June 2- Patiently Waiting

/50 Comments/in Premium /by Alex - Chart FreakMany readers here like to trade daily, attempting to scalp some short term gains or trying to grab a small run. Others may be patiently waiting in cash for a longer term run, like we saw in Miners from Mid January through April? Like the Bear in the theme picture patiently waiting for a salmon run, they soon should be rewarded. After a market review, let's discuss what is involved in that waiting period.

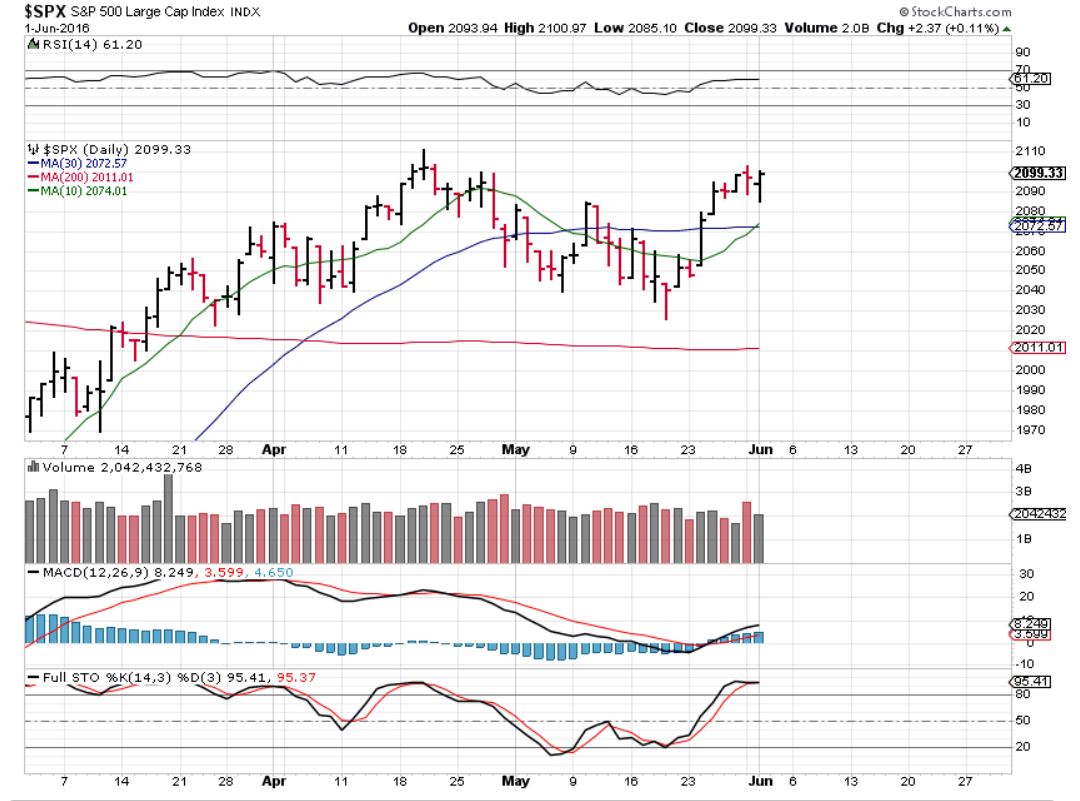

,SPX- We still see our bullish set up and even got a reversal Wednesday after an early sell off.

Read More

Read MoreTechnical Difficulties

/54 Comments/in Premium /by Alex - Chart FreakTo start with, I know many followed me on this trade, since it was pointed out a few times as low risk above the 200sma and very oversold. You should not have been stopped out with price holding the 200sma, as part of the trading plan.

.CLF - May 23 - Low risk entry above the 200sma, stop loosely below the 200sma.

May 25- A trend line was also acting as support and the MACD was correcting itself.

CLF May 31 - Sweet, up 40% more today.

Read More

Read MoreTrust Issues

/80 Comments/in Premium /by Alex - Chart FreakLet's get right into the weekend report, and I will discuss all of the sectors and why I chose trust issues as a theme.

.SPX- Last weekend I had been discussing the expected rally and the potential that it has to be strong since price is near the highs, but the signals that I was getting was saying that it was near term lows ( DCL). Since the markets did form a pattern known as H&S, I used this as one of my charts showing that we were at lows, not highs on a weekly. Would we have a strong week?

May 19 - I saw the H&S too, but I had trust issues with it playing out, because many other factors were calling for a rally.

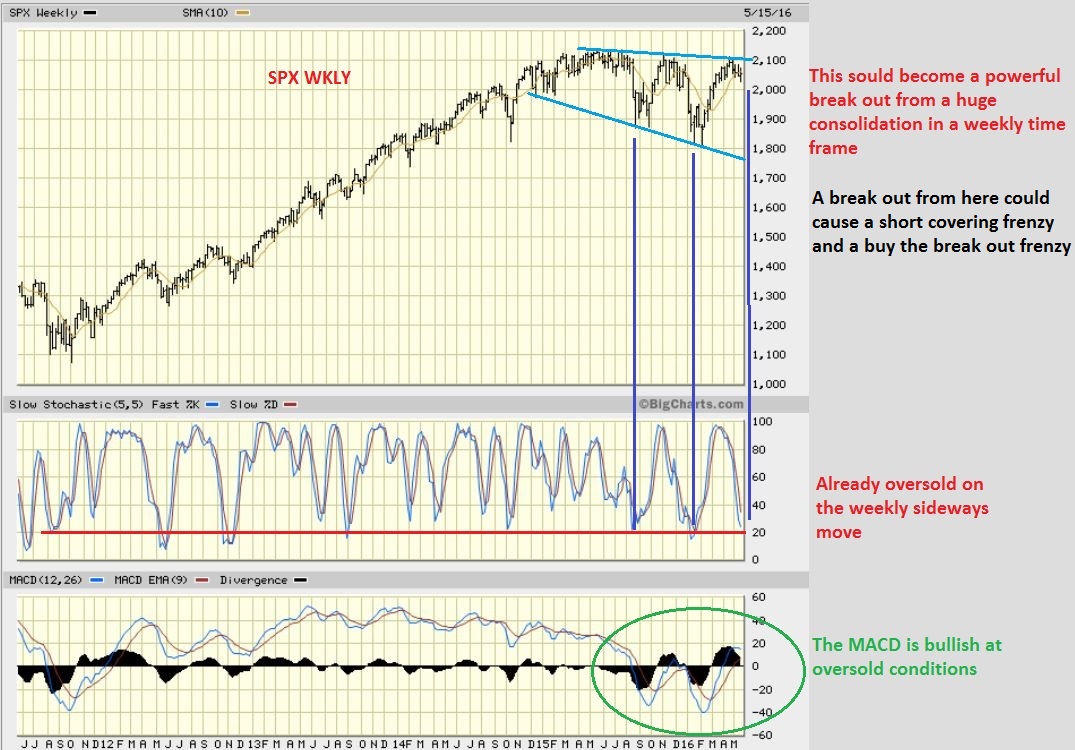

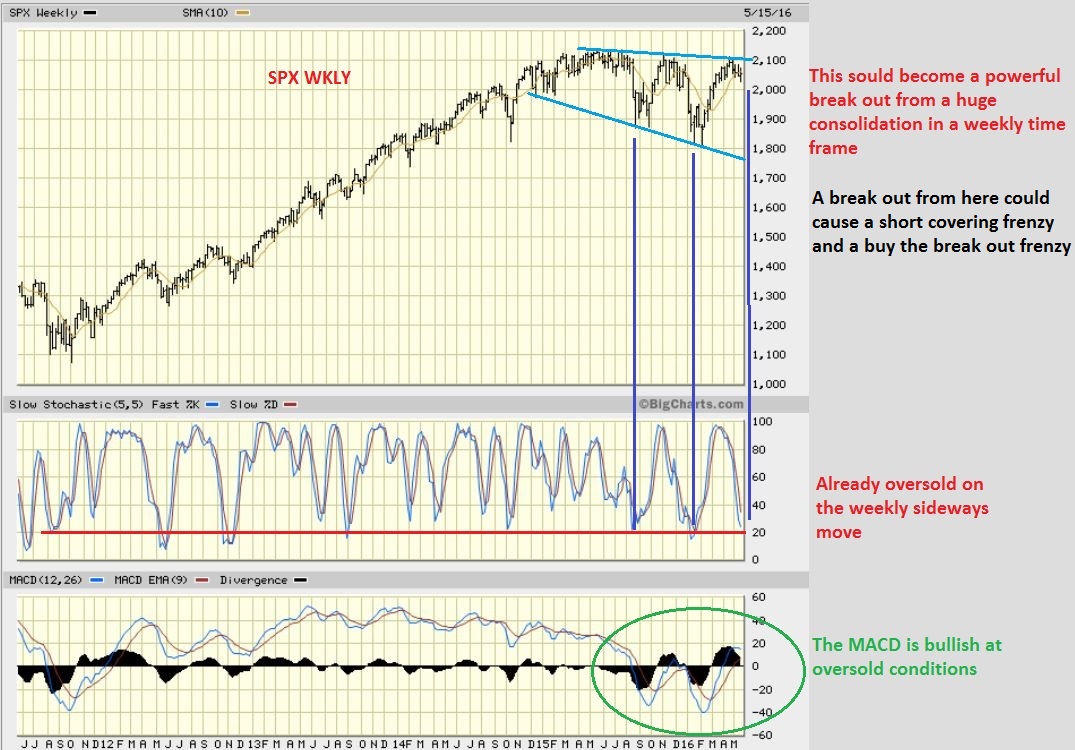

SPX WKLY - That was a strong break higher and the SPX is actually heading to the May 2015 all time highs. If it breaks out from there? I have prepared charts for that time already 🙂 It could get very bullish , apparently climbing a wall of worry, because all I hear is negative talk.

Read More

Read MoreMay 27th – 3 Day Weekend In The U.S.

/59 Comments/in Premium /by Alex - Chart FreakNot much has changed from Thursdays report. Janet Yellen speaks today and she possibly could shake things up with some dovish or hawkish talk, so we'll see how that goes. And then all then traders in the U.S. will have a 3 day weekend to think about it.

.

If you are heavily invested and you'd rather not think about it on your weekend off, you may want to lighten up.

Read MoreFrom Break Through To Follow Through

/61 Comments/in Premium /by Alex - Chart FreakYesterdays report discussed some break outs that were taking place in various sectors. Wednesday, we saw some follow through in those areas too. Just like a baseball player at the plate, when we get a decent pitch tossed our way, we also need to follow through to be able to possibly score. Some may wait for a pullback or start a small position and add on a pullback later, since it is early in some set ups. Lets review.

.SPX - This is the follow through that we expected. We are only on Day 5 today, of a daily cycle that can last over 30 days.

Read More

Read MoreBreak Through

/70 Comments/in Premium /by Alex - Chart FreakTuesday was a Break Through in a several ways. Let's take a look.

.SPX - From the weekend report. For many reasons, we were waiting for a break out higher ( not lower like many other analysts).

SPX Tuesday- We see a Break through. This is Bullish. Today is only day 3 of the 2nd daily cycle, following a R.T. Daily cycle. That means that we could really see this move higher over time. Picture this : Many were shorting what appeared to be a H&S, and they may now start covering and cause a buying reaction.

And the NASDAQ?

Read MoreSetting Up

/99 Comments/in Premium /by Alex - Chart FreakWe didn't really see a whole lot of change on Monday, but as mentioned in the weekend report, some areas could be setting up. Some setting up for a run higher, others setting up for a fall. To the charts...

.SPX - No follow through yet, but I am expecting higher prices soon.

Read More

Read MoreWeekend Report – Bull Cycles

/68 Comments/in Premium /by Alex - Chart FreakIn this weekend report, I want to review the markets as usual and discuss where they are at. Things look very interesting in many ways. I also wanted to discuss a few things about my personal view of trading around cycles. In my analysis, many are aware that I incorporate a variety of helpful techniques. I Mainly use various forms of Technical analysis, and along with that I add Cycles, Sentiment, a little Elliot Wave and so on. In this weekend report, I want to also briefly discuss a few things regarding Cycles and some of the trading that goes on around them. To the charts...

.SPX - As mentioned in a prior report, for the amount of time that the SPX has rallied out of lows and moved to oversold, it has had a mild pullback. Not even a 38.2% retrace yet.

Read More

Read MoreMay 20 – Friday

/68 Comments/in Premium /by Alex - Chart FreakLets do a market review and then I'll discuss what will be in the weekend report.

.SPX - We've been looking at what looks like a H&S. EVERYONE is looking at it and the group think is seldom correct, so I have to wonder if it'll play out. The reversal could be a DCL and may be setting up for a rally back to 2100.

Read More

Read MoreContact Us

26 Broadway,

8th Floor

New York, NY 10004

admin@bigleaguefinance.com

admin@bigleaguefinance.com

Latest Blog Posts

accelerator diet pills goji berry diet pills ultra 90 diet pills keto meal replacement bar top weight loss diet pills for thyroid patients where to buy t lite diet pills keto friendly thickener diet fuel diet pills peanuts keto friendly rite aid diet pills that work envy diet pills diet pills for breastfeeding moms belique diet pills perfect slim weight loss pills calories in a bottle of white wine