9-18 -18 Falling Into Place

/in Premium /by Alex - Chart FreakSPY FROM FRIDAY - We had a double top and divergence in the MACD ( And RSI), so it looks like it wants to pull back. It looks weak here on a daily, and I’ve been expecting a drop soon to a dcl or even an ICL

Read More

Read MoreSept 14th – A Little Choppy

/in Premium /by Alex - Chart FreakWhen the markets are choppy and seem a little indecisive, it can be hard to make money consistently. It becomes a stock pickers market, where some stocks are doing well, others may be struggling. Various sectors of the markets are currently a bit choppy, so we'll discuss that here on this Friday, the last trading day of the week...

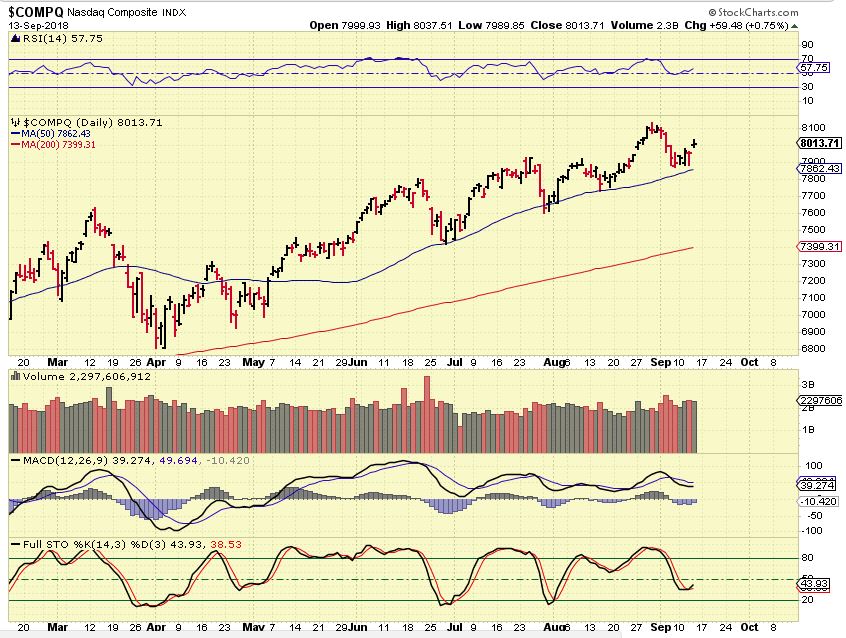

NASDAQ - After last weeks sell down, the NASDAQ landed above the 50sma and at this point that level has held as support, but it has been choppy here this week.

Read More

Read More9-13-2018 Oh Please!

/in Premium /by Alex - Chart FreakIf I could ask for 1 wish pertaining to the markets, that I thought would benefit many people, it would be...

.QQQ - At this time, the 50sma is still holding up the QQQ as support again. The markets sold off on Wednesday , but fought there way back again. Volume is heavier on the downside than the upside, so it needs watching.

Read More

Read MoreWkend Report- Between A Rock And…

/in Premium /by Alex - Chart FreakYou'll see why I chose this Theme Pic shortly, but first let's do our Big Picture Weekend Review...

.SPX WEEKLY - We have a weekly swing high, and I have been expecting a pull back to a dcl, even an ICL.

Read More

Read MoreSitting Near The Lows

/in Premium /by Alex - Chart FreakToday is Friday, the last trading day of the week. Let's discuss just a few details of this weeks activity...

Read MoreSEPTEMBER 6TH – Mixed Again

/in Premium /by Alex - Chart FreakI have been expecting a pull back in the General Markets, but notice what happened on Wednesday...

.NASDAQ - That had a pretty good size drop and the volume increased. Also look at 3 month daily charts of TWTR, FB, GOOG, ( Even AMZN yesterday) , SQ, etc. They are dropping from the highs, so ...

It looks like the pull back has started, however,

.DJIA - The DOW closed higher with increasing volume. Interesting, and ...

Read More

Read MoreContact Us

26 Broadway,

8th Floor

New York, NY 10004

admin@bigleaguefinance.com

admin@bigleaguefinance.com

Latest Blog Posts

accelerator diet pills goji berry diet pills ultra 90 diet pills keto meal replacement bar top weight loss diet pills for thyroid patients where to buy t lite diet pills keto friendly thickener diet fuel diet pills peanuts keto friendly rite aid diet pills that work envy diet pills diet pills for breastfeeding moms belique diet pills perfect slim weight loss pills calories in a bottle of white wine