You are here: Home1 / Premium

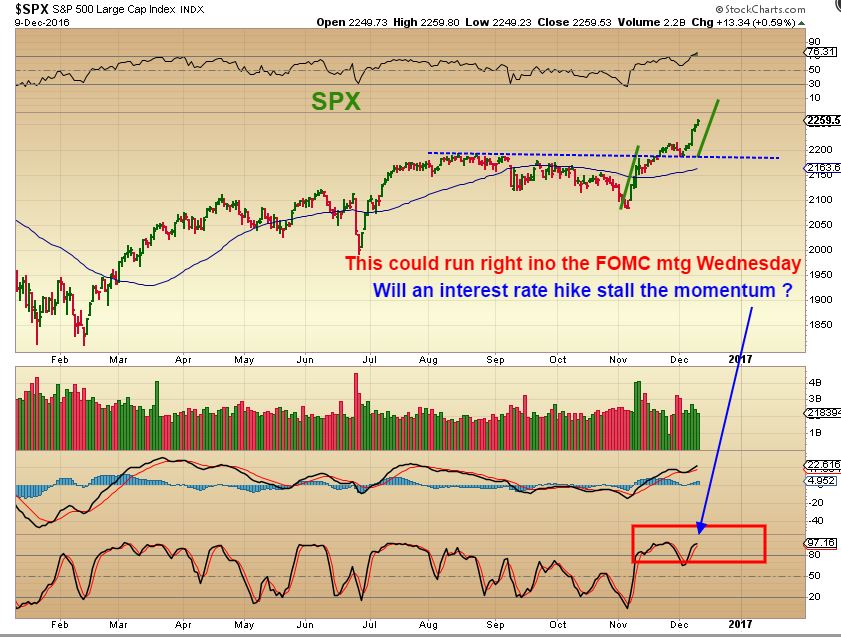

Many sectors began to sell off with the interest rate hike Wednesday. Some were sectors we expected to sell off, others were expected to snap back. Will we get the snap back on Thursday and Friday? Let's discuss what we should be looking for.

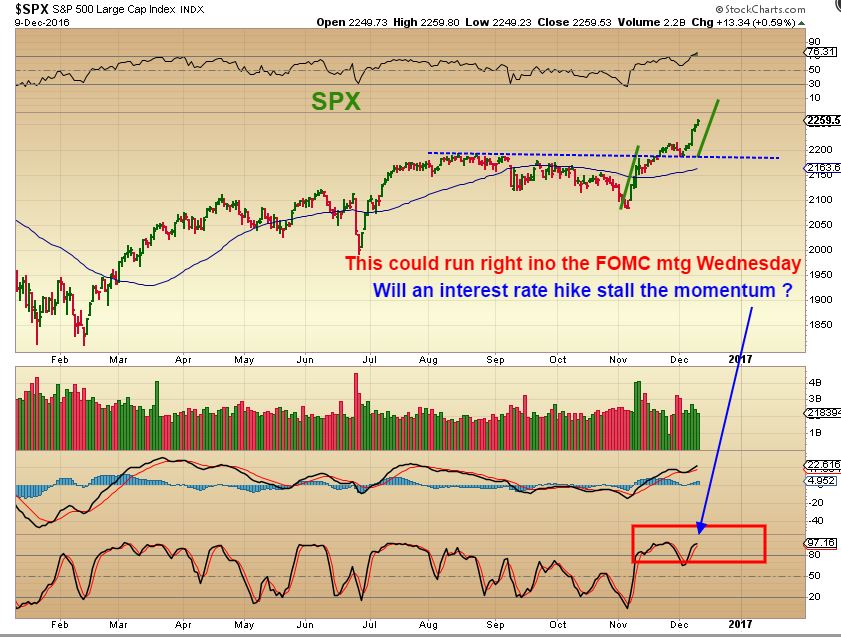

SPX - From Monday, the markets were outside the B.B. on a weekly basis, so I would have expected a dip by the end of the week.

Read More

Read More I've been wanting to answer a frequently asked question and that question is,

" What will happen when the Fed raises interest rates?" Let's take a look at what has happened in the past, and then maybe we have some historical precedence to go by.

Read More We are one day away from the FOMC meeting that is expected to result in the first rate hike of 2016. After a quick review of the markets, we'll discuss some action in the markets Monday that may be of interest to many of us.

Read MoreThe general markets are flying high, but the Precious Metals are still flying low. Let's take a look at last weeks market action.

.

SPX - Please read the chart

Read More

Read MoreMy weekend report covers Monday and I usually post full reports for Tuesday, Wednesday, and Thursday morning. Most of the readers at Chartfreak know that when I started this service, I thought that whatever I wrote in Thursdays report would also be able to cover Friday, the final day of the trading week. The readers here also know that in 2016, I got into the habit of posting a Friday report anyway. Today is Friday, so let's just look at Stock picks!

.

NAK has been on my "must have' list for much of 2016. The chart set up, that long Base, those Volume surges. I also loved the story about their reserves and their future possibilities. I loved it and was loading up when it was 30-40cents.

NAK - After an initial strong run higher, we got a normal correction. In October I was trying again to get people to add to this set up. I have 20 charts of NAK from 2016 reports, encouraging low risk buys all along.I expected a possible 1-2-3-4-5 wave move higher.

NAK Dec 8th. - The first 1-2-3-4-5 was a run from 50 cents to $1. This could be a larger 1-2-3-4-5 playing out. NAK is up around 600% so far - Congrats to all who caught some of this strong move. I'm only selling a partial, and will add on future dips.

Lets look at some current set ups!

.

Read MoreAfter we review the progress of the general markets, we will then try to determine if we are seeing any real progress taking place in the Precious Metals sector. Are things improving or is that sector still just drifting around?

.

SPX - My thinking was that we would get a Dip in the SPX ( to the 13 sma?) after the break out. We got our dip, and it was very similar to prior pull backs out of an ICL, so Wednesday I wrote that the dip may be over and we would watch the upside from here. Longs could even raise stops to a little below the 50sma.

SPX - Well that was some strong upside Wednesday. Maybe people were shorting the dip thinking the markets would roll over, and this was partly short covering?

Well, take a look at this...

Read MoreToday after review of the General Markets, $USD, and Oil, we will discuss the slow motion giddyup that we are seeing in the Precious Metals market.

.

SPX - November 29th I was expecting a small dip in the SPX, and I pointed out this possibility. It showed a drop t about the 13 sma.

SPX - That dip came and it may be over already. Now if someone was 'long' they can watch and see how this unfolds. In the spring time the markets ran straight up. bouncing off of that 13 sma for a while. When moving out of the July lows, the SPX ran higher and then went sideways for months.

Read More

Read MoreIn recent reports I've been pointing out various Miners that have been setting up in bullish manner. On Monday we watched Gold fall to new lows again, but then Gold flipped higher and put in a nice reversal. Maybe now we will see the precious Metals sector gain a little traction? Let's take a look at the markets, and then we'll review some more bullish looking Miners.

.

SPX - The dip that we saw may have finished its course at the 13 sma. We did see that in past moves out of the ICL.

Read More

Read MoreThis week has been another active week in the markets, lets see if all is good, shall we?

.

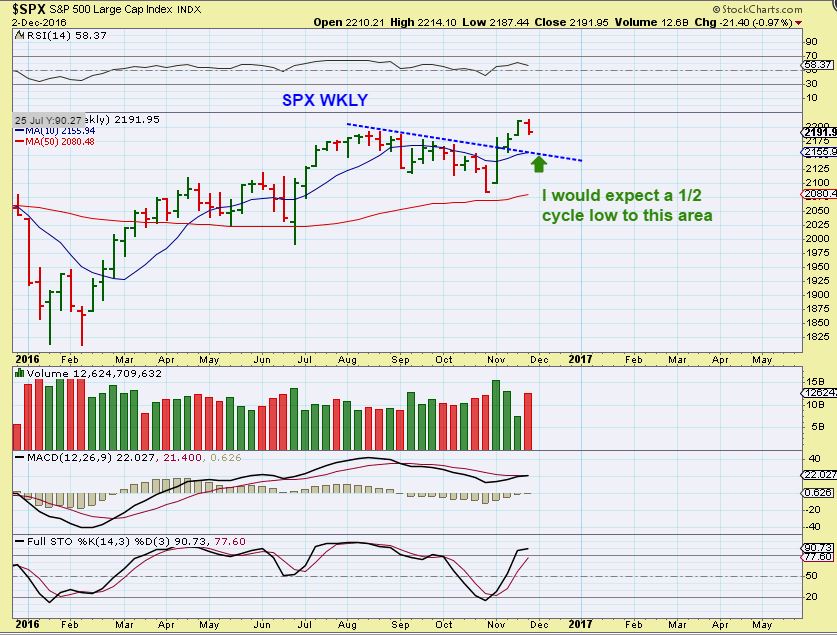

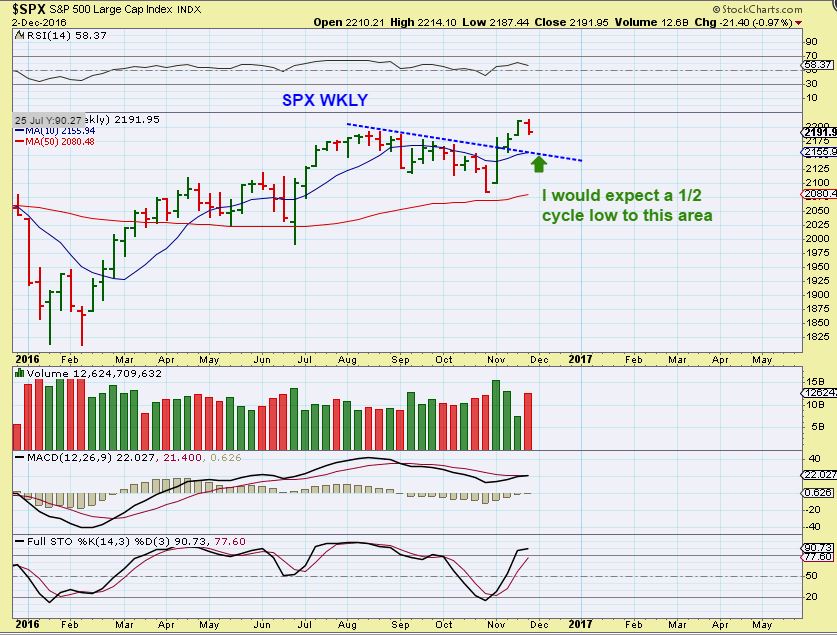

SPX DEC 1st - Expecting a dip to a 1/2 cycle low, this bearish rising wedge was pointed out and is now playing out. Could it drop to 2160?

SPX WKLY - I think that it could.

Here is something to keep an eye on that looks a tad more bearish than the S&P ...

Read MoreI have what I would consider to be some good news! The only problem is, the good news may also be a little bad news.

Let's take a look...

Read More

Scroll to top

Read More

Read More