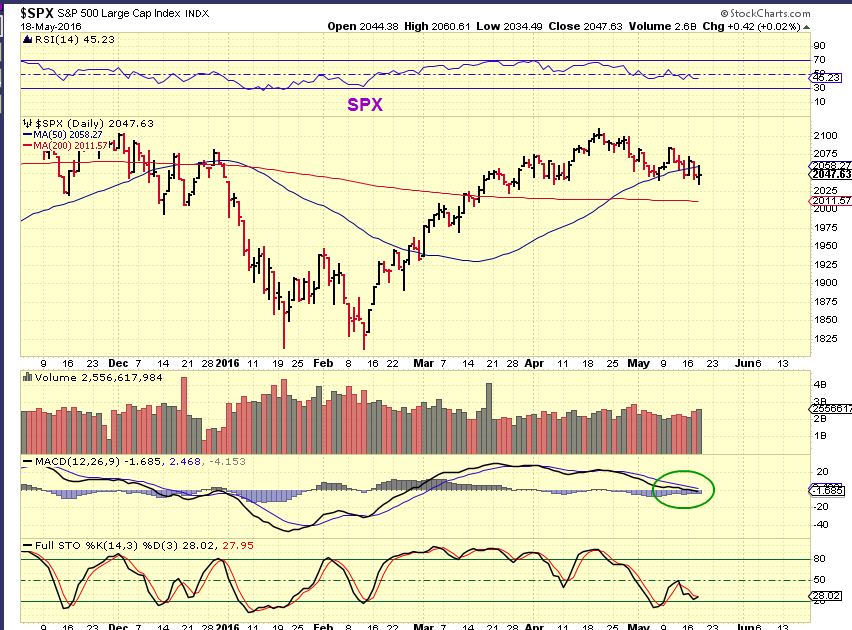

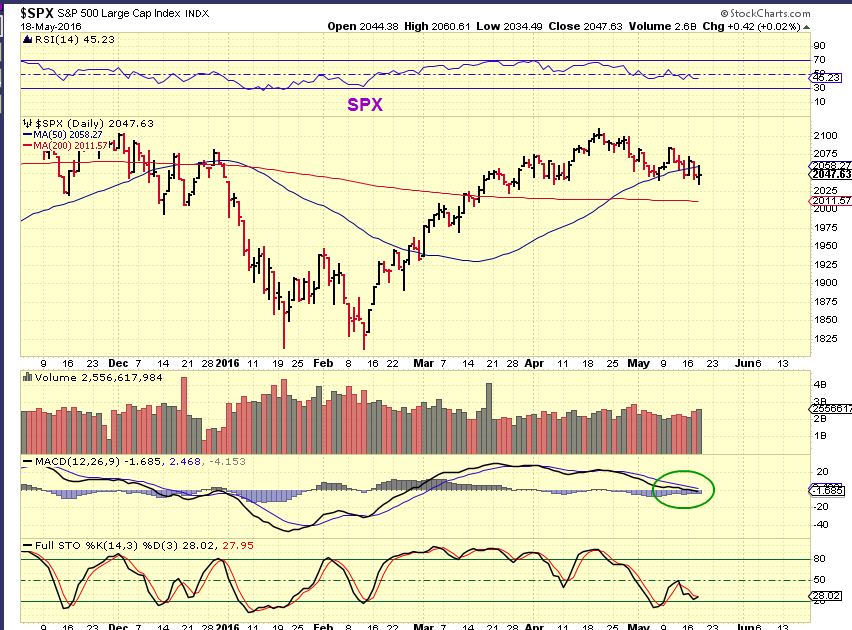

SPX - As mentioned in a prior report, for the amount of time that the SPX has rallied out of lows and moved to oversold, it has had a mild pullback. Not even a 38.2% retrace yet.

Read More

Read MoreLets do a market review and then I'll discuss what will be in the weekend report.

.

SPX - We've been looking at what looks like a H&S. EVERYONE is looking at it and the group think is seldom correct, so I have to wonder if it'll play out. The reversal could be a DCL and may be setting up for a rally back to 2100.

Read More

Read MoreWednesdays release of the Fed Minutes certainly caused a 'reaction' in the various sectors of the markets. It falls in place with the timing of certain cycles, so lets review the action and what it may mean moving forward.

.

SPX - The General Markets sold off with the Fed minutes. They recovered into the close. This still looks like a H&S and has yet to recover the 50sma.

Something that I find very interesting happened on Wednesday, I'll discuss it later in the report.

Read More

Scroll to top

Read More

Read More Read More

Read More