You are here: Home1 / Premium

What happened Mondayand what to expect Tuesday...

.

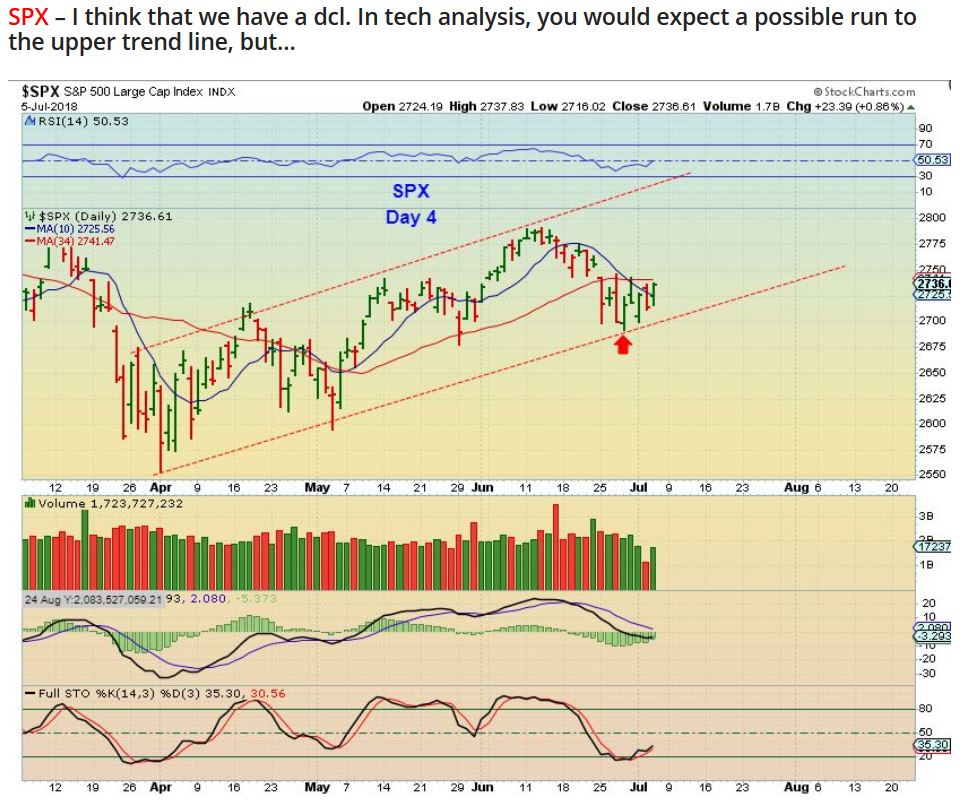

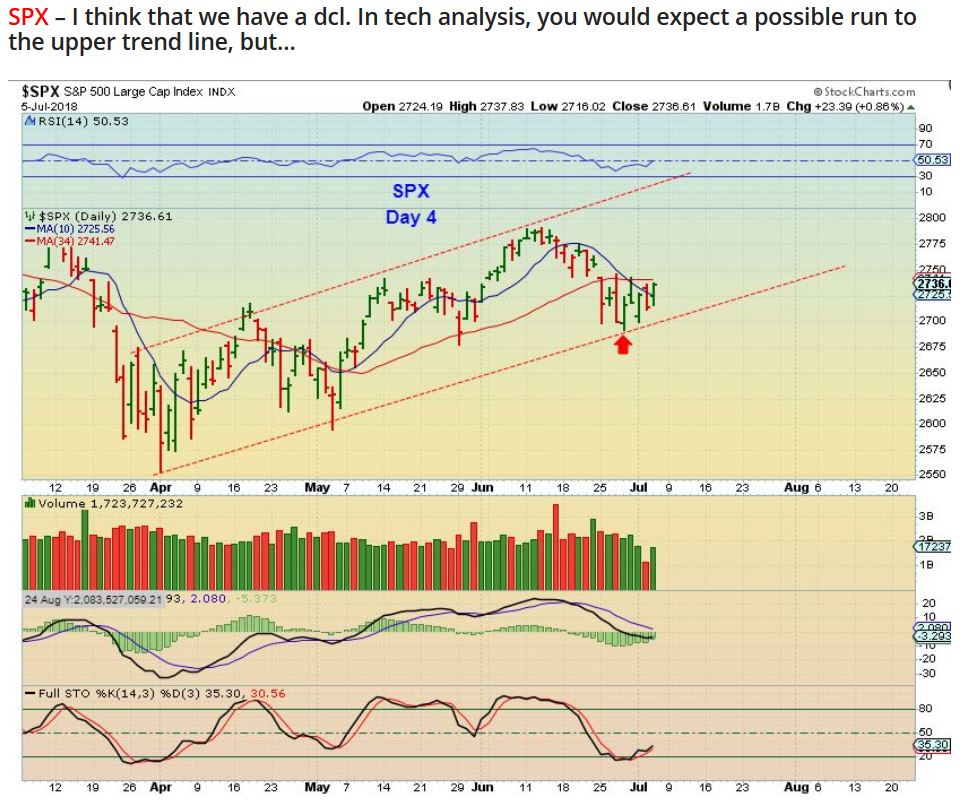

SPX - July 5th we seemed to have our dcl in place, day 4. I mentioned that it could be L.T., but a daily cycle could peak at day 15 and still be L.T., so ride it with a stop.

SPX - And it is heading for the upper trend line.

Read More

Read MoreI know by now you know how I feel about the Precious Metals Sector, but maybe the Theme Pic will help to clear up any doubt at a glace. 🙂 We will discuss all of the Market Sectors, but the main focus is still on Precious Metals.

.

THIS IS A CHART OF THE SPX FROM FRIDAYS REPORT- The 'but' part was simply that I am expecting a L.T. daily cycle after a rally, so I keep that in the back of my mind...

SPX WEEKLY- And we have a weekly reversal that should have follow through higher too. The RSI held the 50% line too, so it is a bullish set up here at this point.

Read More

Read MoreIt is the final trading day of the week, so this report will just be a quick summary and will also include a few trade ideas

SPX - I think that we have a dcl. In tech analysis, you would expect a possible run to the upper trend line, but...

Read More

Read More

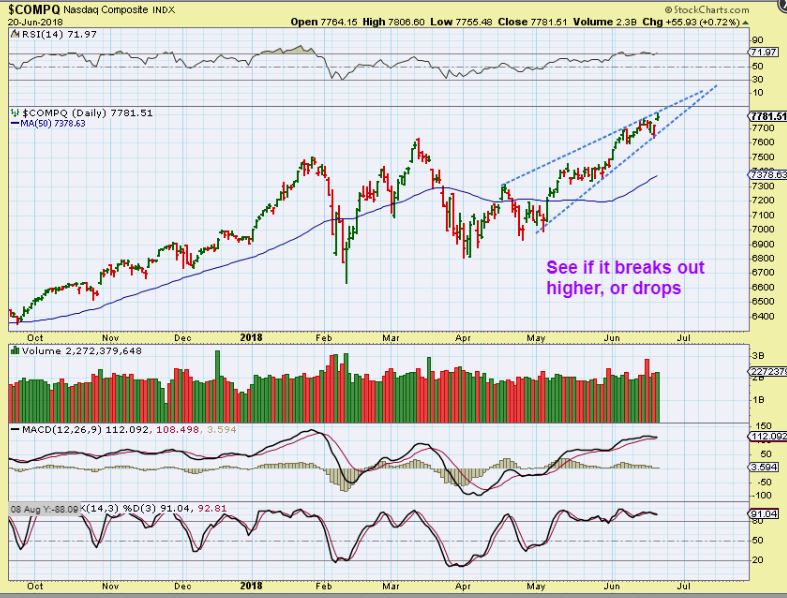

SPX - The General Markets gapped higher on Tuesday and the rolled over again. The 10sma is rejecting price, so we still do not have a confirmed DCL, but we are due for one and we do have a swing low unconfirmed.

Read More

Read More As I sat on the plane returning from my trip yesterday, I thought of the Chartfreak Readers while having a beverage & some Crackers 🙂 I noticed that Gold was selling off, but Miners seemed to be holding up fairly well, and I wondered if that would continue through out the rest of the day.

.

We'll discuss Precious Metals after a quick review of the markets and a friendly reminder that TODAYS TRADING CLOSES AT 1 P.M. IN THE U.S.

.

Read More I'm sorry, but my wife talked me into the picture above for the weekend report. I actually felt right at home on my visit to the Biltmore in Asheville North Carolina. Why? Well, they had Chartfreak Lions everywhere, and also Miners began breaking out Friday morning, easing any concerns that something ugly would happen in Gold while I was away. 🙂 Why did I like what I saw Friday, and what does that move in GDX & GDXJ mean ( if anything?). Let's discuss the market action from this past week and what I m expecting as a result. I also want to mention why I chose the LION as my logo when I started Chartfreak...

Read MoreThis is a snap shot of 'things' for Friday

Read MoreWith every passing day, we are 1 day closer to one of the best trade opportunities that the Precious Metals Markets offers, and they only occur twice a year. Let's discuss the various market sectors and then we'll look at Gold, Silver, and the Miners ...

Read More

Scroll to top

Read More

Read More