You are here: Home1 / Exclusive Strategies

https://chartfreak.com/wp-content/uploads/sites/18/2018/02/FRIDAY.jpg

562

878

Alex - Chart Freak

https://www.chartfreak.com/wp-content/uploads/sites/18/2019/11/Chart-Freak-site-logo.png

Alex - Chart Freak2018-02-09 02:09:472018-02-09 02:09:47Feb 8th – T.G.I.F.When the Ice begins to get too thin to support you, you would proceed with caution and maybe even take the safer route. When the markets experience a serious 2 day slam down, it isn't always the best time to just jump ' all in' with leverage. That is a trade that may or may not work out, and so it has higher risk. Leverage has probably robbed more people of their soul than thin ice has. Let's discuss that in todays report after our recent market sell off ...

NASDAQ -I covered the general Markets extensively yesterday, review that report if you need reminders. We had a strong reversal, and it did stall today. It is an unconfirmed swing low.

Read More

Read MoreThe recent flush down of the markets is viewed by some as alarming and even terrifying, but in a bull market, it's often just a necessary flush of excess bullishness and a re-set to a fresh start. It takes time to see exactly how this will play out, but let's take a look at the recent flush down and discuss those possibilities...

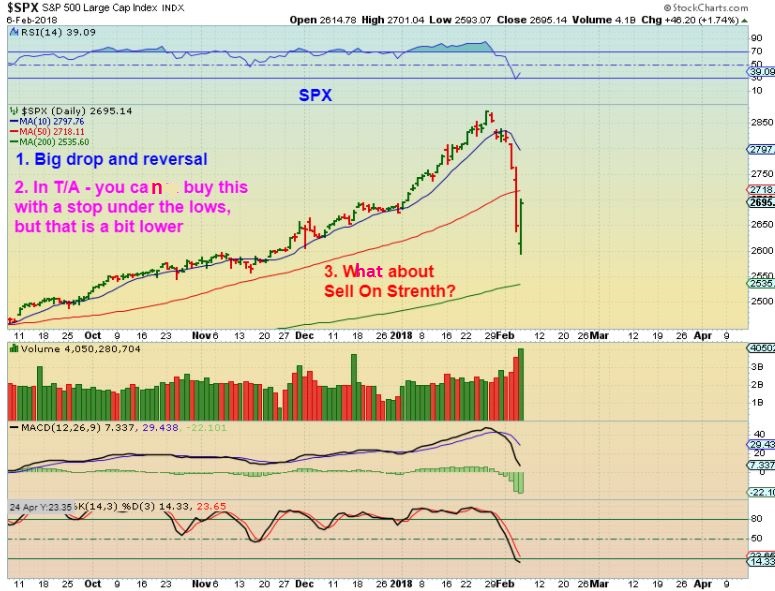

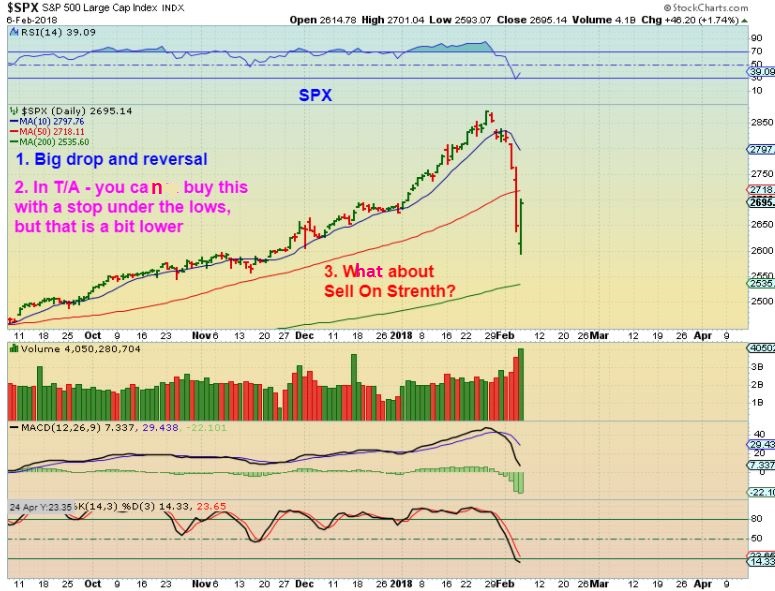

SPX #1 - After a strong reversal, the SPX had a large 'sell on strength'. My thoughts? We just might not get the V-Bottom that many expect. This still may be our 'Lows' for now, and I will show you what I am thinking shortly. This was a massive flush down compared to any other pullback on this chart. Please read the chart.

Read More

Read More

Scroll to top

Read More

Read More Read More

Read More