You are here: Home1 / Exclusive Strategies

Friday is a holiday and the markets are closed, so today is the last trading day of the week. Earlier this week I had mentioned cycle counts and a possible bearish rising wedge, so 'tighten stops and stay alert' was the thought for the General Markets at that time, but now? It may be time to consider 'Safety First'. Let me explain...

.

XBI #1 - This was the XBI ( A Biotech ETF) Tuesday. It landed on the 50sma and also had the support of the 200sma below it.

XBI #2 - This was the XBI on Wednesday, the very next day. Look at that volume and how easily it sliced right through both moving averages. If that is some kind of warning of what might be coming in the rest of the markets, we better be listening.

Read More

Read More

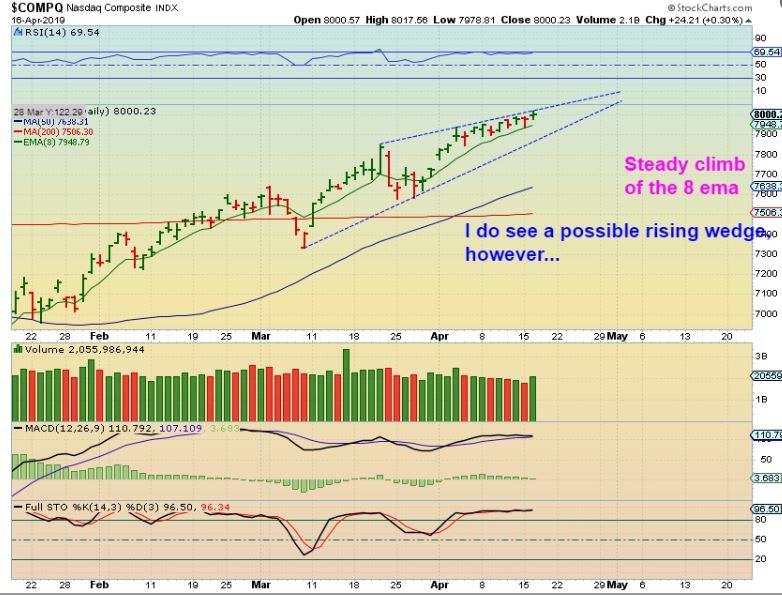

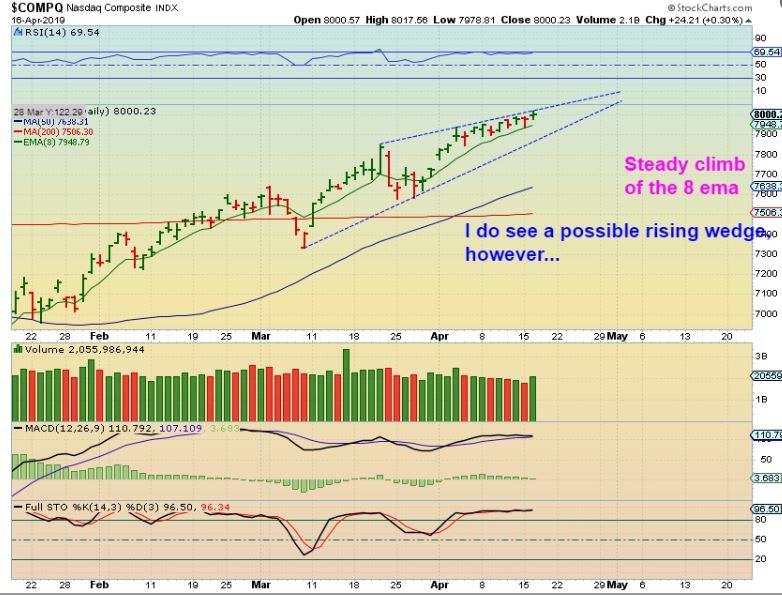

NASDAQ #1 - The NASDAQ has been climbing along the top of that 8 ema ( or 10sma) Bullishly.

Read More

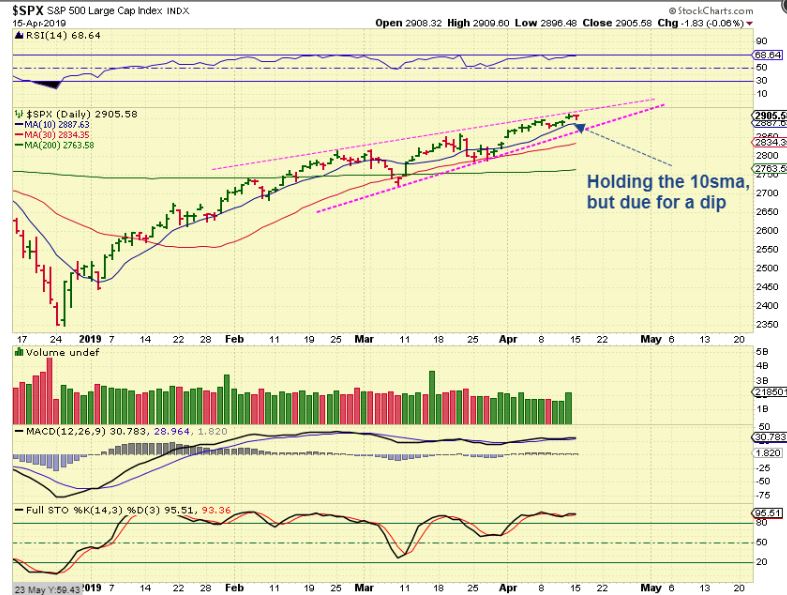

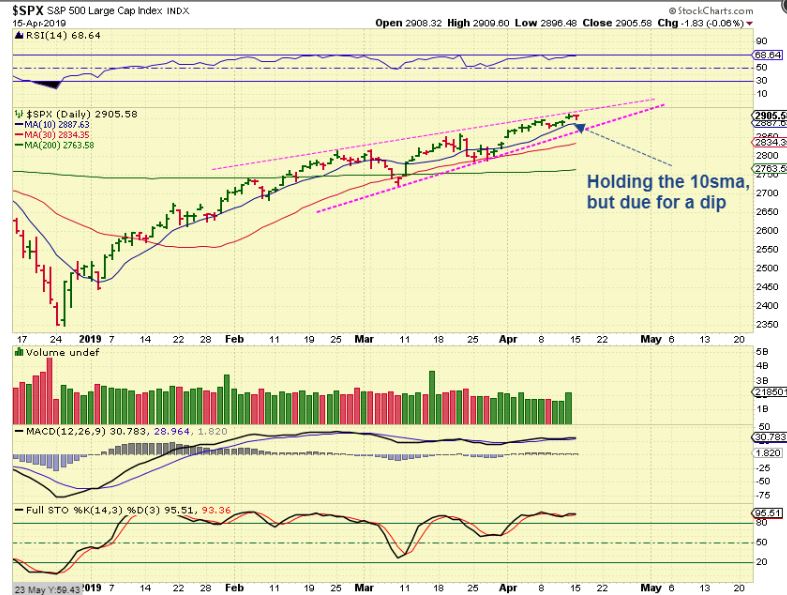

Read More The General Markets should have a little more upside, and if you are willing to ride the dips and just hold current positions, you can use a reasonable stop. If you hate losing any of your gains, it might be wise to tighten stops and keep an eye on open positions. The markets have been running strong and pull backs have been fairly shallow, but it is looking like we could be due for another pull back soon. Let's review what we have...

.

SPX - The bearish rising wedge has been moving closer to the Apex. This is at least shorter term bearish. It doesn't call for a crash, but it does signal a possible pull back may be coming soon, and...

Read More

Read More

Scroll to top

Read More

Read More Read More

Read More Read More

Read More