November 15th – Weekend Review

/27 Comments/in Premium /by Alex - Chart FreakLet's do a market review of the various market sectors and we'll see that things seem to still be playing out as expected.

Read MoreNov 24th – The Blockchain Explosion!

/62 Comments/in Premium /by Alex - Chart FreakWhile waiting patiently for the Gold market to set up properly, we have been trading other areas, and one of those areas recently has been the Blockchain trades. I mentioned that I had been trading these on the side, watching how they play out, seeing if they act as expected, before including them in the reports. Well, they are quite volatile, but I was having success trading them, so I came to the conclusion that they were trade-able and that maybe I should put them in the reports with a small warning about risk last week.

I'm not sure who decided to take these trades with me, and who watched from the sidelines, but I want to review some of these explosive moves (and gains) and point out a couple more set ups that may be ready to follow the leaders.

RIOT - This chart showed a consolidation that I had been trading with BIG SWINGS. After a series of lower lows, we see a higher low Nov 13 and it looked ready to break out, so I Used this chart as a buy and...

RIOT - This chart to show the bigger picture potential. I named a couple of upside targets that sounded kind of ridiculous, like $14 & $16, even in the $20's.

RIOT - I sold 1/4 of my position at $16 & posted that in the comments section. Then it after hrs, it continued to ramp up and was at $18.35, so I placed a sell for 1/4 at $18.30 & it sold immediately. I mentioned this in the comments too, so that others could follow if they wish.

GLNNF - GLNNF, RIOT, and PRELF were the main ones that I traded as an experiment. GLNNF has been very quick mover too, but they are also getting very exuberant and parabolic when they take off ( Bit coin is breaking new highs too). I sold this one a bit early every time, but with solid double digit gains. I mentioned this one near $1.20 I believe, and I sold it at $1.80 ( Red Arrow = early again) 🙂

So let's take a look at some other trade ideas in this sector...

Read MoreNov 22- Markets Are Stepping Up

/161 Comments/in Premium /by Alex - Chart FreakOn this holiday week of trading in the U.S., the markets often have a bullish bias, as traders leave early and travel to be with family. At this point, the Markets do seem to just be continuing higher...

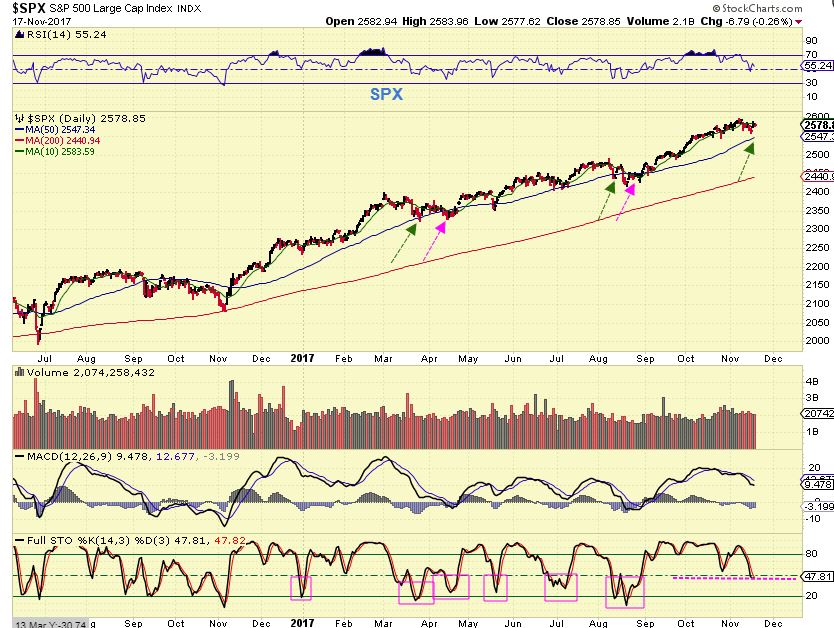

SPX - I would say that this is day 4 of the new daily cycle. Do not stand in the way of this  . Each consolidation leads to another leg higher. It remains a 'buy the dips' market.

. Each consolidation leads to another leg higher. It remains a 'buy the dips' market.

Read More

Read MoreTuesday – Sharp Turns

/87 Comments/in Premium /by Alex - Chart FreakIn the U.S., Thursday is a Holiday and the markets will be closed, followed by a 1/2 day of trading on Friday. Usually many are traveling to be with family on Wednesday afternoon, so the markets volume & trading lightens up on Wednesday. That said, it is a bit hard to know exactly what to expect going forward, especially after Tuesdays trading. For now, lets take a look at Mondays trading, and review a couple of the 'Changes' that we discussed in the weekend report.

Read MoreWeekend Report – Changes

/112 Comments/in Premium /by Alex - Chart FreakIt comes as no surprise that markets can evolve and change over time, so when a change appears, it is best to listen. It may or may not amount to anything in the long run, but we take note of any changes anyway. That said, I have seen 'changes' in the markets this week in a couple of areas, so we will listen, discuss, and prepare. As I mentioned, they may not amount to anything permanent, but we still need to listen and prepare, so let's discuss some changes in the weekend report.

SPX - No change here, but I wanted to point out that in the past, the SPX did visit the 50sma a couple of times before moving higher. These were areas of ICLs that did not sell off as deeply as the ones in the past (see JULY & NOV 2016). So, will the markets just continue higher, or are we coming due for one soon?...

Read More

Read MoreFriday November 17- A Lot Going On

/129 Comments/in Premium /by Alex - Chart FreakToday is Friday and it is the last trading day of the week, so let's take a look at the markets and then discuss a couple more trade set up ideas.

Read MoreThursday November 16th

/36 Comments/in Premium /by Alex - Chart FreakSPX - The drop continues as the SPX is seeking out the next DCL. The trend line is broken and the 10sma has been lost. I actually thought that the 25th could have been a dcl, with the trend line break and close below the 10sma, so now I am simply watching for a swing low first, and then a close above the 10sma. Either I drew the trend line wrong and the 25th was not a dcl, or this is a very L.T. daily cycle on day 15. The divergence that I was pointing out over a week ago is playing out, so our 'caution' was warranted.

ALSO ...

Read MoreNov 15 – Winds Of Change?

/96 Comments/in Premium /by Alex - Chart FreakI would say that we were seeing a normal correction in Oil on Tuesday, and we are heading into the Oil Inventory reports Wednesday, so nothing really changed there. So why did the Theme become "Winds Of Change?" It is because OIL stocks started to pick up in their selling, The Euro situation changed, Biotech broke down further, and a couple of other minor changes also became evident. I wanted to discuss these areas a bit more and the changes that I noticed...

SPX - Each sell off lately is still being scooped back up, but I'm still seeing the divergence that I pointed out a week or so ago as Price went higher. The RSI & MACD are still drifting lower. There is still room to drop on the stochastics, so this time price may want to also drop to the 50sma, or even continue sideways to that 50sma. Why? ...

The TRAN, RUT, BKX, etc., broke below their 50sma. Let's take a look.

Read MoreNov 14 – Something Precious On The Horizon

/135 Comments/in Premium /by Alex - Chart FreakYeah, that little guy on the left is rather precious to it's dad there, but I'm talking about Precious Metals here. Let's discuss what I mentioned in the weekend report about the coming sell off that I expect in Gold, Silver, and Miners, and discuss what we might see ...

I started with these 2 charts, one of GOLD

And the other of GDX

But I also included this chart and it raised questions in the minds of some of our readers, so let me discuss this a bit further...

Read MoreContact Us

26 Broadway,

8th Floor

New York, NY 10004

admin@bigleaguefinance.com

admin@bigleaguefinance.com

Latest Blog Posts

accelerator diet pills goji berry diet pills ultra 90 diet pills keto meal replacement bar top weight loss diet pills for thyroid patients where to buy t lite diet pills keto friendly thickener diet fuel diet pills peanuts keto friendly rite aid diet pills that work envy diet pills diet pills for breastfeeding moms belique diet pills perfect slim weight loss pills calories in a bottle of white wine