You are here: Home1 / Exclusive Strategies

After a very choppy sideways start to the week, the FOMC Minutes release on Wednesday was a non-event, but when we reached Friday and the Jackson Hole speech was delivered, it looks as though we finally have our 'directional' trades revealing themselves. The China trade wars and the Jackson Hole speech did seem to shake things up a bit. I usually mainly discuss the Big Picture in the weekend report, but this report will contain some short term possibilities with daily charts & The Bigger Picture.

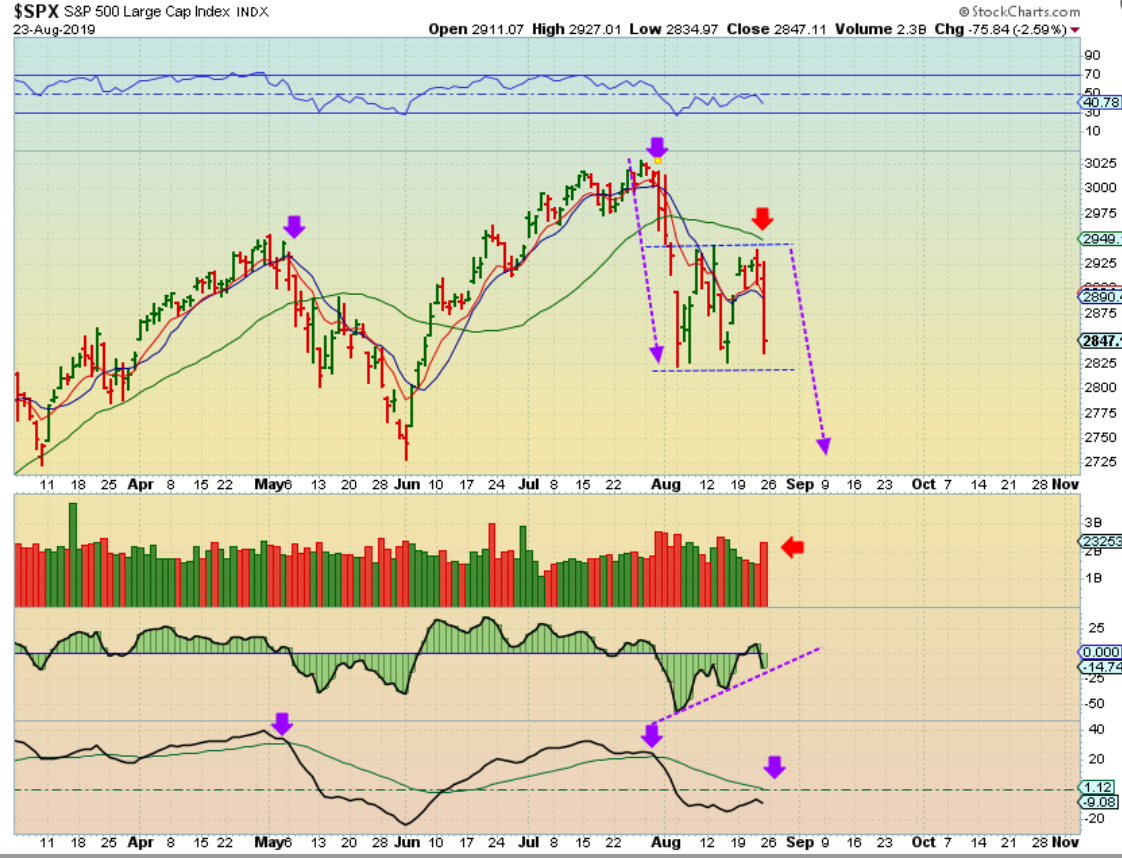

SPX DAILY - That was a big drop with heavy volume Friday and this is only day 14! We have plenty of time for this to really sell off. The General Markets closed below the 10 sma, and this definitely looks like we will revisit the June lows short term, and possibly experience an even deeper drop & break down. The Big Picture shows a possible large drop too...

.

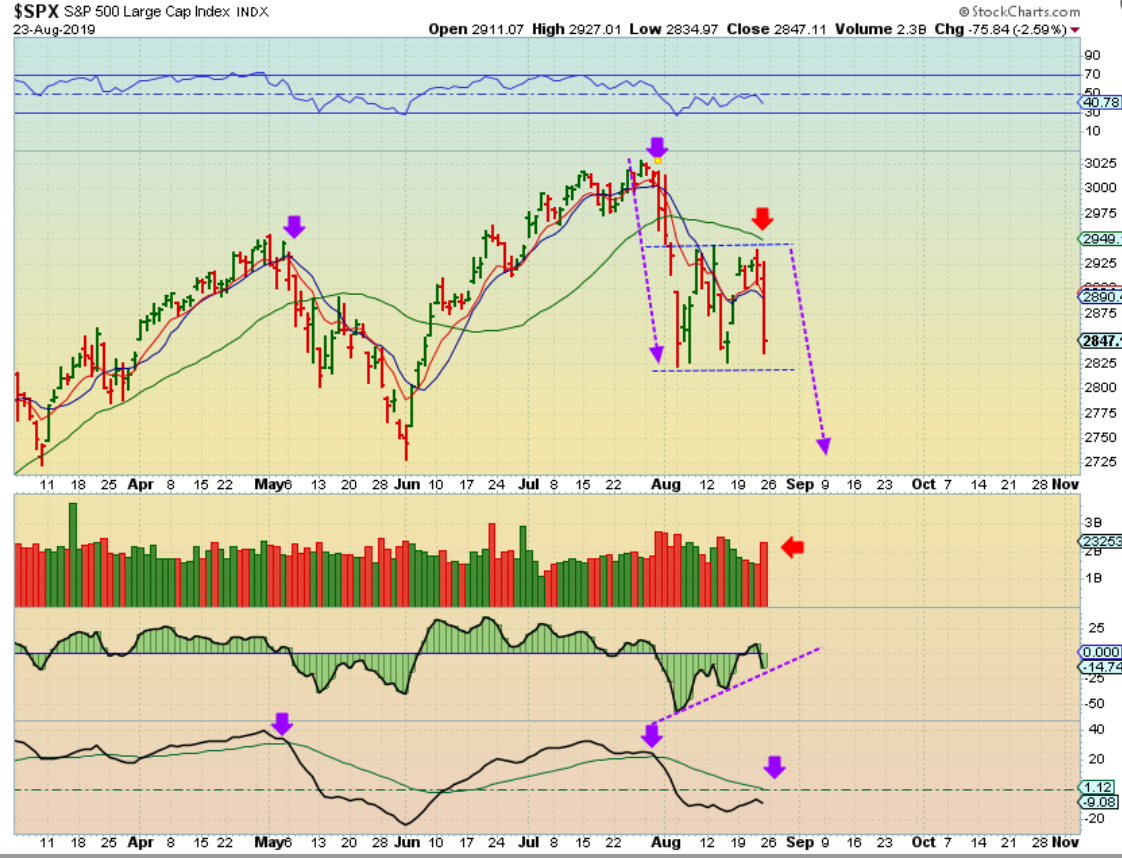

SPX WEEKLY - LAST WEEK I showed you tthis break down and possibly 'just a back test' during this chop, and now it looks to be breaking down further...

.

SPX WEEKLY - In the past, I have also pointed out this possible Bullhorn or magaphone in the Bigger Picture, and the idea is still valid. This has been warning that we could have a deeper sell off at anytime, rather than 'New highs & Blue skies' at the '5' area, as many used to think.

Read More

Read MoreThe various market sectors have been choppy and sideways, but with Fed Chair Powell speaking at Jackson Hole this morning ( U.S. Time), there is at least a chance for that to change. Let's look at our markets...

Read More

Scroll to top

Read More

Read More