Friday August 31 –

/in Premium /by Alex - Chart FreakSPX - The SPX broke out above the upper trend line, but dropped back down on Thursday. We see a gap & the 10sma below, these could be initial targets, so let's see how things play out.

Read More

Read MoreThursday August 30

/in Premium /by Alex - Chart FreakLet's discuss the current set up in various market sectors.

Read MoreAUGUST 29th – Here Again

/in Premium /by Alex - Chart Freak1. Last Night I mentioned to my readers that I was seeing a drop in Gold coming. Gold was at $1212, and I posted this chart saying that we could see a drop to $1200. That is not a big deal, but we are waiting for a short cover rally, so apparently we had to 'expect delays'...

2. The drop started here, and I posted this in the comments section. Again, not a big scary concern, just Expect delays..

Let's talk about Gold $1200

Read MoreAugust 28th – Things Are Popping

/in Premium /by Alex - Chart FreakA Monday night report should be short, because we've only had one day since the weekend report, but Monday was a very active market. This report will be longer than the usual Monday report.

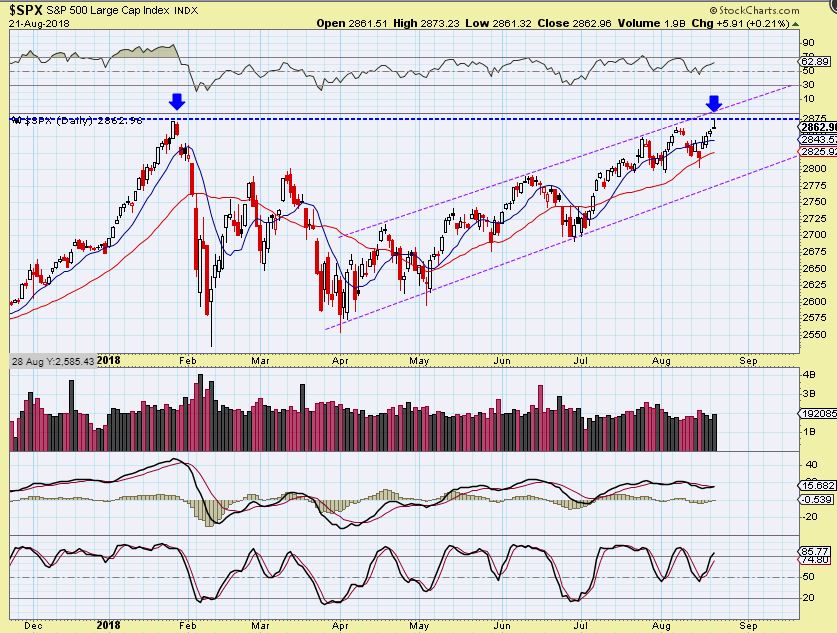

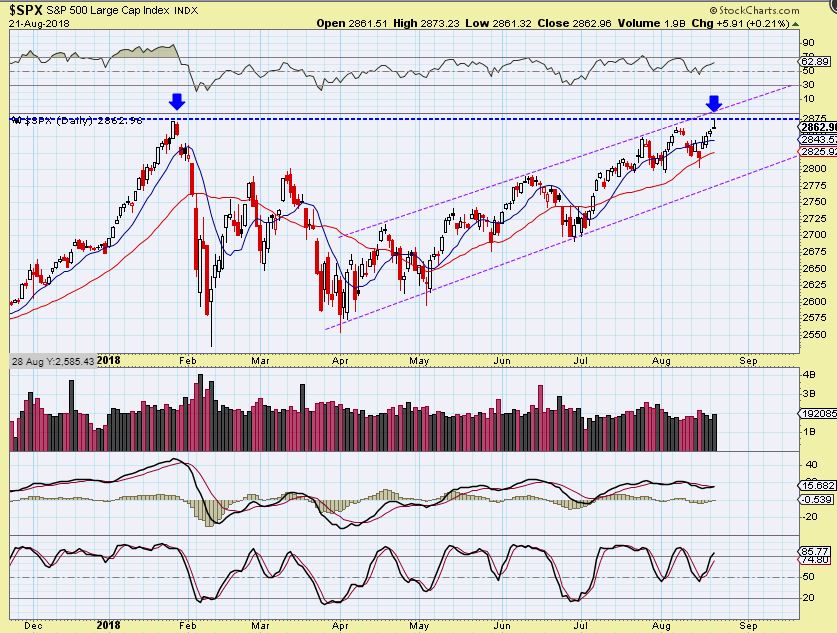

.Review SPX August 21st - This was last week, and we saw the SPX meet up with 2 resistance points.

SPX WEEKLY Aug 24th - So for the weekend report, I drew that same resistance here. It could climb along the upper magenta line, but would need to break the blue line first...

Read More

Read MoreAugust 25th – Do The Weekend Swing Dance

/in Premium /by Alex - Chart FreakFriday seemed like some sort of an anti-gravity day, with most sectors climbing nicely higher. We even had Swing Lows enter the dance floor, so let's take a look at our current market set ups...

RUSSELL 2000 - We looked at IWM and TNA earlier this week as buy signals, and we have follow through. Raise stops and see if they continue higher ...

Read More

Read MoreFriday Aug 24th

/in Premium /by Alex - Chart FreakWelcome to the last trading day of the week...

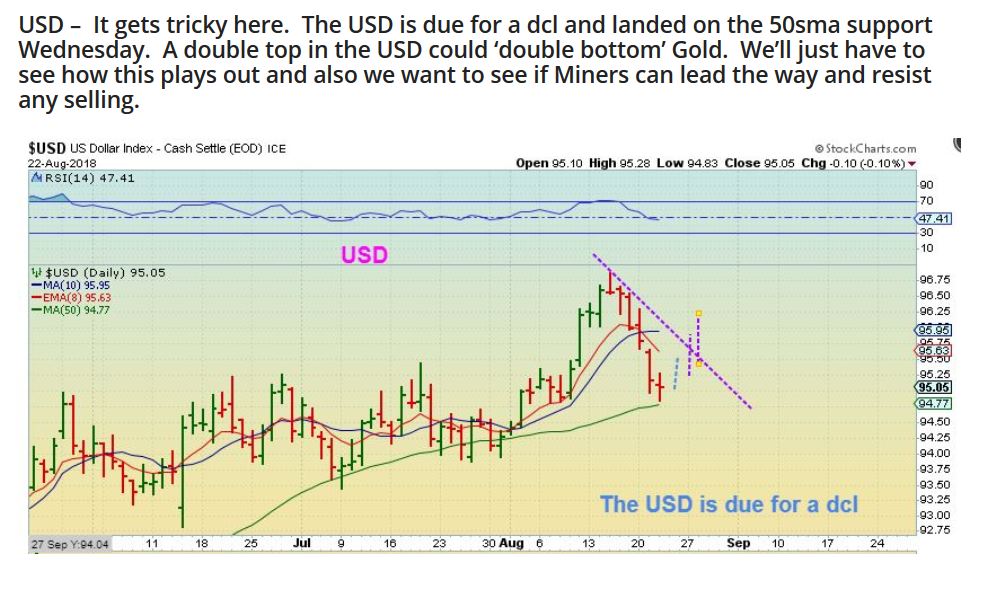

USD- This is a copy/ paste from yesterdays report, expecting a USD DCL.

UUP ( USD) - It looks like the DCL may have formed. I mentioned yesterday

Now let's discuss Gold...

Read MoreAugust 23rd – Chart Set Ups

/in Premium /by Alex - Chart Freak.

I will have many trade ideas at the end of this report.

.TNA - I mentioned that The Russell 2000 ( RUT, IWM, and you can use the TNA) Looked bullish, and this was the break out. It was and is a buy.

Read More

Read MoreAugust 22 – FOMC Minutes

/in Premium /by Alex - Chart FreakThe release of the FOMC Minutes from the last Fed Meeting is scheduled to be released today. At times, this can cause a reaction in the markets, if the verbiage or language that was used seems more Hawkish or Dovish than originally interpreted. For example, if they were to mention a concern pertaining to inflation rising faster than expected, that could affect certain sectors, so we just want to be mindful that the markets could move unexpectedly around 2 P.M. Eastern.

SPX #1 - Right where the SPX was about to break to new highs, it sold off a bit.

Read More

Read MoreContact Us

26 Broadway,

8th Floor

New York, NY 10004

admin@bigleaguefinance.com

admin@bigleaguefinance.com

Latest Blog Posts

accelerator diet pills goji berry diet pills ultra 90 diet pills keto meal replacement bar top weight loss diet pills for thyroid patients where to buy t lite diet pills keto friendly thickener diet fuel diet pills peanuts keto friendly rite aid diet pills that work envy diet pills diet pills for breastfeeding moms belique diet pills perfect slim weight loss pills calories in a bottle of white wine