Tuesday Nov 27th

/in Premium /by Alex - Chart FreakNot a lot has changed from the weekend report, so let's take a look at Mondays action...

.

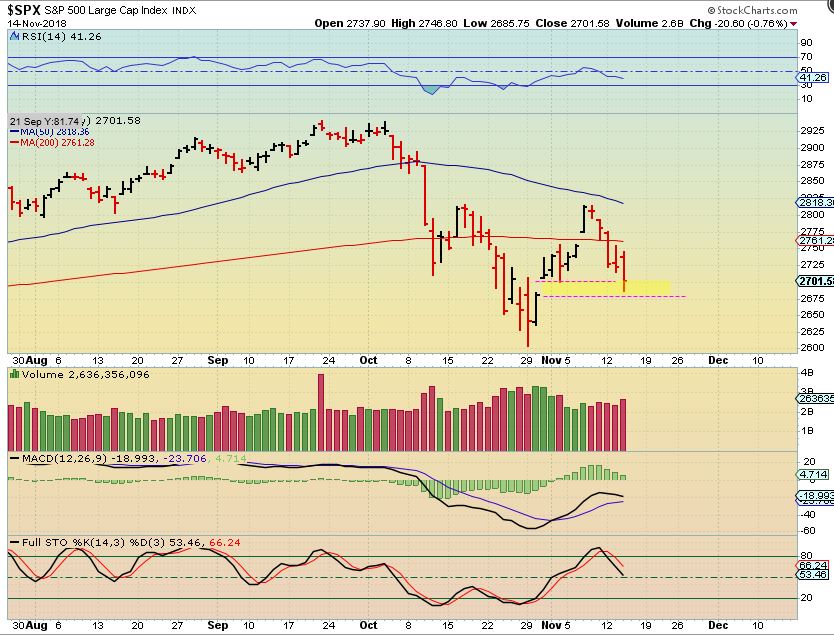

SPX - After breaking above the 10 sma, SPX was turned down at the 50 sma and revisited the lows. The SPX is oversold and the MACD does have divergence so we are at least getting a bounce on day 19.

From my weekend report, the ICL could be ahead, and if so, any long trade will be capped.

I discussed my thoughts on the General Markets in greater detail last week and in the weekend report, but let's take another look at the NASDAQ.

Read MoreNov 24th – Weekend In Review

/in Premium /by Alex - Chart FreakLet's take a look at our Big Picture layout with the Markets...

.

SPX- The markets dropped toward their ICL, and I mentioned that similar to what we saw in Feb & March, this could now become a choppy market, instead of the 'Buy he dips' that everyone got used to. The ICL could still be ahead, and I will explain why, but if that was the ICL in October, this could just remain choppy putting in a higher low like last April. See the chart.

TRAN - The TRAN actually broke to a new low, below the Feb lows. As mentioned in prior reports, this could become a double top down the road.

Half Day Friday

/in Premium /by Alex - Chart FreakIn the U.S. , the stock market is only open for a 1/2 day, so I wanted to discuss the Precious Metals...

. Read MoreExpect Light Holiday Tradin’ ?

/in Premium /by Alex - Chart FreakOne would expect a light volume holiday trading week, but so far many of the charts that I looked at have normal or average volume. Maybe it will lighten up each day, but let's take a look at what trading took place after the weekend report.

.SPX - The markets have been choppy and instead of that inverse H&S pattern breaking back above the 200 sma again, Monday the Markets dropped.

I used this chart in the weekend report along with the increasingly ugly charts of FB, GOOG, NVDA, and even the IWMs lack of strength, to show the current weakness. I warned again that if we don't see strength soon, we may see an a-b-c drop that looks like this on the General Markets Weekly Charts.

Read More

Read MoreNovember 17 Weekend Report

/in Premium /by Alex - Chart FreakAs time moves forward, we begin to see the moves that we anticipated in various sectors, as they begin rising out of the recent lows. Let's get updated on our Big Picture expectations...

.SPX WEEKLY #1 - We see that price has moved to resistance, please read the chart.

Read More

Read MoreFriday November 16th

/in Premium /by Alex - Chart FreakJust a reminder : Today is the last trading day of the week, and next week will be a holiday shortened trading week in the U.S., so let's see where the markets stand and enjoy our Friday of trading!

,Note: we'll see how 'earnings' affect the markets going forward, but NVDA released earnings after the bell, and got crushed, down over $33 or 16%. We will discuss that with the NASDAQ too.

.SPX - Wednesday we had a gap fill and a bounce into the close. We need a bigger sign of strength than that, so we'd see if Thursdays trading could show some strength...

SPX - Markets sold off to a new low on Thursday morning, and then put in a nice reversal. It overtook more than 1/2 of the prior days candle, so you could add to positions on a day like that, with a tight stop at the lows. Our inverse H&S remains in tact, let's see if this can power higher.

Read More

Read MoreNovember 14th – Saving Grace?

/in Premium /by Alex - Chart FreakLet's take a look at the Markets, and I will discuss the Theme Picture later in the report. Consider the last part of this report as important, and please read it carefully.

.DJIA - We have a gap fill. Now let's see if these markets can get moving to the upside. I have discussed my thoughts on the General Markets in recent reports.

Read More

Read MoreWednesday – Oil Did What?

/in Premium /by Alex - Chart FreakIt certainly looks as though Oil has entered the capitulation phase of a sell off into an ICL, and a low is very near. I want to discuss that as a future buy opportunity in this report, but first we'll do a market review. Just to reiterate: In just about every sector, Trading remains very choppy. That can be a bit frustrating or even a bit damaging if position size isn't kept small, stops aren't honored, etc. The sidelines are not a bad place to be until the dust settles a bit.

.SPX - Rejected at the 50 sma on a bounce, so far this peaked on day 7. We now have a possible inverse H&S, but the open gap below could draw price in for a gap fill.

Contact Us

26 Broadway,

8th Floor

New York, NY 10004

admin@bigleaguefinance.com

admin@bigleaguefinance.com

Latest Blog Posts

accelerator diet pills goji berry diet pills ultra 90 diet pills keto meal replacement bar top weight loss diet pills for thyroid patients where to buy t lite diet pills keto friendly thickener diet fuel diet pills peanuts keto friendly rite aid diet pills that work envy diet pills diet pills for breastfeeding moms belique diet pills perfect slim weight loss pills calories in a bottle of white wine