You are here: Home1 / Premium

https://chartfreak.com/wp-content/uploads/sites/18/2017/05/Subconscious.jpg

590

887

Alex - Chart Freak

https://www.chartfreak.com/wp-content/uploads/sites/18/2019/11/Chart-Freak-site-logo.png

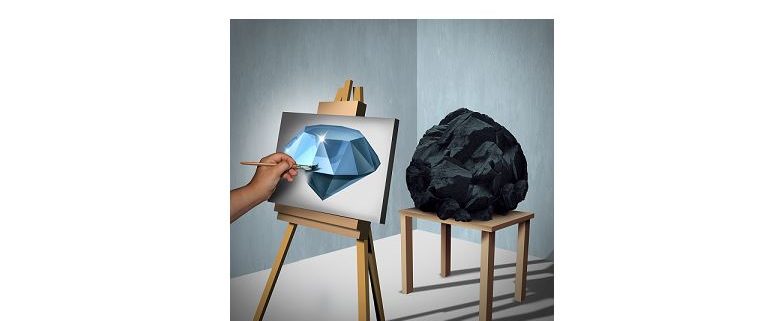

Alex - Chart Freak2017-05-21 17:22:252017-05-21 17:22:25WEEKEND REPORT – SubconsciousIt is the final trading day of the week, so let's review the market action...

SPX - The SPX backtested the break out trend line and bounced after filling a gap. Please read the chart.

Some may think that this is the dcl, and the "buy the dip'" team has rescued it again. That might be true, however...

Read MoreThis mornings futures show the markets down a bit, but they have been holding up well lately, especially the Tech area. Let's do a little pre-market review...

.

SPX chart from Yesterdays report. We are still due for a dcl, but the pullbacks have been shallow.

I like to use the NYA too, and this is a bullish set up / consolidation so far. If it continues to hold the 50sma, it remains bullish looking .

We also have been keeping an eye this...

Read More

SPX - They just dont sell it off for long anymore, do they? New highs.

Read More

Read More That sunset sure is a beauty, and this chart below is also a beauty to many of us that went long...

Read More

NASDAQ - The NASDAQ continues to climb that wall of worry. If you were long, a trailing stop may work out well, this is now another right translated daily cycle in a Bull Market. As shown in recent reports, Some stocks are doing well with earnings, and others are getting crushed. Add NVDA & TSEM to the 'doing well' group. Yelp & SNAP to the getting slapped group.

This is a reminder - This was my My February thought showing a possible parabolic blow off top . The pattern is similar with a sharp sell off and then a ramp higher.

Read More

Read More

Todays report will be short and sweet, there is no need to cover 'everything' after the weekend report, but it does still include over 20 charts to cover a number of ideas, some new and others that we have discussed in prior reports.

Read More

Scroll to top