You are here: Home1 / Premium

Google

...had their earnings release and it Popped $50 to $80 after hrs

GOOGLE - This was GOOGLE ( Alphabet) at the close. Notice that it has formed a long choppy consolidation all year long. With the earnings release, a break out could happen Tuesday.

So I Caught the POP after hours on this chart. It is a 6% break out if it holds overnight, but tomorrow on your charts, it will be a GAP OPEN.

There are a few things that I wanted to point out with GOOGLES earnings and the affect on the NASDAQ...

Read MoreLets review the markets , and then I will discuss the purpose of the Theme Pic

SPX- I have been saying since the DCL that one should let their long positions ride, use stops that should be raised along the way, and I would assess things as we get to day 15...

Read More

Read MoreIt's the last day of the trading week, lets talk about...

Read More.

Looking for a swing low...

Read MoreTuesday was definitely a story of Pops and Drops. I have SO MUCH to talk about, so let's take a look...

SPX - From yesterday, we are early in the daily cycle, so I had drawn this chart up, with a run to the top of the trend line likely, before a dip into a dcl starts...

however, I also saw something else that looks important on Tuesday...

Read More

This is a chart that I put in my report last Tuesday. The Financials ( Banks) were set to start reporting earnings, and this actually looked pretty good. Take note of the POP last Monday to the 50sma.

Lets take a look at the financials this week...

Read More I'm sure that by now, you are ready too! Well, I have some good news on the 'Waiting for an ICL in Gold' part, but first let's cover all of the markets, including something very interesting that I noticed about The EEM. To The Charts!!

.

Read MoreToday is Friday the 13th, the last trading day of the week. No, I am not superstitious, and the things that we have been watching unfold seem to almost be complete. Let's take a look...

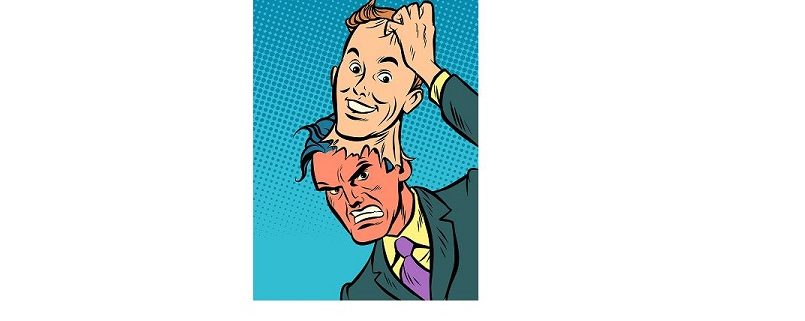

Read MoreThis report is going to discuss a few things about our 2 faced friends - The Miners 🙂

Read More Let's review some of yesterdays market action...

Read More

Scroll to top