You are here: Home1 / Premium

We are getting the follow through that we expected in many different areas of the Market. The small pieces of the big picture continue to add up. Will it continue? Lets check the charts! 🙂

SPX Jan 27 – I pointed out that the drop mid week was normal, the same thing happened coming out of the August lows. I still expected a run higher.

SPX Jan 29 – Friday we got our follow through.

Moves higher out of the lows can be convincing, but will it lead to a break to new highs in a bull market, or a bounce?

Read more

I wasn’t planning on a Friday report, but Thursdays action in several areas was important enough that I wanted to share a few charts. Also a reader ( we shall call him D.F.), pointed out an area of interest that I will touch on here too.

.

Lets start with the USD. I saw weakness and have been saying that I expect it to drop. I posted these charts last week.

We have been in Gold & Miners for a while now, but a weak dollar could help Precious Metals and Commodities further. I will cover this more in the weekend report , but for now, what did the Dollar do Thursday?

Read more

The markets are always dancing around on a Fed Wednesday, and often the volatility spills over into Thursday. Lets take a look at the charts and see what we can see.

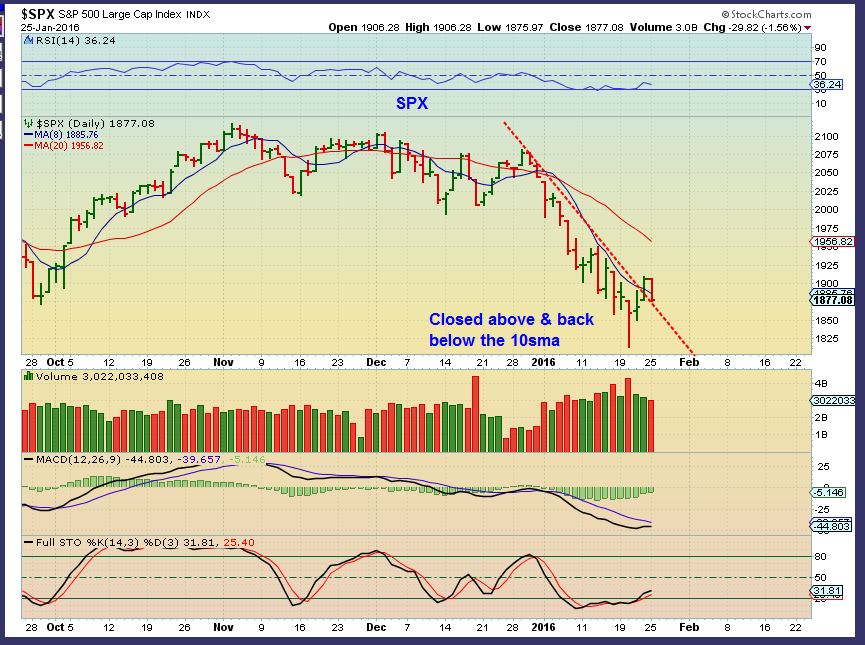

SPX – The markets sold off after the Fed Decision. I called for lows recently and I still expect higher prices to develop from a bounce. You can see that this is how the markets moved coming out of the lows in August too. I do not expect the recent lows to be broken, but a little more downside is not out of the question. Please notice how difficult it would have been to trade the Lows in August/ September.

That being said, the RUT / IWM looks like a bear flag, so lets look at a few other areas.

Lets look at the NASDAQ…

Read more

So lets just pretend that today is just a Wednesday like any other Wednesday. Things are playing out exactly as expected. To the charts!

.

SPX Monday – I called the reversal last week a trade-able low, and the Quick sell off Monday just a back test of the trend line.

SPX TUESDAY – It’s only day 4 , so I expect this run higher to continue.

Read more

Monday saw a little drag on various sectors of the market, but I still expect a bounce before another wave of strong selling resumes. WEDNESDAY is a FED day, so anything can happen, but Cycle timing is right for bounce.

The old saying is that a picture is worth 1000 words, and sometimes I see a chart that’s worth a thousand words too. The Banking index, for example , says a lot.

.

This is the Banking Index

The above chart is quite oversold, but it is also quite unhealthy looking…

Read more

The weekend report will discuss the changes that we have expected for months, and how we now see those changes taking place. Also, as mentioned in the last report, the recent sell off is now changing into a Long position, but for how long? To the charts! 🙂

.

SPX – On Thursday, Jan 21st I mentioned that a swing low was in place ( Bullish for going long). It is safer to wait for follow through with a confirmation break above the 9 sma.

SPX – We had that confirmation on Friday. For traders, going long SSO, TQQQ,IWM, and various stocks was in place.

But please, lets not forget the Big picture too…

Read more

Just a Quick market review and then I want to discuss some fast trades for those that like to trade, but aren’t ready to buy & hold quite yet.

.

SPX – I discussed the reversal and likelihood of that low to be in place for a bounce / rally. Thursday did put a swing low in place and the timing is right for a low. We do not have a break above the 10sma as confirmation yet , so the safer trade lies ahead, but some may have wanted to buy the swing based on timing, and place a stop below the Wed lows.

SSO, TQQQ, etc can be traded coming out of the lows, with a stop just below recent lows.

Read more

The Dow Jones Industrial Average was down over 550 points yesterday and then rallied back into the end of the day, putting a form of reversal candle in place. Thursday morning the futures are RED, but we are at an extreme point that calls for a bounce/ rally. Yes it could last for days and weeks, but is the selling over? Lets review the markets and some stocks.

.

The SPX put in a large reversal candle too, after breaking below the August lows. 1730 is a normal downside target, but I think we rally first. It should be easy to get a swing low. A move above yesterdays highs begins the process.

What do I expect from this move higher after it starts?

Read more

Yes, Gold has a bullish looking set up, and miners not only sold off, but they broke to new lows. We will discuss that, but first lets take a look at the rest of the markets.

.

NASDAQ – The futures are up over 100 to 200 points each morning, but the rally fades. What to do?

Here is the SPX …

Read more

As expected, we have seen quite the sell off in the general markets. Oil & Commodities have been selling off too. Gold , Silver , And Precious metals are holding up, but are they ready to run now, or will they sell off? I actually spent a part of this weekend digging in to older charts and making some new ones, so lets take a look.

.

While digging into older charts, I actually found this warning chart that I posted in April of 2015, when I said I thought we were seeing that rising wedge forming. Also by counting the months of the Bull market, we looked to be late in the bull. I am re-posting it because it had a logical target to me at that time.

SPY – We topped in May 1 month later. Now drop to Test the break out?

SPX – We broke the Aug lows Friday and recovered. This is a failure, but we can get a solid bounce soon. Lets discuss a couple of possible scenarios . One is a flash crash right now, the other is a believable rally that rolls over eventually.

SPX – We broke the Aug lows Friday and recovered. This is a failure, but we can get a solid bounce soon. Lets discuss a couple of possible scenarios . One is a flash crash right now, the other is a believable rally that rolls over eventually.

Read more

Scroll to top

SPX – We broke the Aug lows Friday and recovered. This is a failure, but we can get a solid bounce soon. Lets discuss a couple of possible scenarios . One is a flash crash right now, the other is a believable rally that rolls over eventually.

SPX – We broke the Aug lows Friday and recovered. This is a failure, but we can get a solid bounce soon. Lets discuss a couple of possible scenarios . One is a flash crash right now, the other is a believable rally that rolls over eventually.