Weekend Rejoice! Oh, I Guess I Mean Weekend Review

/in Premium /by Alex - Chart FreakWe are all well aware of what happened in the markets this week, and really it is what we have been waiting for and discussing in the Big Picture Views for a while. That said, we now have a lot to look at in this Big Picture Review. Read each chart carefully.... To the charts!

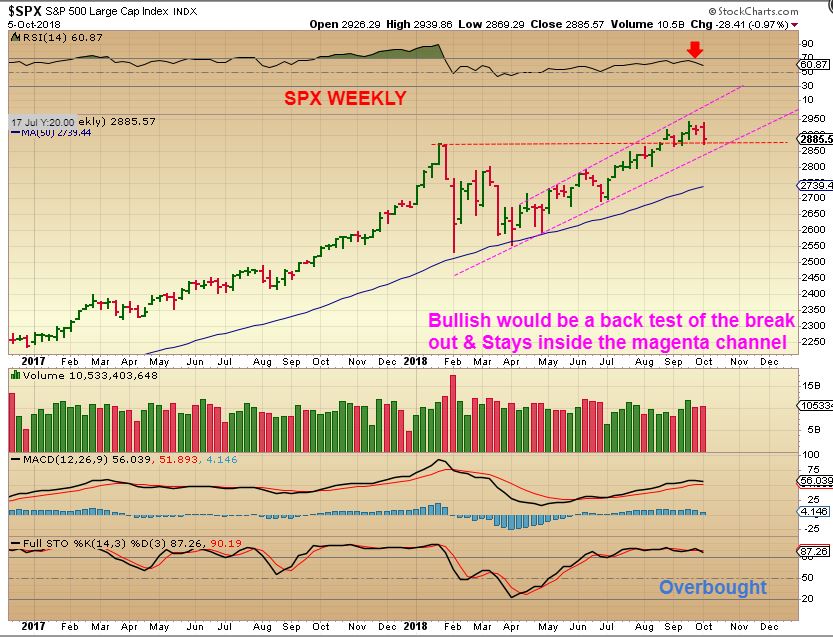

.SPX WEEKLY - I've been looking for a drop into an ICL , similar to January. There it is, read the chart, and there is more..

Read More

Read MoreThar She Blows Matey!!!

/in Premium /by Alex - Chart Freak.

Thar she blows is right!

.

GOLD - We have been expecting this kind of 'recognition day ' for a while, so Let's discuss this BURST higher in Gold and Miners...

GOLD climbed $28 on Thursday, and it was pretty much steady and straight up.

Read More

Read MoreThursday – Hanging On

/in Premium /by Alex - Chart FreakI have been mentioning that the markets were due for a drop into an ICL, and I used this chart to show the potential downside -

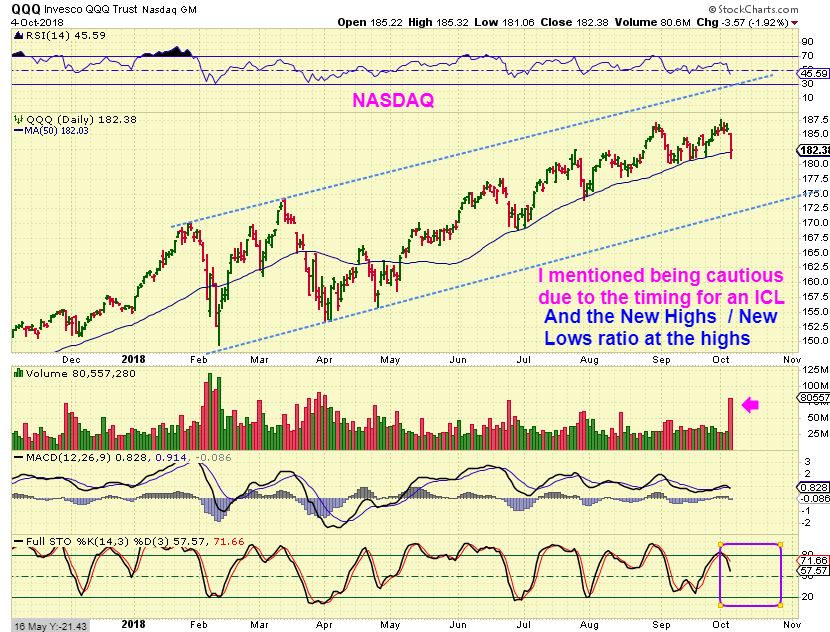

.NASDAQ AUGUST - I thought that we might run to the top and then drop into an ICL just like the drops we saw in the beginning of 2018, and ...

This chart looks to be a lot of what I was expecting, but I wouldn't just jump in here. The NASDAQ broke & closed below the 200sma. Even though this could be a shake out, there is no need to try to catch this falling knife. We'll monitor it along the way.

Read More

Read MoreOctober 10th – Nothing New Here

/in Premium /by Alex - Chart FreakWe really didn't see a lot of changes take place that were not expected on Tuesday. As the markets pull back, things do get choppy and sloppy. At this point, let's do a market review and then discuss a few possible trade ideas...

. Read MoreWhat A Nice Surprise

/in Premium /by Alex - Chart Freak.

What was surprising about Monday? It was this- Gold dropped over $17 and the Miners fought their way back to green...

GDX:GLD - I discussed the bullishness when Miners lead Gold, so this is how Golds drop & Miners POP affected the GDX:GLD ratio. Bullish.

Read More

Read MoreOct 6th – Weekend Market Review

/in Premium /by Alex - Chart FreakSPX WEEKLY #1 - I have been expecting a dip into a DCL, and likely an ICL. Last week saw the SPX drop how deep will it be? Please read chart #1...

And now Chart #2

Read MoreFriday October 5th

/in Premium /by Alex - Chart FreakIt is Friday, the last trading day of the week, so let's just do a quick review...

.SPX - Yesterday using this chart , I pointed out that the SPX was running up along the top of the B.B. with divergence and due for a daily cycle low. The Markets dropped yesterday.

QQQ - The Markets began to sell off . We Also discussed that the General Markets were showing divergence in the RSI & MACD, Due for a dip cycle-wise, and showing a much higher number of new lows than new highs at the top here. A dip is due and seems to be starting here...

Read More

Read MoreThursday Trading

/in Premium /by Alex - Chart FreakAfter a quick review of the markets, we'll look at some of the stock picks in recent reports and a few new thoughts...

Read MoreOct 3rd – What’s That Guy So Happy About?

/in Premium /by Alex - Chart Freak.

Maybe he is Long Gold too 🙂

.GOLD - This was a nice break higher and this took place with the USD moving higher an also on the infamous ' Chinese Golden Week'. It was a nice on day pop and I'd like to see some follow through this week.

GDX - Our last report already discussed the GDX : GOLD Ratio, and showed that the Miners have been leading Gold. They kept up with Gold on Tuesday with a nice push higher on strong volume. Since this looks like GDX is coming out of a 1/2 cycle low, it should be able to break right through that 50sma and back test it on a dcl. We'll see.

Read More

Read MoreContact Us

26 Broadway,

8th Floor

New York, NY 10004

admin@bigleaguefinance.com

admin@bigleaguefinance.com

Latest Blog Posts

accelerator diet pills goji berry diet pills ultra 90 diet pills keto meal replacement bar top weight loss diet pills for thyroid patients where to buy t lite diet pills keto friendly thickener diet fuel diet pills peanuts keto friendly rite aid diet pills that work envy diet pills diet pills for breastfeeding moms belique diet pills perfect slim weight loss pills calories in a bottle of white wine