You are here: Home1 / Exclusive Strategies

DJIA - I can't say with certainty whether this is a long term double top or not, but it has played out as a short term double top. We were expecting this drop into an ICL for weeks . Look at the strong bearish divergence on the MACD & RSI on a weekly basis. I've discuss in my daily reports what to expect going forward.

Read More

Read More I love Rocky Road Ice cream, but Rocky Road Trading? Not so much. My last few reports have mentioned that even though we do have a 'low risk entry' for Buying at a swing low in the General Markets and some other areas, stops are a must. It is not a confirmed swing low, and we have volatility and choppiness, so buying the swing doesn't necessarily mean that it will be an easy ride.

In fact, yesterdays report was entitled : 'It Is Still A Rough Ride.' Going into the last day of trading for the week, lets review Thursday and see if this proved true.

.

Yes, it proved true - The Dow was down over 399 points and the NASDAQ was down 184 when I captured this in the afternoon...

.

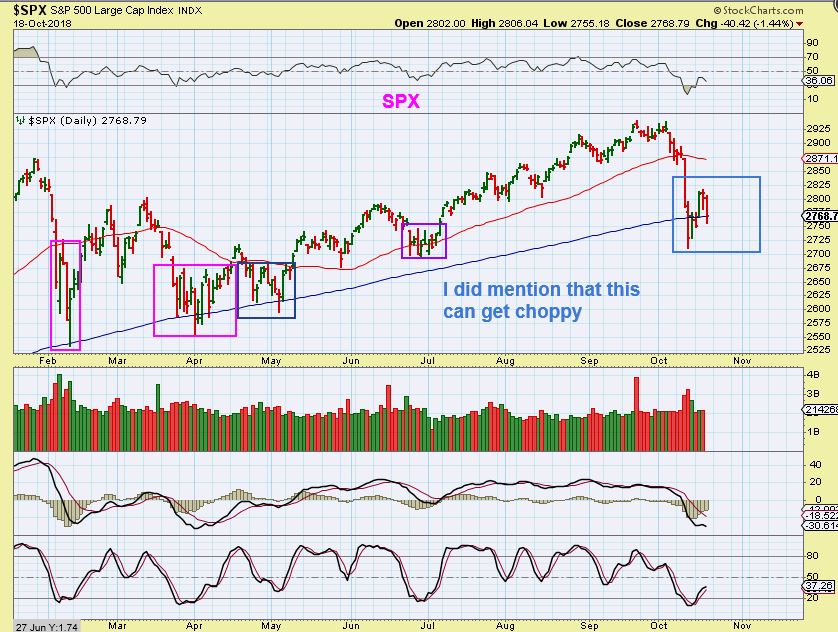

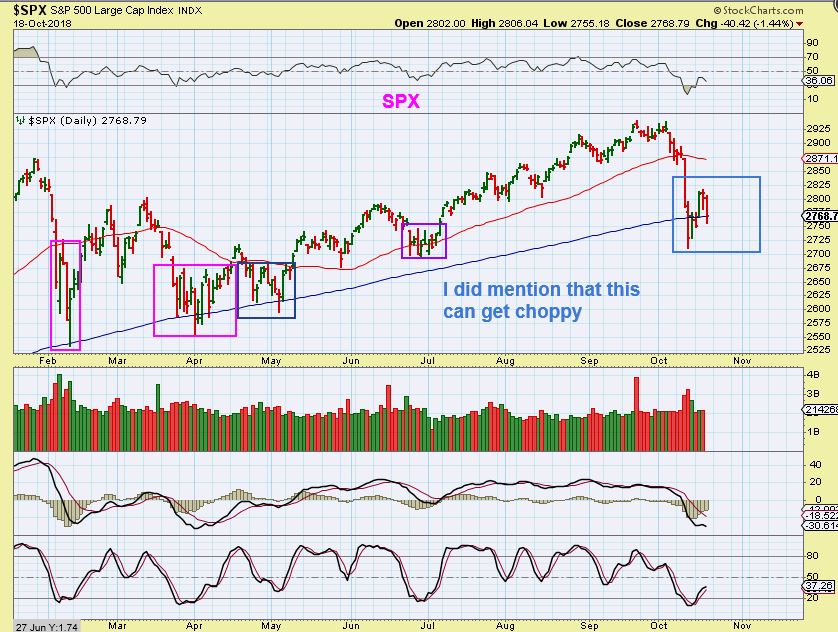

SPX - I also mentioned that similar to February and March, things can be choppy around this 50sma, even with a swing low in place.

Read More

Read MoreThe release of the FOMC Minutes really didn't seem to have any meaningful or lasting reaction in the markets. It may have added a little knee jerk reaction or volatility, but overall there was no big directional change. Let's take a look at our markets, and again, there really are no major changes from yesterdays report to discuss, but we'll still review what we have...

.

SPX - I have been looking for a steep drop and an ICL. We have that steep drop and a reversal after the 200sma was taken out, so this could be a shake out. It is a swing low, and yesterday I said that this could be bought ( TQQQ or UPRO, etc) however...

Read More

Read More

Scroll to top

Read More

Read More .

.

Read More

Read More Read More

Read More