11-30 Lining Up

/217 Comments/in Premium /by Alex - Chart FreakIt seems that many things within the market structure are lining up again. Let's take a look...

.SPX - We did get our initial burst higher out of the anticipated lows as shown on the 2 charts below.

.This was Oct 31 - Anticipating the trade-able low

SPX now - We got the lows and the initial run higher, but will it continue? Notice how the 13 SMA affected the first run. The 2nd run tagged it and then crawled sideways for weeks. No good trade resulted Long or Short for months last summer, and that may happen again. It can still be bought or held above that 13 sma.

Read More

Read MoreNov 28th – What’s Next?

/217 Comments/in Premium /by Alex - Chart FreakWhen you look at the flowers in the above picture, you cannot really tell what the future will hold at this point. It is hopeful as we begin to see growth, but the surrounding conditions are difficult. Will it remain too dry for growth or will some refreshing rains begin to nurture it? And even if all of the conditions exist for solid growth, will it avoid being trampled on?

What does this have to do with the Precious Metals market? We'll compare this flowers future with the dry conditions that we've seen in that sector lately and discuss future prospects.

Read MoreNov 26th Weekend Report

/119 Comments/in Premium /by Alex - Chart FreakThere are many things to keep an eye on going forward, lets take a look.

Read MoreFRIDAY NOV 24th – REVIEW

/66 Comments/in Premium /by Alex - Chart FreakThis is a Friday update on the Precious Metals Sector

Read MoreIs It Really Moving?

/249 Comments/in Premium /by Alex - Chart FreakSometimes things are moving so slowly that you can't believe that they are even moving at all. Well, We've seen this in the Precious Metals Sector over the past few days, but with the release of the Fed Minutes Wednesday, that just might change.

Read MoreA Balanced View

/118 Comments/in Premium /by Alex - Chart FreakIt's a holiday week in the U.S., and Monday didn't bring much in the way of change since the weekend report. On Wednesday we do have the release of the Fed Minutes however, and that may be the catalyst that we are looking for in one area. 🙂 To the charts...

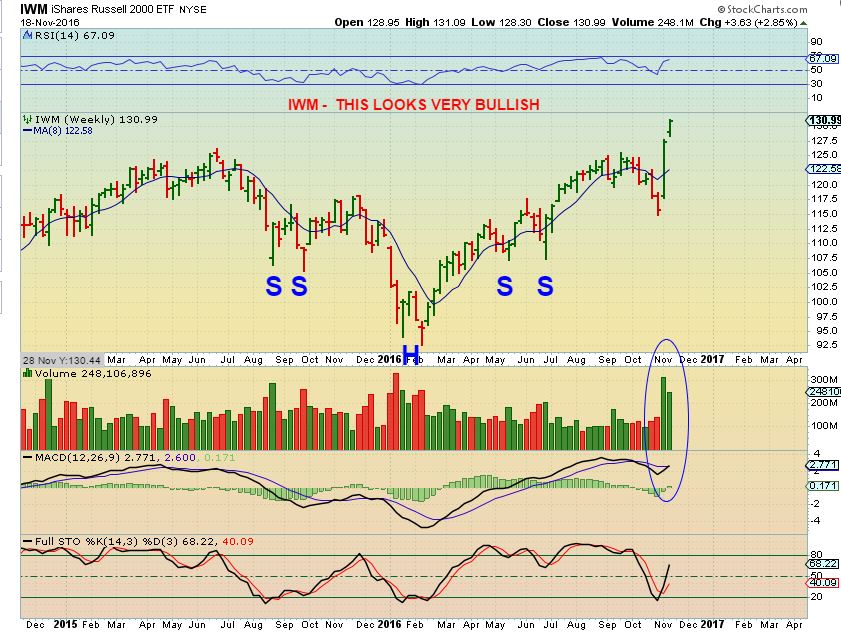

.SPX - The S&P broke to new highs. I was thinking that it will take a rest, but have you seen the IWM? It looked similar to the S&P now, but it is just continuing higher each day. We may pull back soon, but it is also possible that light holiday trading may just keep it floating higher ( See the IWM). If that happens, it may be on the following week that we see a consolidation or a pullback.

Read More

Read MoreLeaving Bias At The Door

/53 Comments/in Premium /by Alex - Chart FreakWhenever we are examining the markets, we really need to try to leave any 'Bias' that we may have aside to see things clearly. That doesn't mean you have to just accept how things look at a glance, however. Dig in, do research, and find the underlying factors that are there. I have done very well investing in a way that is contrary to what others are seeing and posting, so while being objective and leaving bias at the door, let me show you some of the things that I am looking at this weekend.

.SPX - The SPX is attempting to make a break out to new highs, as the DJIA has. We do see a rising wedge forming, and this usually ends with a pullback. Notice the red arrows and the stochastics on this chart. We should pull back soon.

SPX WKLY - A bullish burst from the lows, with great volume as expected. This was a move from an ICL.

IWM - New highs here too. So far a very good trade out of the ICL.

Read More

Read MoreLeap Of Faith

/120 Comments/in Premium /by Alex - Chart FreakJust a short report for Friday, where we're discussing a leap of faith 🙂

Read MoreContact Us

26 Broadway,

8th Floor

New York, NY 10004

admin@bigleaguefinance.com

admin@bigleaguefinance.com

Latest Blog Posts

accelerator diet pills goji berry diet pills ultra 90 diet pills keto meal replacement bar top weight loss diet pills for thyroid patients where to buy t lite diet pills keto friendly thickener diet fuel diet pills peanuts keto friendly rite aid diet pills that work envy diet pills diet pills for breastfeeding moms belique diet pills perfect slim weight loss pills calories in a bottle of white wine