You are here: Home1 / Premium

The weekend is upon us, let's review what the last week brought our way and what we should expect going forward.

The NASDAQ continues to climb upward and it is hard to tell if this is forming a wedge or is it rallying into a blow off top? I want to look at the SPX and discuss a thing or two there .

SPX - I had drawn this wedge inside of a long term channel for last weekends report. I said that the markets do have the potetnial to keep climbing, but eventually they would reach the top at what looks like $2400 ish. Here it was at 2280.85.

Read More

Read MoreFriday is the last day of the week, and I usually just do a brief report with a few bullish chart set ups. On Thursday, we did see a variety of action however, so Fridays report will be a bit longer than normal. Keep in mind that I usually cover things with a bit more detail in the weekend report.

.

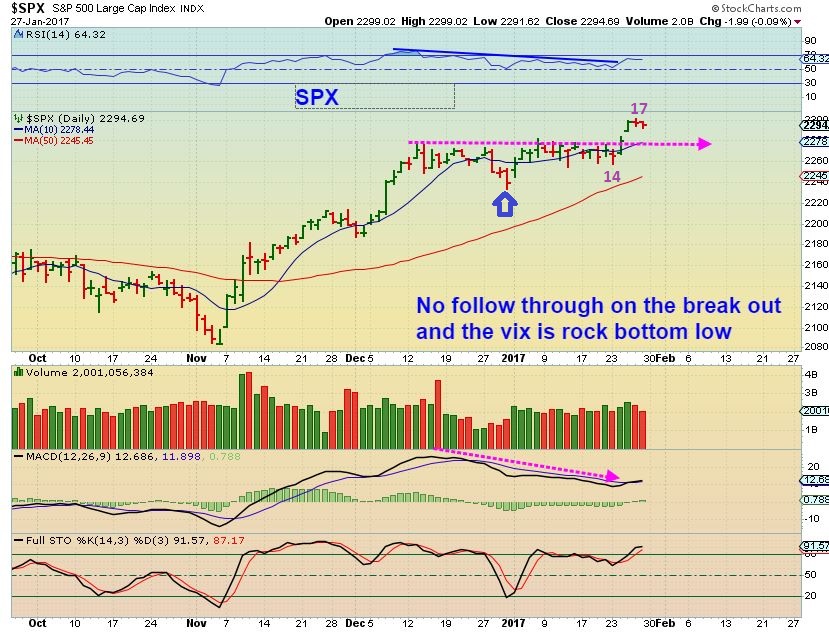

SPX - Many think that the market is breaking out and going to rally a lot higher. I do not think that for reasons mentioned in prior reports, including the VIX situation.

Last weekends chart

Read More

Read MoreTime has certainly been on our side and our trades have been making gains for several weeks now. That said, Nothing lasts forever, so as we move forward we do begin to think about where we are in the stream of time. We are basically racing against time, but I am not concerned yet. I will discuss this briefly now and a bit more in the weekend report. Lets review the markets.

.

Read MoreI find that I'm still not making any changes to my thinking since the weekend report. Let's review the markets.

.

SPX - I'm watching the green trend line, and that will let me know when the general markets are ready to drop into a dcl. Even though we do have a break out, the SPX has basically moved sideways since early December.

SPX WKLY from my weekend report. I'm not expecting a strong continuation higher before we roll over.

Read More

Read MoreLook at a chart of SPX, DJIA, or even OIL and nothing has changed from the weekend report, so we are going to go right to the Precious Metals sector for a review of Mondays action.

.

Notice that the USD was moving higher for most of the day on Monday, but that didn't hinder the gradual melt up that took place all day long in Precious Metals, right into the close.

Read More

Read MoreThis weekend we are going to just keep it simple. We are in the middle of what has turned out to be some very good trades, and they have been acting correctly for weeks now. Why get too complicated when we are seeing things remain right on track as we go forward. To the chart!

.

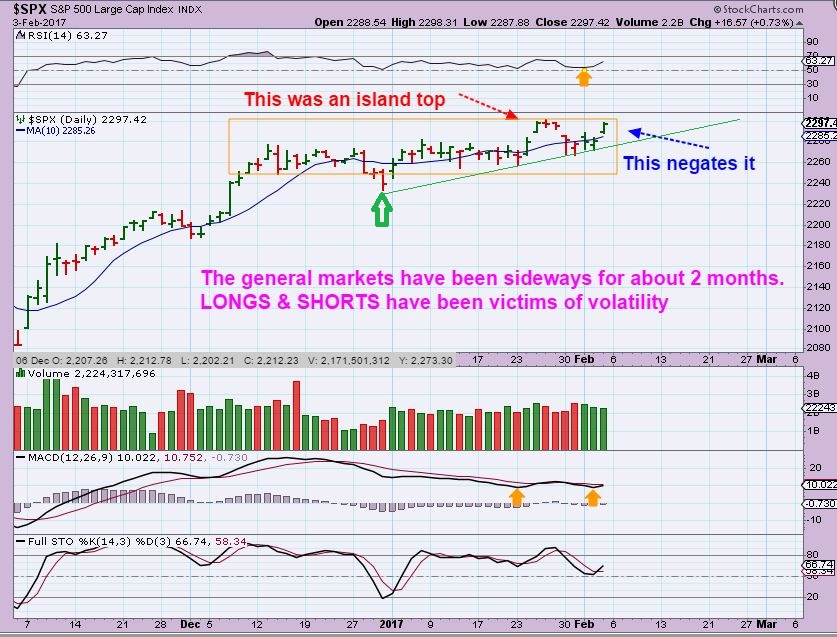

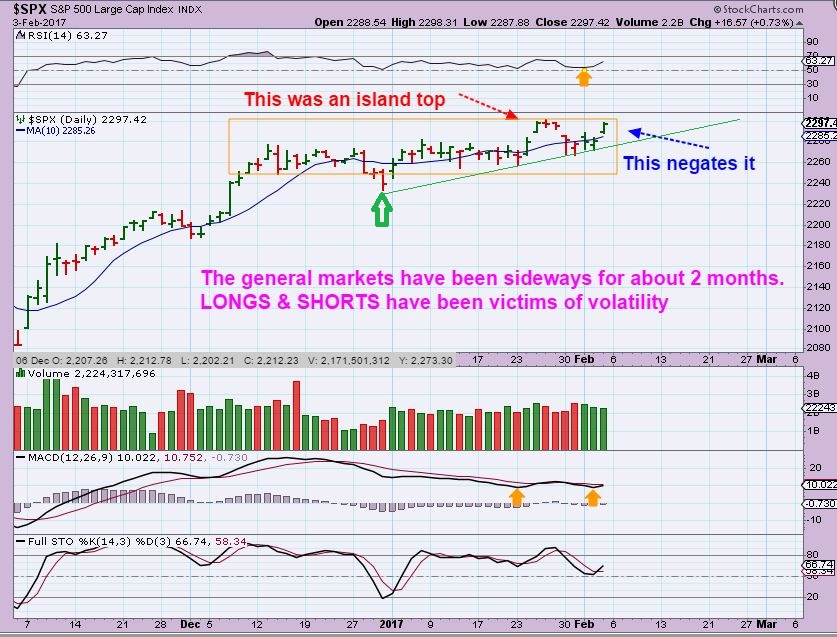

SPX - Personally I have not taken a trade in the general markets by means of ETFs. Individual stocks have done well, but the volatility in this sideways consolidation has schooled both the Long & shorts.

1. We had a break out (bullish) , but the VIX was down near 10 ( Bearish)

2. We had a failed break out when it gapped down, and an ISLAND TOP formed ( bearish).

3. That was negated Friday when the gap closed, and this looks bullish again. The green trend line is key going forward.

We were watching the VIX , which was indicating that the markets would likely pull back in February sometime ( I mentioned that the VIX is not a short term timing tool, I use it as a cautionary measure). Now let's look at the weekly charts.

Read MoreWe have a mixed bag in the markets, so let's get right to the charts.

.

SPX - Do you see what I see Gilligan? The markets have been all over the place along with the vix since 2017 began. It looks weak. This is an ISLAND TOP actually, a bearish top if price doesn't close that gap soon.

Read More

Read MoreWell, That went pretty Well, didn't it? 🙂

.

Read MoreThere were a lot of interesting moves in the markets Tuesday. Today is Fed Wednesday, so we shall soon find out which ones may have been fake moves and which ones may be real. Let's take a look at a few of these moves...

Read More

Scroll to top

Read More

Read More